💰 How You Can Make Money From the Ethereum ETF Boom (Without Coding a Single Line)

-

It’s not every day that Wall Street and crypto shake hands — but when they do, smart investors listen up.

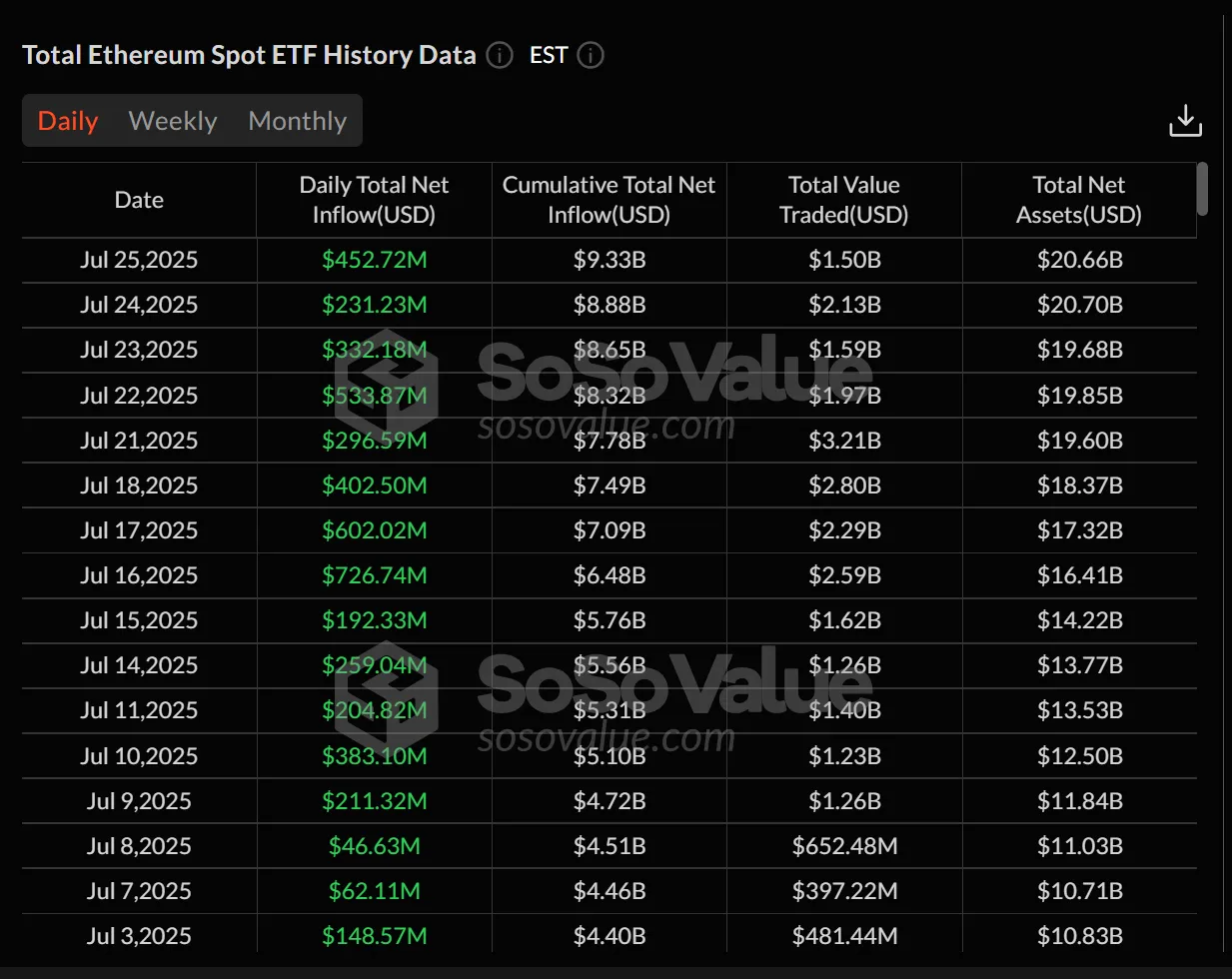

Spot Ether ETFs just hit 16 days of straight inflows, pulling in a massive $453M in a single day. Total net assets in U.S. Ethereum ETFs now sit at a whopping $20.66 billion — that’s over 4.6% of ETH’s entire market cap.

Spot Ether ETFs just hit 16 days of straight inflows, pulling in a massive $453M in a single day. Total net assets in U.S. Ethereum ETFs now sit at a whopping $20.66 billion — that’s over 4.6% of ETH’s entire market cap.So… how can you turn this ETF boom into a money-making opportunity? Here’s the breakdown:

What’s Happening?

What’s Happening?BlackRock’s Ethereum ETF (ETHA) led the charge with $440M in daily inflows. Fidelity, Bitwise, and other major players are riding the wave too. Ethereum’s demand is outpacing supply nearly 7:1 over the next year.This isn’t just hype. Institutions are betting big on ETH, and where they go… profits usually follow.

How You Can Profit:

How You Can Profit:- Buy ETH Before More Big Money Does

ETFs make it easier for institutions to buy ETH without touching crypto wallets. That demand? It’s pumping prices. Get in before the next wave.

📍 Start small. Set a recurring ETH purchase plan through Coinbase, Gemini, or Kraken.- Stake Your ETH — Earn Passive Income

With more ETH locked in ETFs, staking yields may increase. Platforms like Lido, Rocket Pool, or even centralized exchanges offer 3–5% APY.

📍 Example: Stake $1,000 in ETH = ~$40–$50 in annual rewards (plus potential price appreciation).- Use ETF Signals to Swing Trade ETH

Traders love ETF inflow data — it often foreshadows price movements. Sites like SoSoValue or CoinGlass can help you time entries and exits.

📍 Look for high-inflow days as a signal of incoming bullish momentum.- ETFs Without the Crypto Hassle

If you prefer TradFi, you can buy actual Ether ETFs through platforms like Fidelity or Robinhood (depending on availability in your region). No keys, no wallets — just exposure.

📍 Bonus: Spot ETFs are tax-efficient and IRA-eligible in some jurisdictions.- Create Content & Get Paid

The crypto ETF space is exploding. There’s demand for explainers, walkthroughs, and reviews on YouTube, X, TikTok, and Medium.

📍 Tip: Start a “Crypto for Boomers” series explaining Ether ETFs. Monetize with affiliate links. Bonus: Follow the Smart Money

Bonus: Follow the Smart MoneyBitwise’s CIO Matt Hougan says demand for ETH may hit $20B in 2025. With only 0.8M ETH issued yearly… you do the math. 🤯

Don’t miss the next big crypto money wave. Whether you’re staking, swing trading, or just stacking sats — ETFs just made Ethereum mainstream.

Don’t miss the next big crypto money wave. Whether you’re staking, swing trading, or just stacking sats — ETFs just made Ethereum mainstream.What’s your ETH game plan for the rest of 2025? Share below and let’s grow together.

#ETH #ETFs #CryptoInvesting #MakeMoneyWithCrypto #Ethereum #BlackRock #Bitwise #SmartMoneyMoves #PassiveIncome

-

Clear and empowering breakdown—ETFs have truly opened the door for non-technical participants to benefit from Ethereum's growth. Investing in ETH ETFs like those from major asset managers provides institutional-level access and diversification, without needing to run nodes, stake funds, or handle smart contracts. For retail investors, this means easier portfolio entry and lower technical overhead. It’s a smart way to ride adoption safely.

-

Smart framework—but ETF exposure comes with its considerations. While ETH ETFs remove the complexity of onboard staking or wallet security, they also introduce management fees, tracking error risk, and potential regulatory changes. Plus, if the ETH price rises dramatically, demand to redeem ETF shares could strain liquidity chains. Keeping some ETH in cold storage or self-custody while using ETFs for broader exposure might be a balanced long-term play.