Bitcoin mining costs signal potential downside risk

-

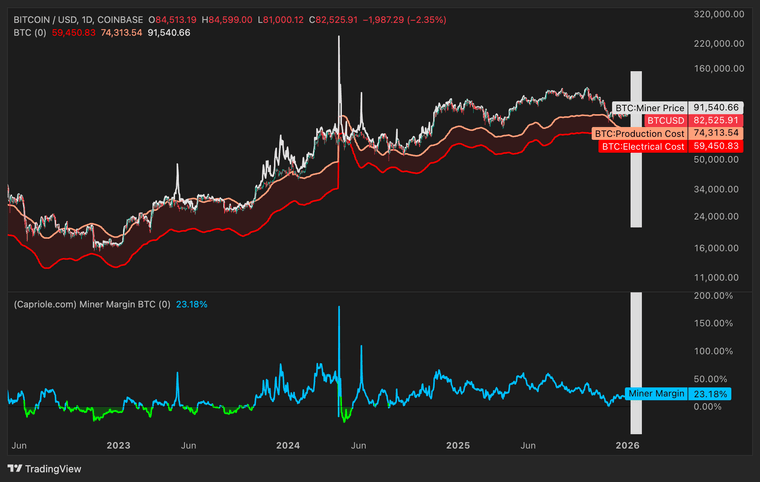

A key Bitcoin metric tied to mining costs is flashing caution signs for bulls, suggesting BTC could still face downside pressure before finding a durable bottom.

Data from Capriole Investments shows the average electricity cost to mine one Bitcoin is about $59,450, while total production costs sit near $74,300. With Bitcoin recently trading above $80,000, analysts say the market still has room to fall into this cost zone before miners feel significant financial stress.

Capriole founder Charles Edwards warned that an ongoing “miner exodus” has expanded the range for near-term downside. Bitcoin’s hash rate dropped to mid-2025 levels in late January, a move some analysts attribute to miners reallocating power toward AI workloads, while others point to winter storms in the US disrupting operations.

If selling pressure continues, BTC could slide toward the $59,000–$74,000 range, where mining economics may help stabilize prices.

-

miner exodus expanding downside range sounds scary, but maybe just another classic shakeout before a bigger rebound