How to use Session Profiles for Day Trading Pt 2

-

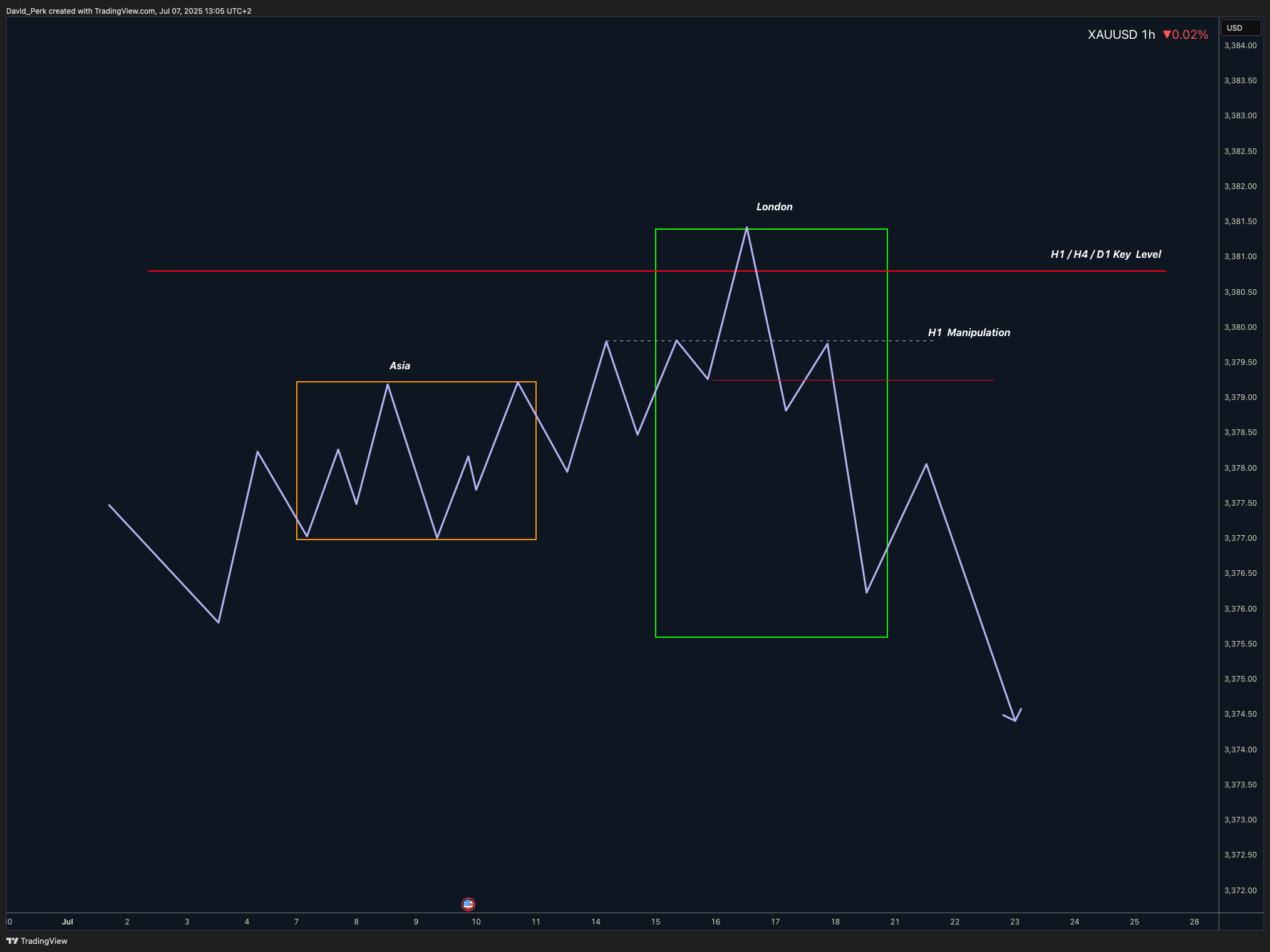

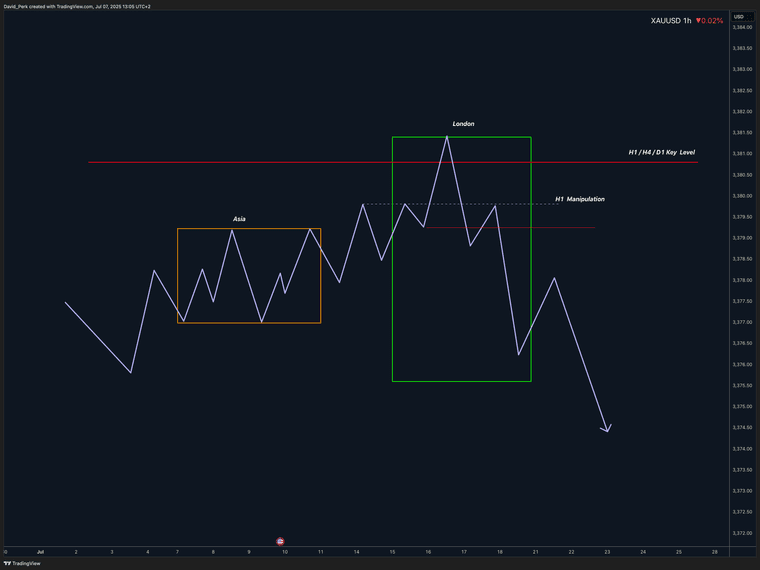

2. London Reversal Profile

London Reversal ProfileConditions:

• Asia session consolidates near a higher timeframe key level

• London open initiates the manipulation into the key level

• Displacement + M15 BOS after manipulationExample:

• H1: Asia consolidates under daily FVG

• London opens, price runs Asia high into that FVG

• M15 breaks down → clean short setup

• Target: higher timeframe draw on liquidity (e.g., previous day low)Invalidation: the London session high (manipulation point)

Narrative: London performs the manipulation → price reverses.

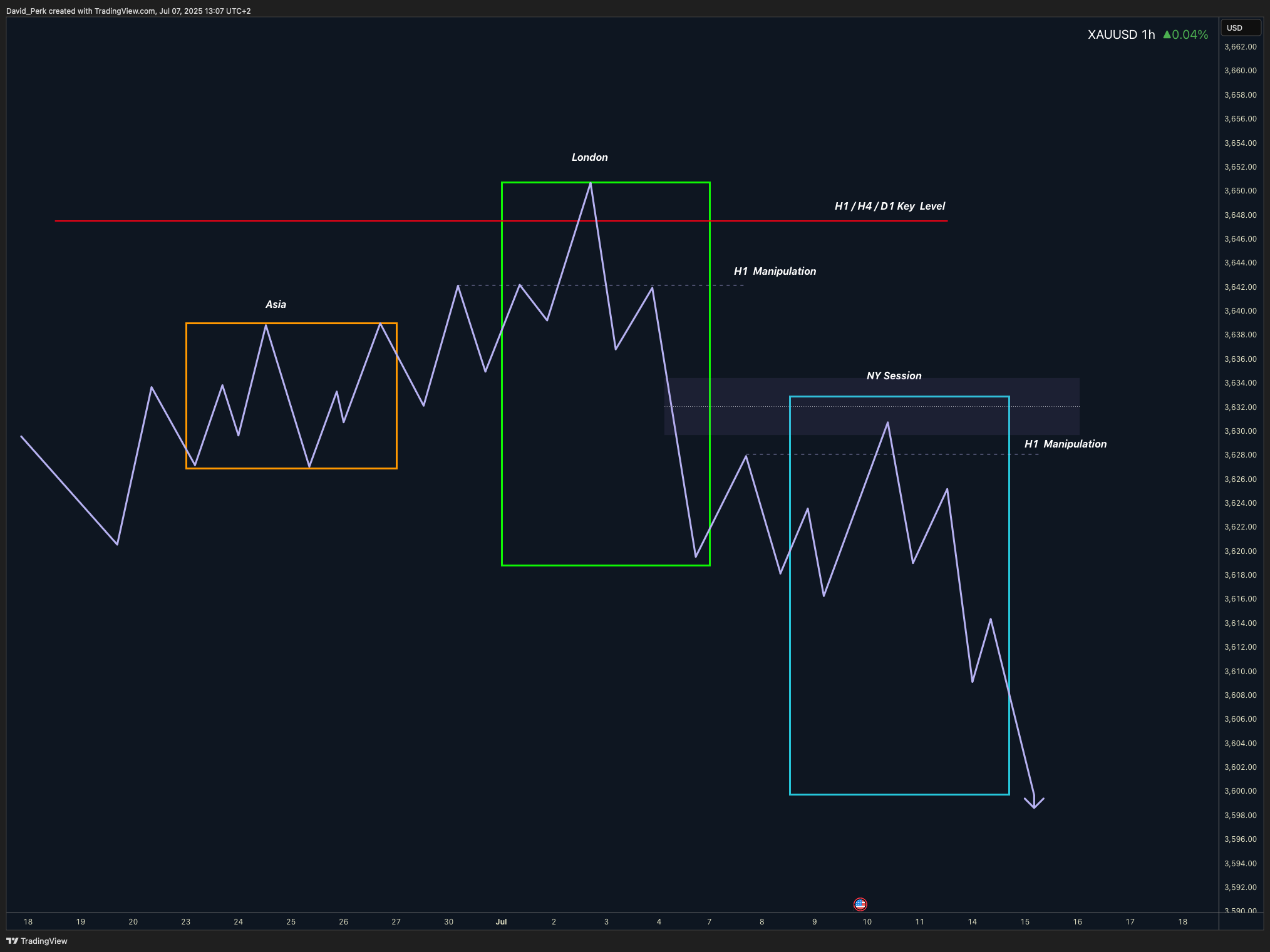

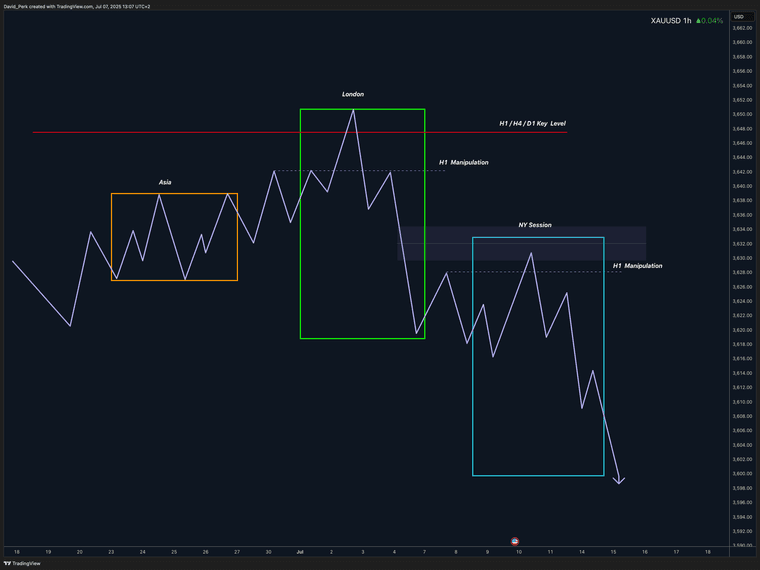

New York Continuation Profile

New York Continuation Profile

Conditions:

• Asia + London already created a clear manipulation and displacement

• London has not reached the final draw on liquidity

• London is not overextended (e.g., <70 pips move)

• New York opens with structure intact for continuationExample:

• H1: London makes a reversal from a key level and displaces lower

• Draw on liquidity (e.g., previous day low) still untouched

• NY opens and continues the sell-off, retracing briefly into M15 imbalance before expanding lowerInvalidation: manipulation level from London

Narrative: London set the direction → NY finishes the move.

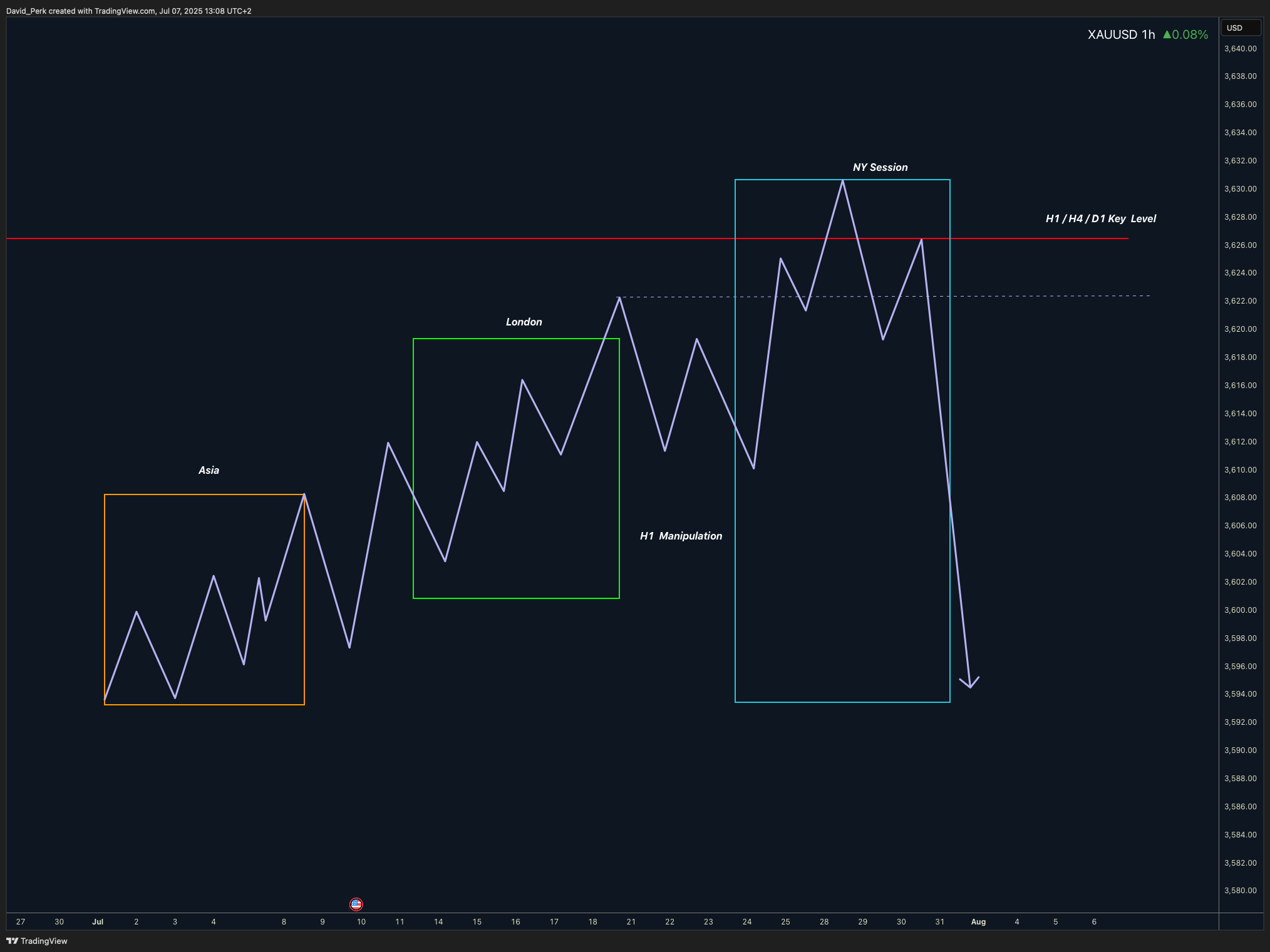

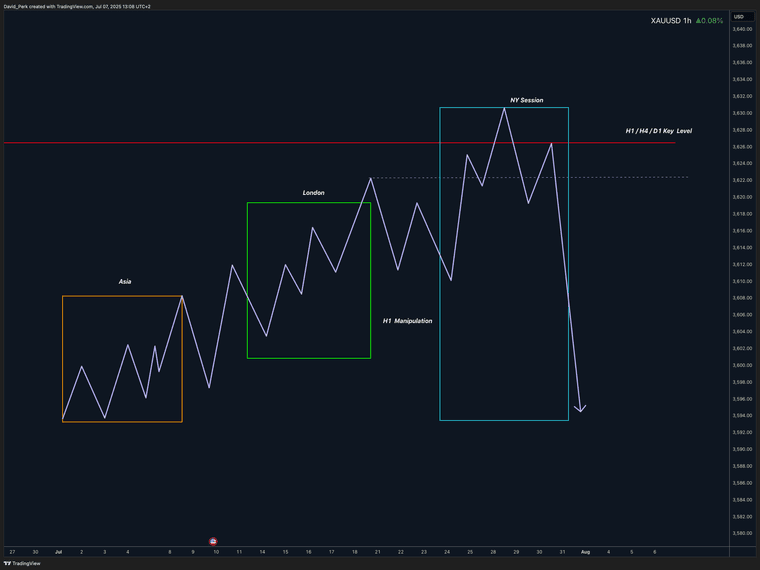

New York Reversal Profile

New York Reversal Profile

Conditions:

• No clear London profile (no key level touched, no strong CHoCH)

• NY opens and manipulates into a key level (e.g., daily OB, FVG)

• Clear M15 or H1 CHoCH or BOS confirming reversal

• Asia + London lows still intact (liquidity available below)Example:

• H1: No strong setup in London

• NY opens, price spikes into daily OB and takes out London highs

• M15 structure shifts → sell targeting London + Asia lowsInvalidation: NY session manipulation high

Narrative: London was noise → NY takes control and reverses.

Visual Structure Flow

Visual Structure FlowBefore applying any session profile, confirm:

- High-probability trading conditions (e.g., key level proximity, market open, liquidity available, Red News)

- Bias in place (HTF (D1 and Weekly direction must be known)

Then:

→ Check for valid session narrative

→ Select the correct session profile

→ Wait for the stop run of H1 / H4

→ Is there enough room for the move to key level

→ If we are still in first half of session you can enter. If its close the end of session skip it.

→ Apply your entry and risk model.

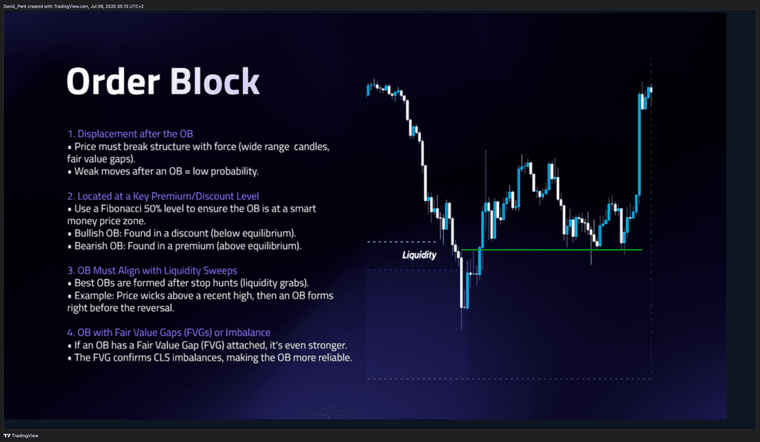

→ Dont be greedy look for 2:1 RR trade and get out. [I]How to enter ?

[I]How to enter ?

if bearish - You always want enter above H1 I H4 candle after LTF CIOD

If bullish - You always want to enter bellow H1/ H4 after LTF CIOD.Use Order block to enter the market here is how to identify it correctly

snapshotRemember:

Never sell low / Never buy High... wait for stop run / Liquidity sweeps. If you dont know where is the liquidity - you will be liquidity.Hope this brings clarity to your trading.

Done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis."Adapt what is useful, reject what is useless, and add what is specifically your own."