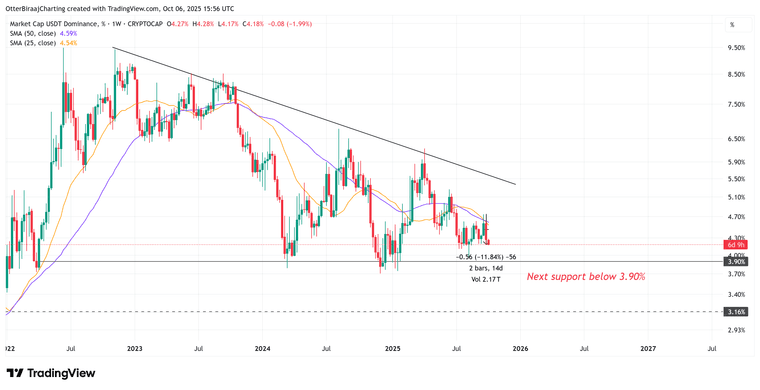

Tether Dominance Plunges as Investors Move into Risk Assets

-

USDT dominance has dropped sharply from 4.74% to 4.18% over the past week — its steepest fall this year — suggesting traders are pulling money from stablecoins and betting on altcoins.

A further decline below 4% would mark the lowest Tether dominance since January 2025.

This rotation of capital into volatile crypto assets is seen as a hallmark of rising market confidence — and a possible signal that a new altseason is taking shape.

-

That’s usually a bullish sign — people shifting from stablecoins to crypto again.

-

Risk appetite returning, market confidence seems to be back on track.

-

A further decline below 4% would mark the lowest Tether dominance since January 2025.

Falling USDT dominance usually means traders are rotating back into risk assets — classic early signal that the market’s gearing up for an altcoin rally

Falling USDT dominance usually means traders are rotating back into risk assets — classic early signal that the market’s gearing up for an altcoin rally

A drop in USDT dominance like this often marks the start of a strong rotation — if altcoins keep this momentum, we might be at the early stages of a real altseason

A drop in USDT dominance like this often marks the start of a strong rotation — if altcoins keep this momentum, we might be at the early stages of a real altseason