💰 Ways to Earn Money: The Rise of Tokenized Money Market Funds

-

ChatGPT said:Here’s a quiet but powerful shift in finance that could open new doors for everyday investors and institutions alike: tokenized money market funds.

What’s happening?

What’s happening?

Big banks like Goldman Sachs and BNY Mellon are now tokenizing shares of money market funds — turning traditional cash-like investments into blockchain-based assets. This means you could soon use tokenized fund shares as margin collateral or even for faster, more flexible investing — without giving up the interest you'd earn holding cash. ️ Backed by regulation:

️ Backed by regulation:

The new GENIUS Act, a major stablecoin bill, is helping accelerate this shift by providing a clear framework for digital dollar usage. This sets the stage for cash to evolve without losing its value in a stablecoin-dominated future. Why does this matter for earning money?

Why does this matter for earning money?You can earn yield on tokenized funds while using them in DeFi or other on-chain services. New on-ramps into digital finance mean more ways to put your capital to work. It combines the security of traditional finance with the speed and transparency of blockchain. As JPMorgan strategist Teresa Ho put it:

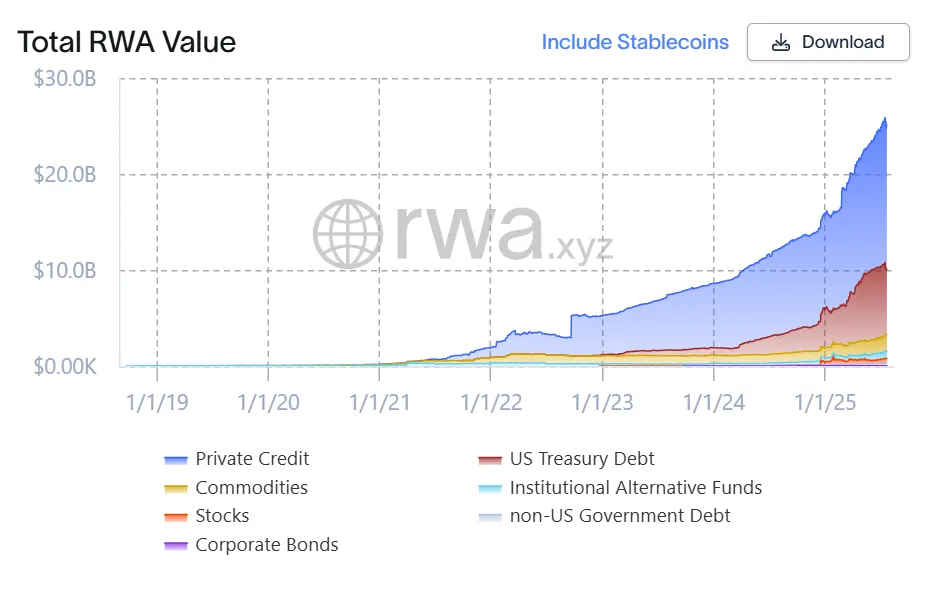

As JPMorgan strategist Teresa Ho put it:“Instead of posting cash or Treasurys, you can post money-market shares and not lose interest along the way.” The tokenized real-world asset (RWA) market — excluding stablecoins — has already ballooned to $25B. That number is expected to grow rapidly as more firms embrace this model.

The tokenized real-world asset (RWA) market — excluding stablecoins — has already ballooned to $25B. That number is expected to grow rapidly as more firms embrace this model.Bottom line:

If you’re looking for low-risk ways to earn, tokenized money market funds could offer the best of both worlds — safety and utility. Stay ahead by keeping an eye on this space — it may soon become a staple of smart, on-chain income strategies. 🧠

Are you ready to earn interest without missing opportunities in Web3?