💻 How to Earn Money by Mining Crypto in 2025

-

Think crypto mining is dead? Think again. While it’s no longer the wild west of 2013, crypto mining remains one of the most proven (and passive) ways to earn income — if you know how to play the game in 2025.

Here’s how to get started

️ What Is Crypto Mining?

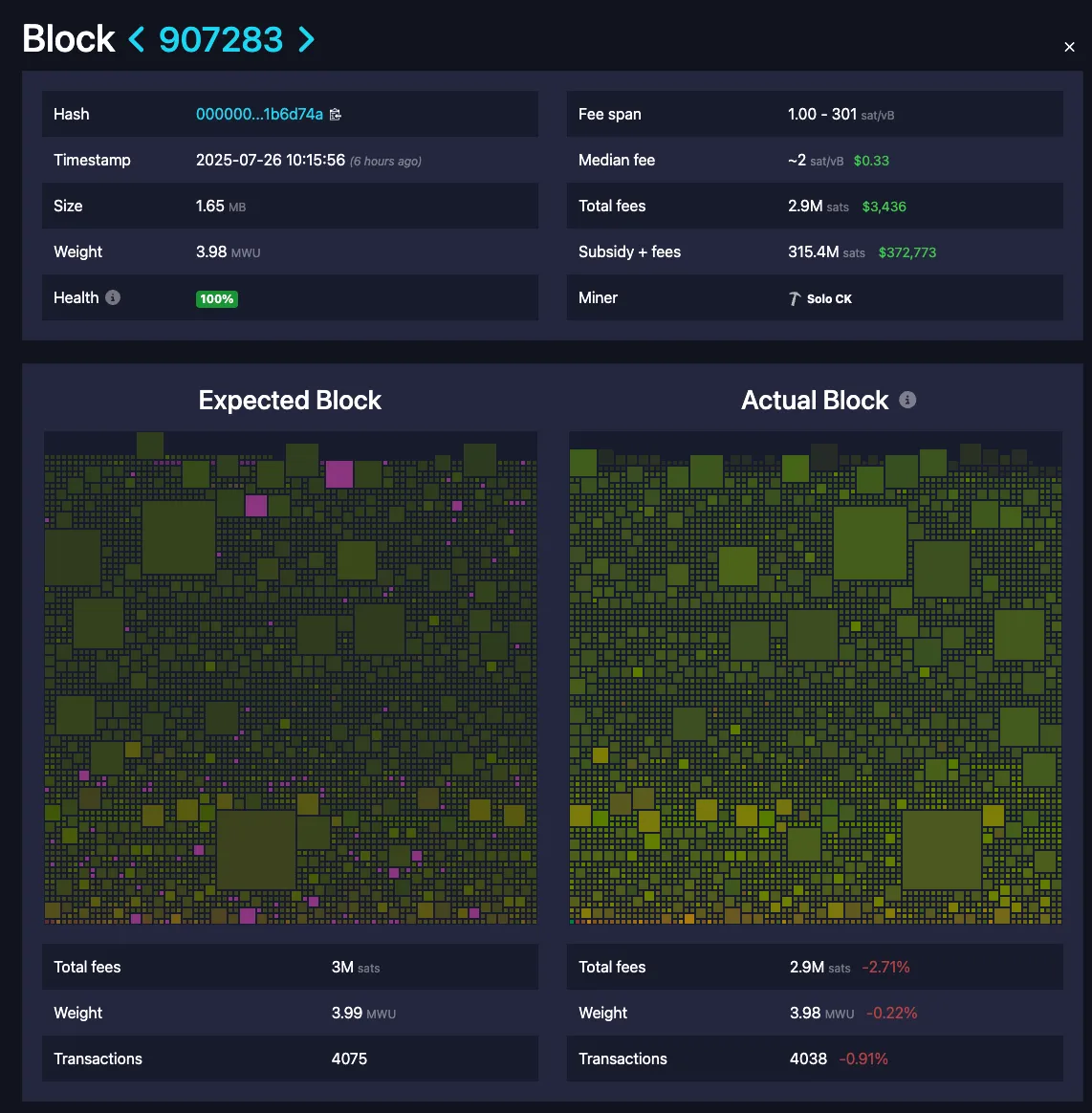

️ What Is Crypto Mining?At its core, mining is the process of verifying transactions on a blockchain network (like Bitcoin or Kaspa) using computational power. In return, miners are rewarded with newly minted coins and transaction fees — aka money in your wallet.

How Much Can You Make?

How Much Can You Make?It depends on a few factors:

🧮 Hardware power (ASICs or GPUs) ⚡ Electricity costs 🪙 What coin you mine (Bitcoin, Kaspa, Dogecoin, etc.) ⛏ Mining difficulty & block rewardsA single Bitcoin ASIC like the Antminer S21 can bring in $5–15/day in profit — more if BTC rises. GPU miners targeting altcoins like Kaspa or Toncoin can earn less, but with lower upfront costs.

2025 Mining Trends to Know

2025 Mining Trends to Know🔋 Energy efficiency matters more than ever. Go for newer, low-power machines. 🏭 Mining-as-a-Service (MaaS) is booming — rent machines remotely and earn BTC without running a rig at home. 🌍 Eco-friendly & solar-powered mining is on the rise — lower bills, higher margins. 🧠 Some miners now auto-switch between profitable coins using smart software.🪙 Top Coins to Mine in 2025

Bitcoin (BTC) – Classic, reliable, and still profitable with efficient ASICs. Kaspa (KAS) – GPU-friendly, fast-growing, and energy efficient. Toncoin (TON) – Backed by Telegram, rising in popularity. Dogecoin (DOGE) – Still meme-worthy and merge-mined with Litecoin. How to Start Mining

How to Start Mining🔌 Choose your gear (ASIC or GPU rig) 📡 Pick a mining pool (like ViaBTC, F2Pool, or 2Miners) 🔐 Set up a secure wallet ⚙️ Configure software (NiceHash, Hive OS, or native miners) 💸 Start earning crypto rewards daily ️ Pro Tips

️ Pro TipsWatch your electricity costs — mining is about profit, not just revenue. Monitor prices & difficulty regularly. Consider mining altcoins and swapping profits to BTC for long-term holding. Would you rather mine crypto yourself or use a mining service? Let’s hear your take below

Would you rather mine crypto yourself or use a mining service? Let’s hear your take below

#HowToEarnMoney #CryptoMining #BitcoinMining #Kaspa #Toncoin #PassiveIncome #ASICMiner #GPUMining #Crypto2025 #DeFiEarnings #MiningProfit

-

Crypto mining in 2025 can still be profitable—but only under very specific conditions.Top-tier ASIC hardware (like WhatsMiner M60 or Antminer S21) and electricity rates below ~$0.05 / kWh are essential for Bitcoin profitability. Alternatives like GPU or CPU mining may work for coins like Kaspa, Monero, Ravencoin, or Ergo, but margins are slim. Joining a reputable mining pool (e.g. F2Pool or SlushPool) is key to steadier returns.Importantly, regulatory environments vary—countries like Kazakhstan and Canada offer favorable terms, while others impose restrictions. Always calculate ROI factoring in hardware costs, difficulty, coin price, and energy usage before jumping in.

-

Beyond pure hardware mining, diversifying your crypto earnings approach can yield better returns.Cloud hosting or staking (like Ethereum post‑Merge) offers more stable passive income without needing upfront investment in rigs. CPU mining—especially Monero with RandomX on Ryzen 7950X—remains surprisingly viable. Mobile apps like Pi or Mira allow entry-level users to earn small crypto rewards with zero hardware. But beware: cloud mining scams are widespread.Staying profitable in 2025 means consistently monitoring market volatility, Bitcoin halving cycles, regulatory news, and energy trends. And if you can’t access renewable power or cheap electricity, mining likely isn’t worth the risk.

-

Gold tokenization via XAUt is attractive—but not without risks. While Tether publishes regular attestations and the gold is stored in Swiss vaults under LBMA standards, some critics cite less rigorous audit frequency compared to competitors like Paxos.Tether has previously faced transparency concerns, and aUSDt—a gold-collateralized stablecoin built on XAUt—adds complexity. Redemption mechanisms exist but have minimum thresholds, and regulatory uncertainty could evolve.If you’re exploring gold-backed crypto, consider portfolio mix, reserve policies, custodian credibility, and overall transparency.