210k Capital Posts 640% Return — Bitcoin, Politics, and a Hedge Fund Power Move

-

In a year where Bitcoin hit record highs and political allegiances got a crypto twist, one hedge fund decided to go all in—and it paid off. Big time.210k Capital, founded by serial entrepreneur and Bitcoin evangelist David Bailey, has reportedly delivered a 640% net return over the 12 months through June 2025, according to Bloomberg. The kicker? The fund didn’t just bet on Bitcoin—it helped shape U.S. policy around it.

Let’s break down what happened, why it matters, and what it means for the broader Bitcoin ecosystem.

🧠 The Strategy: Buy Bitcoin. Influence Trump. Moon.The fund’s winning formula boiled down to three parts:

Stack Bitcoin-heavy stocks – 210k Capital made smart bets on companies that added BTC to their balance sheets. Expand globally – Treasury investments weren’t just U.S.-centric. The fund went global, with exposure in the U.S., UK, Canada, Australia, and Sweden. Play politics – Bailey reportedly advised Donald Trump’s campaign on Bitcoin, helping steer the former president into a pro-crypto stance.The result? A portfolio tailor-made to benefit from both market movements and regulatory winds shifting in Bitcoin’s favor.

The Portfolio: A Who’s-Who of BTC-Linked Firms

The Portfolio: A Who’s-Who of BTC-Linked Firms210k Capital is part of UTXO Management, and while it’s a private firm (meaning it doesn’t have to publish its financials), anonymous insiders gave Bloomberg a peek behind the curtain. The fund holds stakes in companies that could best be described as Bitcoin proxies—they’re not selling hardware wallets or NFTs, but their fates are deeply tied to BTC's price.

Here are a few names:

Strategy (MSTR) – Formerly MicroStrategy. Think: Michael Saylor and the original BTC treasury play. Metaplanet (3350) – Japan’s take on corporate Bitcoin exposure. Moon Inc. (1723) – Sounds fun, probably volatile. The Smarter Web Company (SWC) – Web3 dreams, presumably. The Blockchain Group (ALTBG) – Because naming things “Blockchain” never goes out of style. Liquid Technologies (LQWD) – Lightning-focused. H100, Matador, DV8 – No, not a startup dance crew. Real tickers.Managing Partner Tyler Evans said they’re evaluating 30+ more investments in Bitcoin-related companies, suggesting this is just the beginning.

🧩 The Bailey EffectDavid Bailey isn’t just making money—he’s making moves. Best known as the founder of Bitcoin Magazine and BTC Inc., Bailey apparently played a central role in Trump’s crypto pivot. Bloomberg even credited him as the “chief architect” of the policy shift.

If that wasn’t enough, Bailey’s other firm, Nakamoto Holdings, recently:

Raised $300 million in May, Merged with healthcare firm KindlyMD, Added another $51.5 million in fresh capital, And is now eyeing a public offering.The guy’s either building a Bitcoin empire or playing 4D chess. Either way, he's in motion.

Bitcoin Treasury Firms: Trend or Bubble?

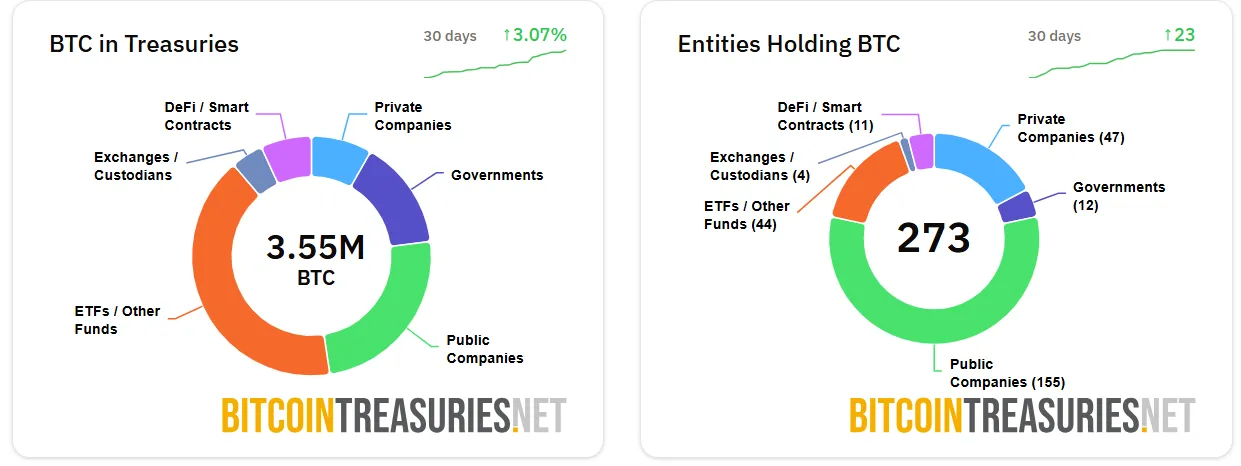

Bitcoin Treasury Firms: Trend or Bubble?Since Michael Saylor kicked off the “Bitcoin as treasury asset” trend in 2020, more than 150 public companies have joined in. According to BitcoinTreasuries.net:

Public companies now hold 868,709 BTC, Known private firms hold another 292,355 BTC.The logic? Why let inflation eat your cash reserves when you can ride the hardest asset on the planet?

But not everyone’s buying in. Venture firm Breed warns that success for these companies hinges on maintaining a high market cap vs. net asset value (MNAV). If Bitcoin crashes, so does their valuation—and potentially their ability to raise debt for future BTC buys.

Glassnode’s James Check puts it bluntly:

“We’re already close to the ‘show me’ phase… It’ll be increasingly difficult for random company X to sustain a premium without a serious niche.”Translation: Not everyone can slap “Bitcoin” on their pitch deck and print stock gains anymore.

️ Meanwhile in Washington...

️ Meanwhile in Washington...Politics and Bitcoin are now officially dating.

Last week, the Republican-controlled House passed three crypto bills covering:

Stablecoin regulation Market structure clarity A ban on the creation of a central bank digital currency (CBDC)Crypto finally has the ear of lawmakers—and Bailey seems to be playing a key role in whispering into it.

TL;DR

TL;DR210k Capital turned a killer return by betting big on Bitcoin-linked equities and influencing U.S. policy. The fund’s success highlights the growing intersection of politics, macro strategy, and crypto. David Bailey is building a Bitcoin-centric empire—and influencing the shape of U.S. crypto regulation along the way. Bitcoin treasury plays are hot... but only the serious players will survive long-term. The U.S. might be inching toward real crypto regulation, just in time for the next cycle.Conclusion:

Bitcoin isn’t just a tech trend anymore. It’s a geopolitical, macroeconomic, and now political asset. The lines are blurring between markets and policy—and 210k Capital is riding that wave with the finesse of a surfer holding a laser-eyed American flag.Welcome to the Bitcoin capital wars.

#btc #crypto #coin #cryptocurrency #USDT