Bitcoin options signal highest fear in over a year

-

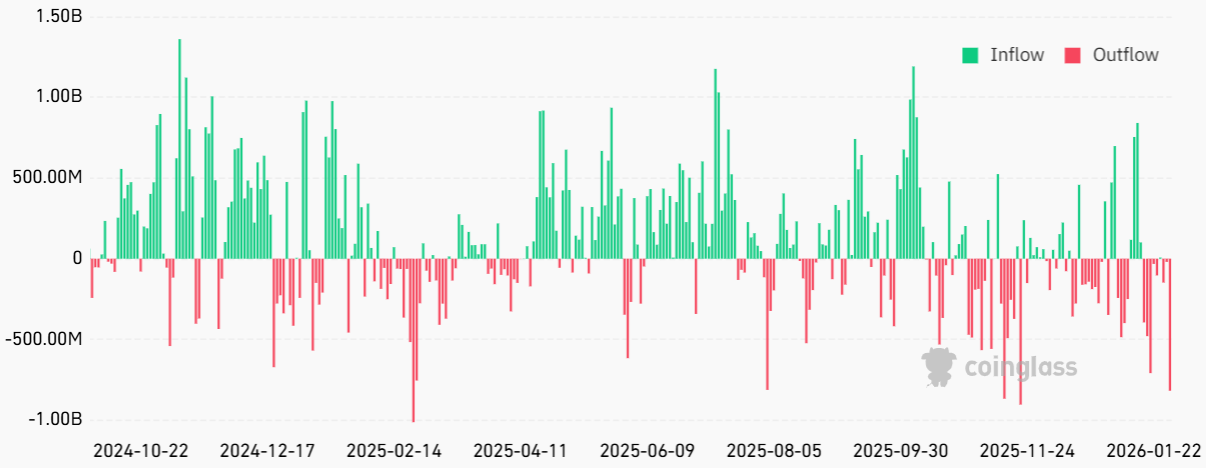

Bitcoin derivatives are flashing heightened fear, with options markets showing their most bearish sentiment in over a year. The BTC options delta skew surged to 17% on Friday, far above the level typically seen in neutral conditions, where put options trade at a modest premium to calls.

Such elevated skew levels suggest traders are aggressively hedging against further downside, often a sign of extreme caution. This shift follows a sharp selloff that pushed Bitcoin lower by double digits over the past two weeks, increasing volatility expectations among market makers.

Analysts note that while extreme fear can amplify short-term price swings, it has historically appeared near periods of market stress rather than sustained rallies. Bitcoin derivatives now reflect a market bracing for uncertainty rather than confident directional bets.