Spot vs. Futures — Reading the Smart Money in Ethereum

-

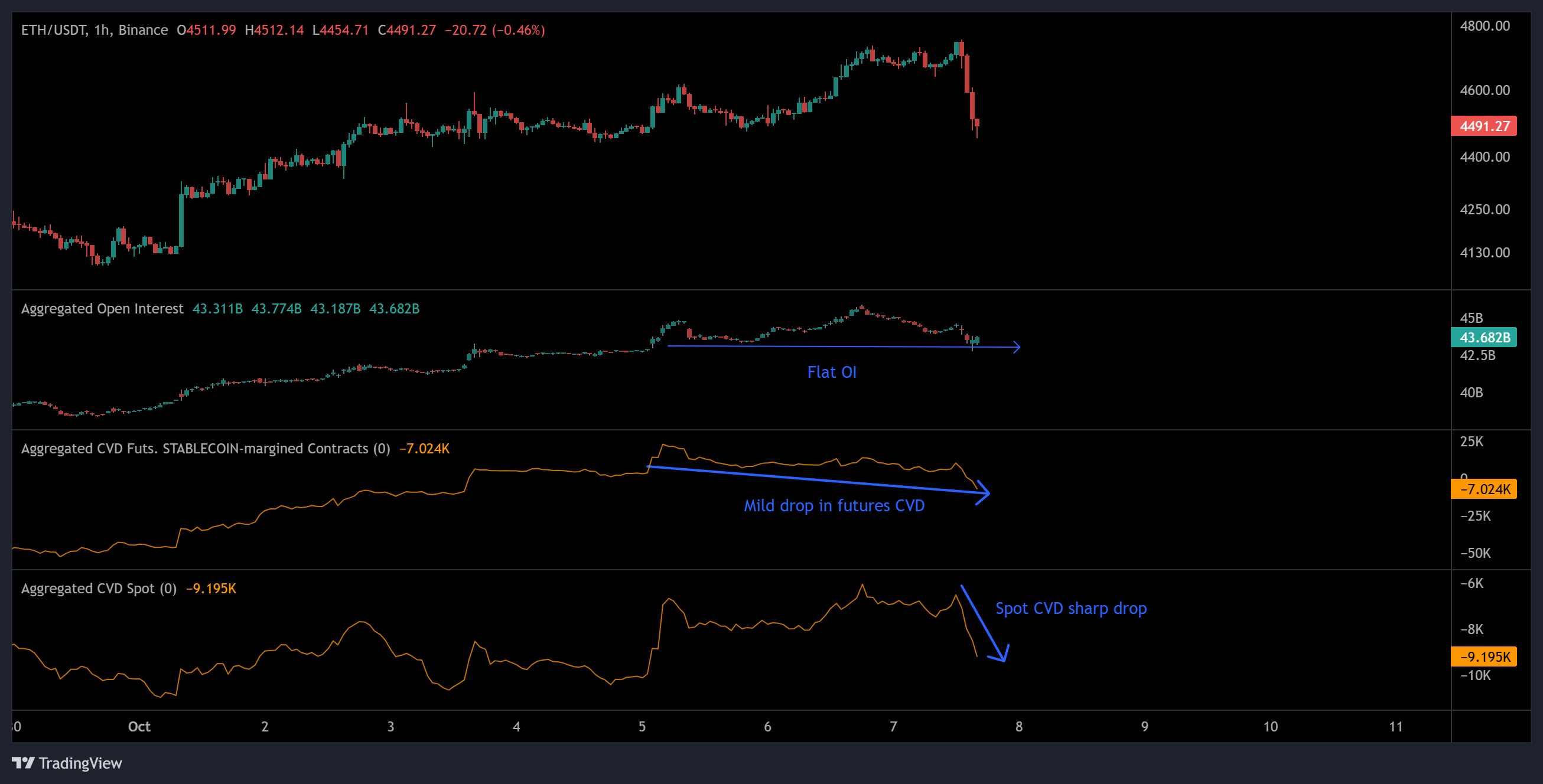

ETH traders are split:

Spot sellers are taking profits (spot CVD dropping).

Futures traders are holding and adding leverage, betting on volatility.

How to make money:

How to make money:When spot selling increases but futures open interest stays high, it often signals an upcoming volatility spike.

Scalp traders can ride quick rebounds from liquidity sweeps (around $4,400).

Swing traders can wait for confirmation of strength to ride the next leg up.

️ Use mixed data signals as a setup filter — not all dips are bearish; some are just reload zones.

️ Use mixed data signals as a setup filter — not all dips are bearish; some are just reload zones. -

Smart money flows from spot first — it’s like watching footprints before the sprint.