CEXs at a Crossroads as DEXs Gain Market Share

-

Centralized exchanges face a pivotal moment: adapt and evolve into full-service financial institutions or risk losing users to decentralized rivals. While DEXs continue their surge, CEXs dominate liquidity and are expanding into payments, tokenization, and identity services.

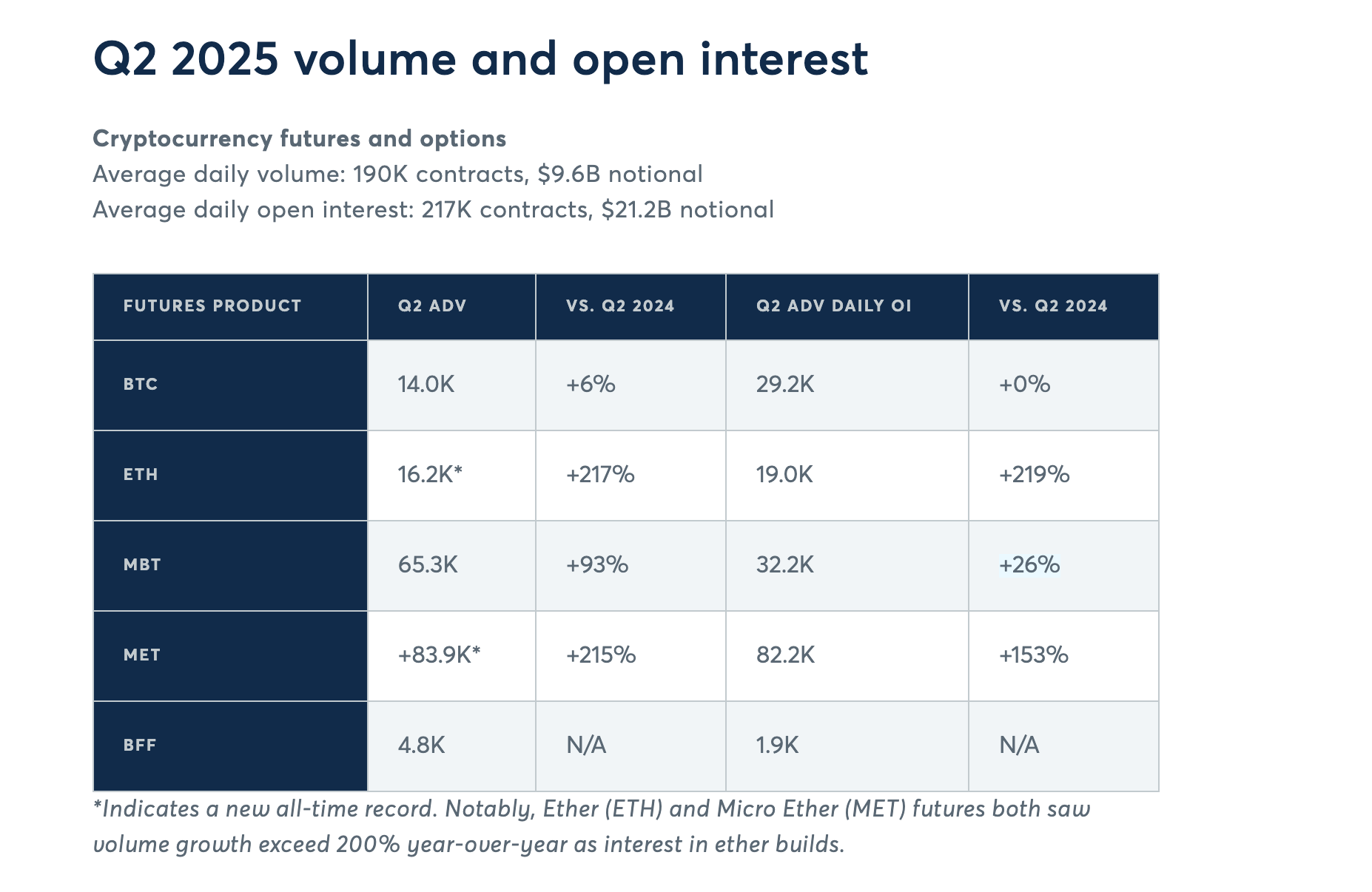

Institutional demand for derivatives is rising, with ETH and Micro Ether futures surging, highlighting opportunities for regulated exchanges. However, new bank-like oversight could increase costs while boosting credibility.

Experts emphasize that exchanges must bridge centralized and decentralized finance, offering safe, simple, and compliant access to crypto and traditional markets. IPOs, super-app features, and diversified offerings could cement CEXs as systemic finance hubs for the next generation of users.

-

Here’s a good comment you can use for this post:

"Strong insight

The surge in ETH and MET futures really highlights how institutional demand is shifting — CEXs that adapt with tokenization, payments, and ID services could lock in long-term dominance

The surge in ETH and MET futures really highlights how institutional demand is shifting — CEXs that adapt with tokenization, payments, and ID services could lock in long-term dominance

"

"Want me to also make you a shorter, more casual version with just emojis and 1–2 punchy lines?

either evolve into full-service hubs with payments, tokenization & ID services, or risk losing ground to DEXs

either evolve into full-service hubs with payments, tokenization & ID services, or risk losing ground to DEXs