RLUSD Thrives While XRP Utility Faces Questions

-

Despite RLUSD’s rapid adoption, its success has not translated directly into gains for XRP. Nearly 76% of RLUSD’s circulating supply currently lives on the Ethereum rather than on Ripple’s native XRP Ledger, limiting XRP’s direct utility. Transactions settled on Ethereum do not contribute to XRP burns or on-ledger fee demand, sparking debate within the XRP community.

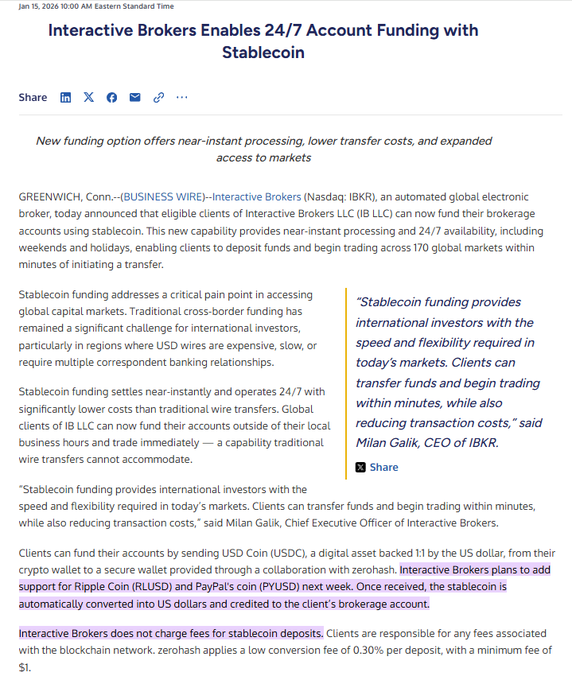

Still, RLUSD’s institutional credibility continues to strengthen. The stablecoin has secured regulatory approvals from the Abu Dhabi Financial Services Regulatory Authority and preliminary EMI approval in Luxembourg, opening pathways for broader EU adoption. With additional integrations announced by firms like Interactive Brokers and growing uptake from institutions such as DBS and Franklin Templeton, RLUSD is increasingly positioned as a bridge between traditional finance and crypto—even as questions remain about how much that success ultimately benefits XRP holders.