Tokenization boom lifts Securitize to $1.24B valuation

-

Securitize said its planned SPAC merger would value the company at $1.24 billion, supported by a $225 million private investment in public equity from institutional investors. The company projects revenue of $110 million and adjusted EBITDA of $32 million in 2026.

The platform manages roughly $4 billion in tokenized assets and counts firms such as BlackRock, Apollo, Hamilton Lane, and VanEck among its partners. Its growth mirrors broader momentum in real-world asset tokenization, as traditional finance firms increasingly adopt blockchain infrastructure.

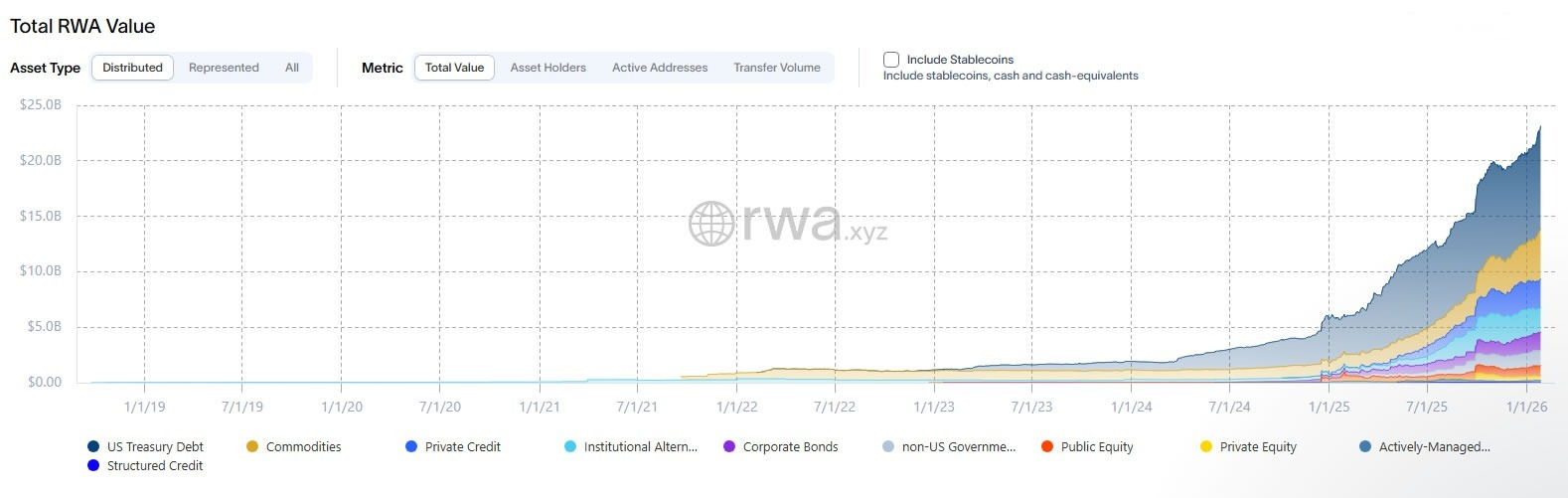

According to RWA.xyz, the on-chain value of tokenized assets has climbed 310% over the past year to $24.2 billion, led by tokenized US Treasuries. Ethereum remains the dominant network for asset tokenization, accounting for about 65% of the market when layer-2 networks are included.

-

841% growth sounds insane until you remember how small the base was, still impressive though.