Bitcoin’s smaller size could amplify upside versus gold

-

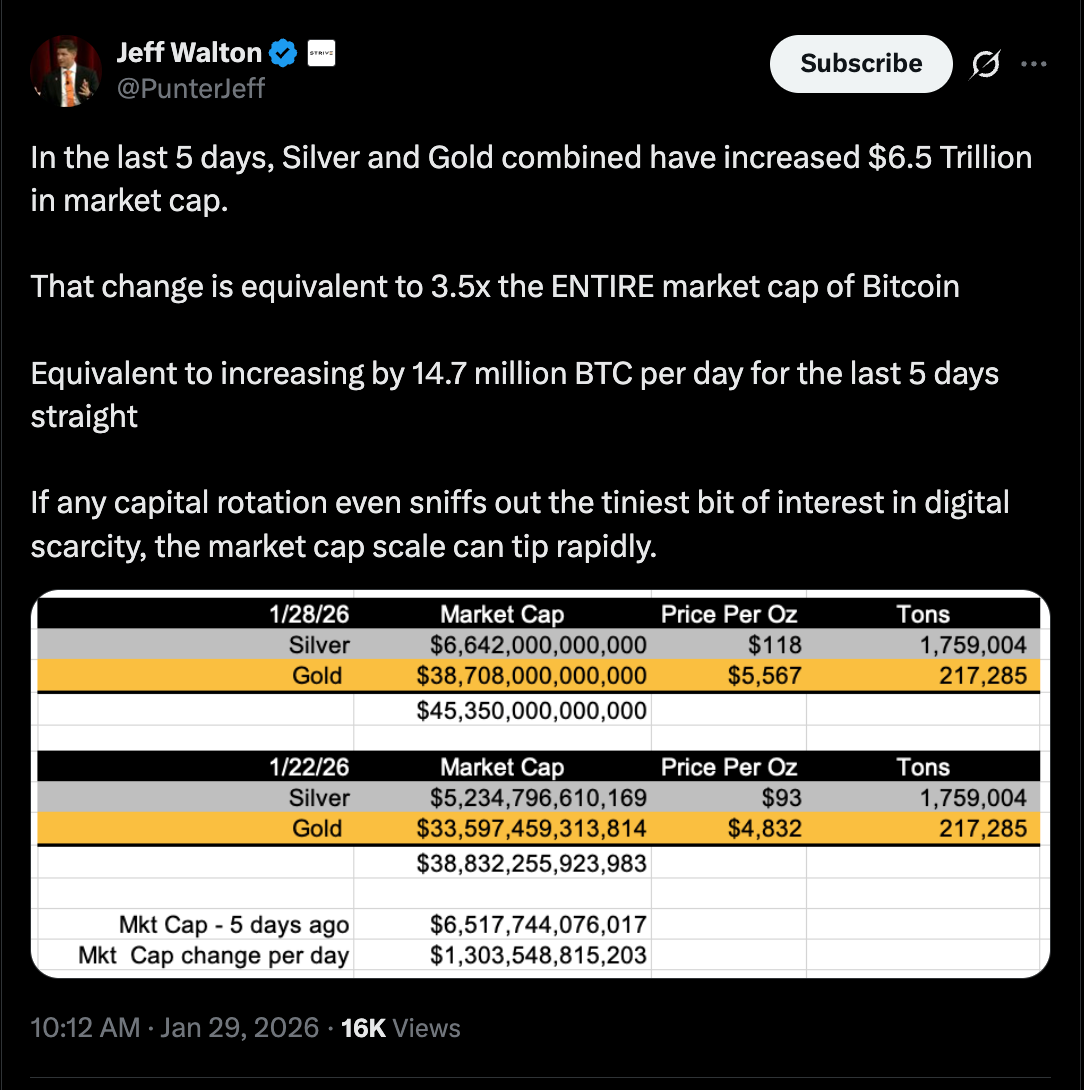

Gold still dominates the hard-asset landscape, with a market capitalization of roughly $41.7 trillion. Bitcoin, by comparison, represents just over 4% of that total.

That size gap cuts both ways. While Bitcoin remains more volatile, even small reallocations from gold-style demand could have an outsized impact on BTC’s price. Investors already using gold for inflation protection, currency hedging or geopolitical risk may view Bitcoin as a complementary allocation.

Analysts suggest that a hypothetical 5% rotation from gold into Bitcoin would translate into more than $2 trillion in inflows. At current valuations, that could imply a Bitcoin price approaching $190,000 — highlighting how marginal demand shifts may carry disproportionate effects.