Chart Patterns - How to read them like a Pro

Hero Portfolio

1

Posts

1

Posters

9

Views

1

Watching

-

Chart patterns are visual formations on price charts that help traders anticipate potential market movements.

These patterns fall into three main categories: bullish, bearish, and indecisive.

- Bullish Chart Patterns

Bullish patterns often signal that price is likely to move upward.

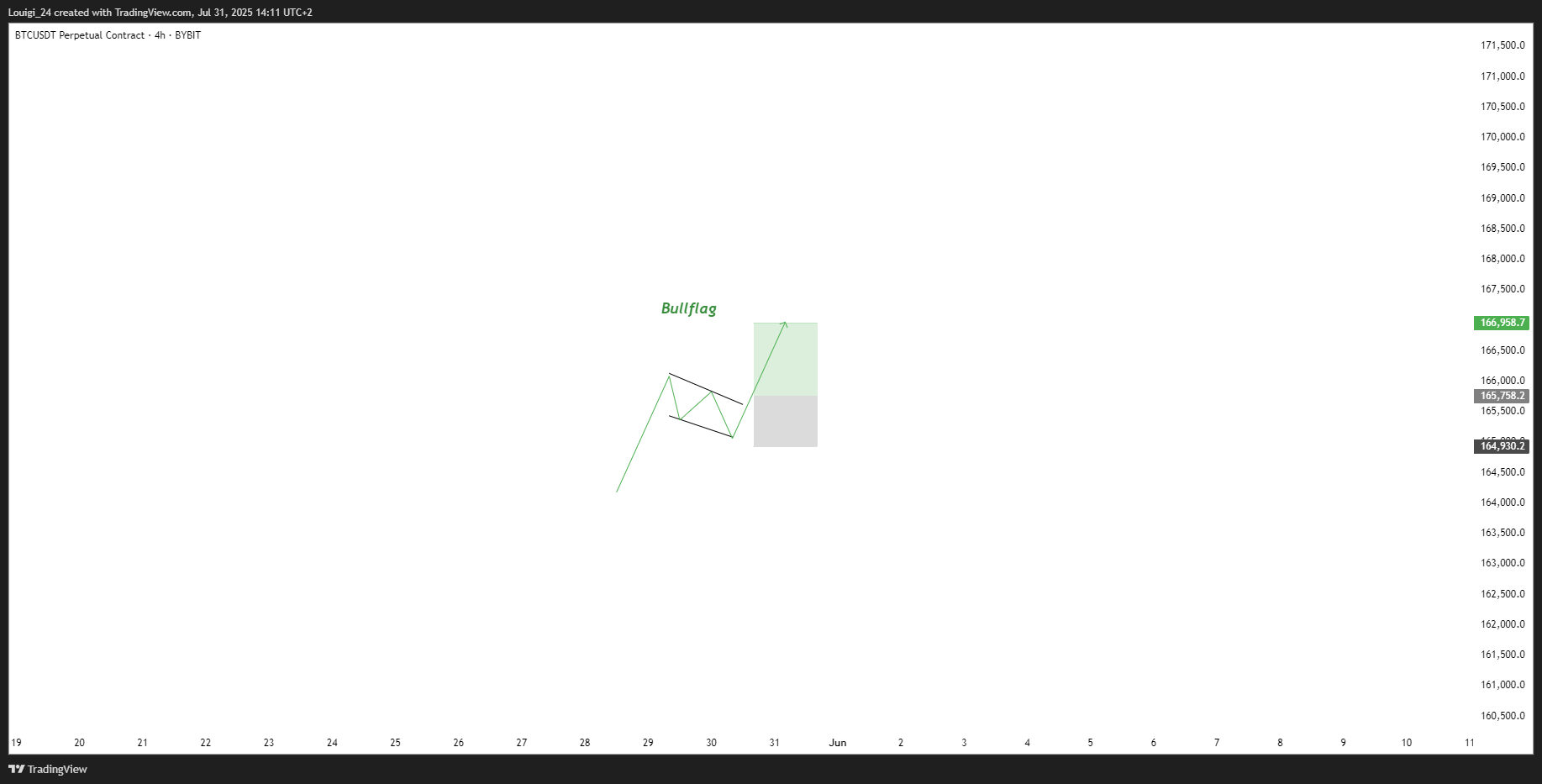

1.1 Bull Flag

- What it looks like: A sharp upward move followed by a small downward-sloping rectangle (the flag).

- Meaning: After a strong rally, the price consolidates briefly before continuing higher.

- Key insight: A breakout above the flag typically signals a continuation of the trend.

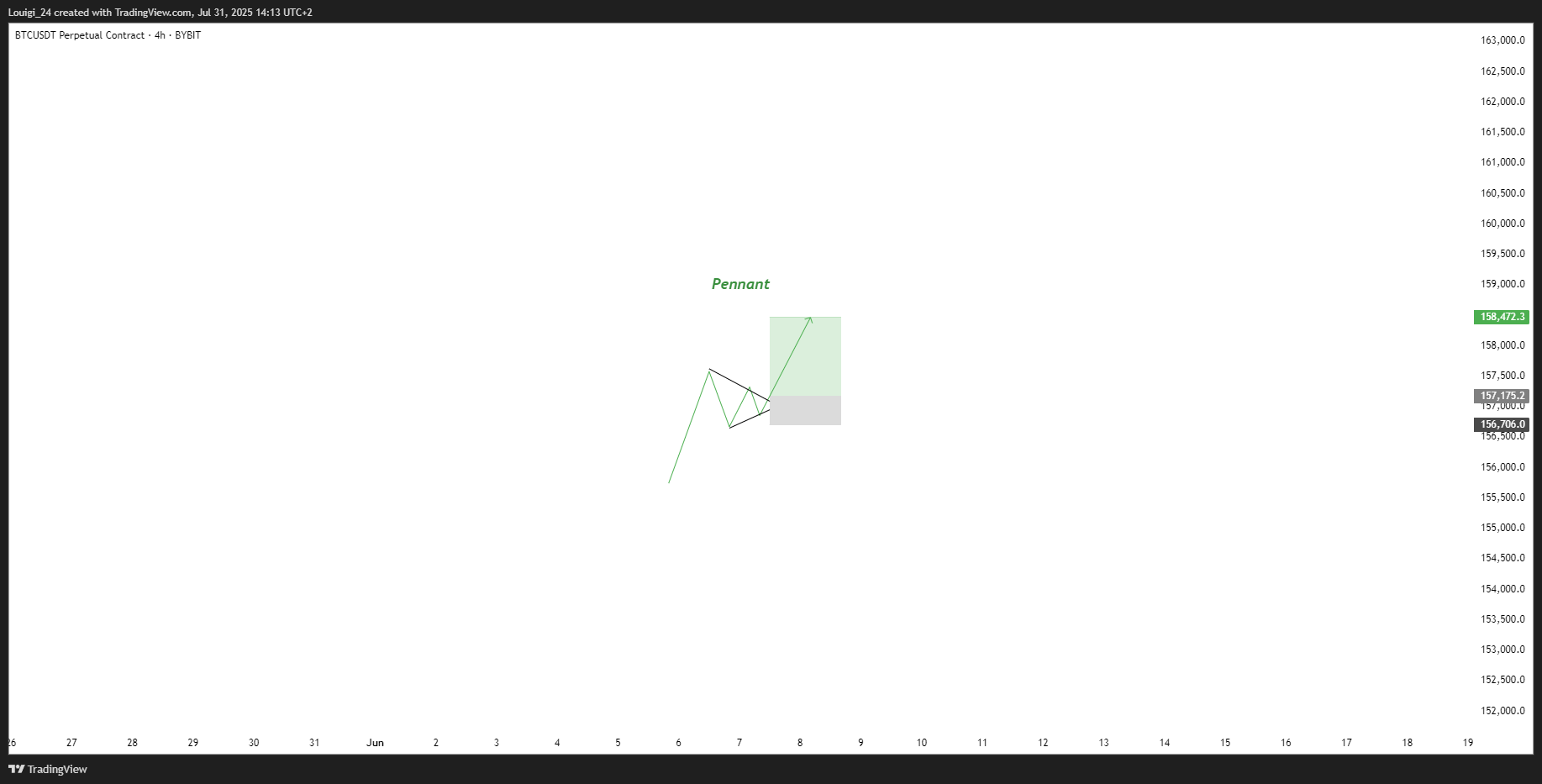

1.2 Pennant (Bullish)

- What it looks like: A strong upward move followed by a small symmetrical triangle.

- Meaning: Similar to the bull flag, but the consolidation takes a triangular form.

- Key insight: Once price breaks above the pennant, the uptrend often resumes.

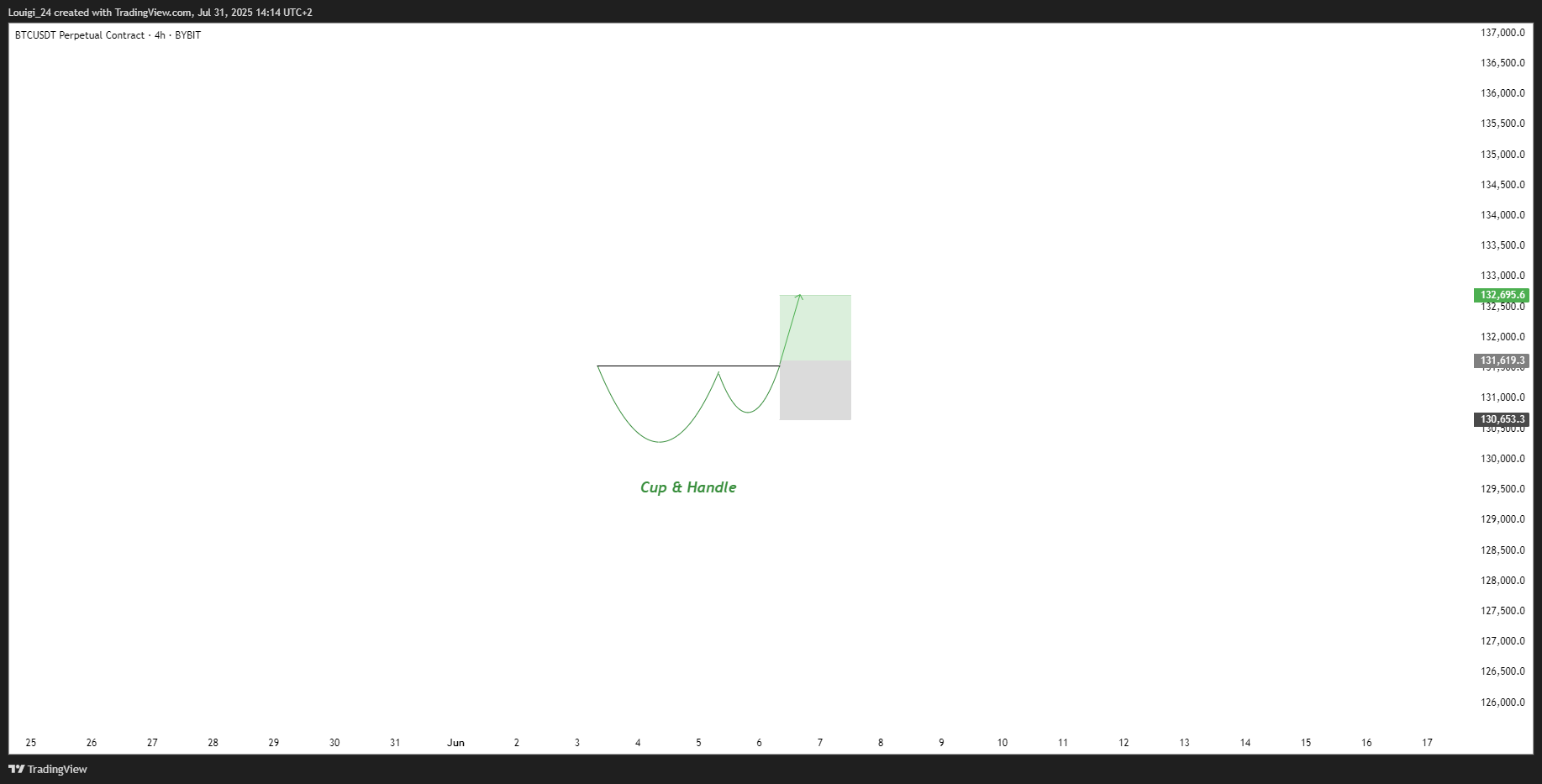

1.3 Cup & Handle

- What it looks like: A “U”-shaped curve (the cup) followed by a small downward drift (the handle).

- Meaning: This pattern suggests a period of accumulation before price breaks higher.

- Key insight: A breakout above the handle signals the beginning of a new bullish leg.

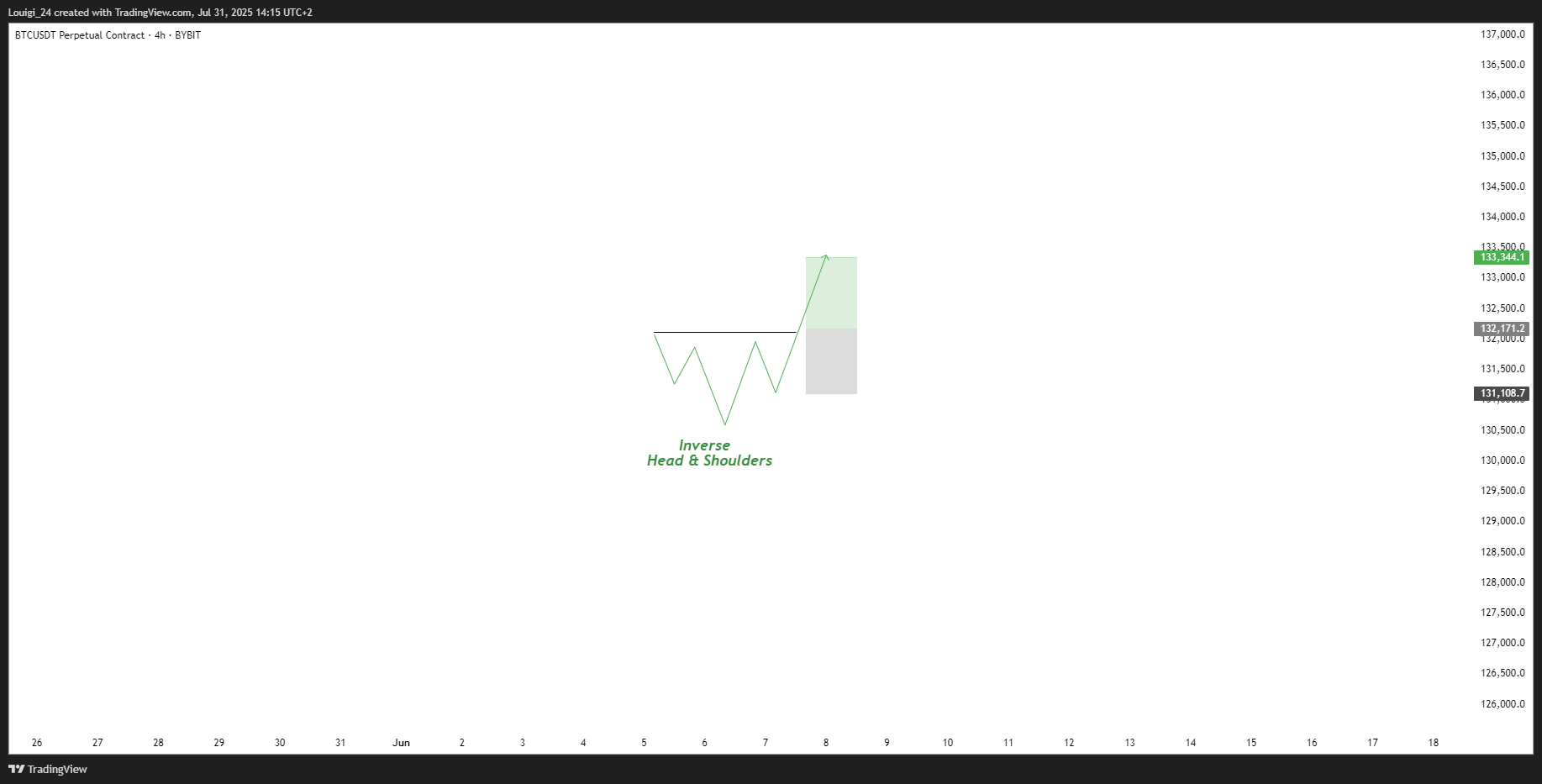

1.4 Inverse Head & Shoulders

- What it looks like: Three low points, with the middle low being the deepest.

- Meaning: This reversal pattern appears after a downtrend and signals a potential change to an uptrend.

- Key insight: A breakout above the “neckline” confirms the reversal.