Profiting From ETH Caution While Institutions Hesitate

-

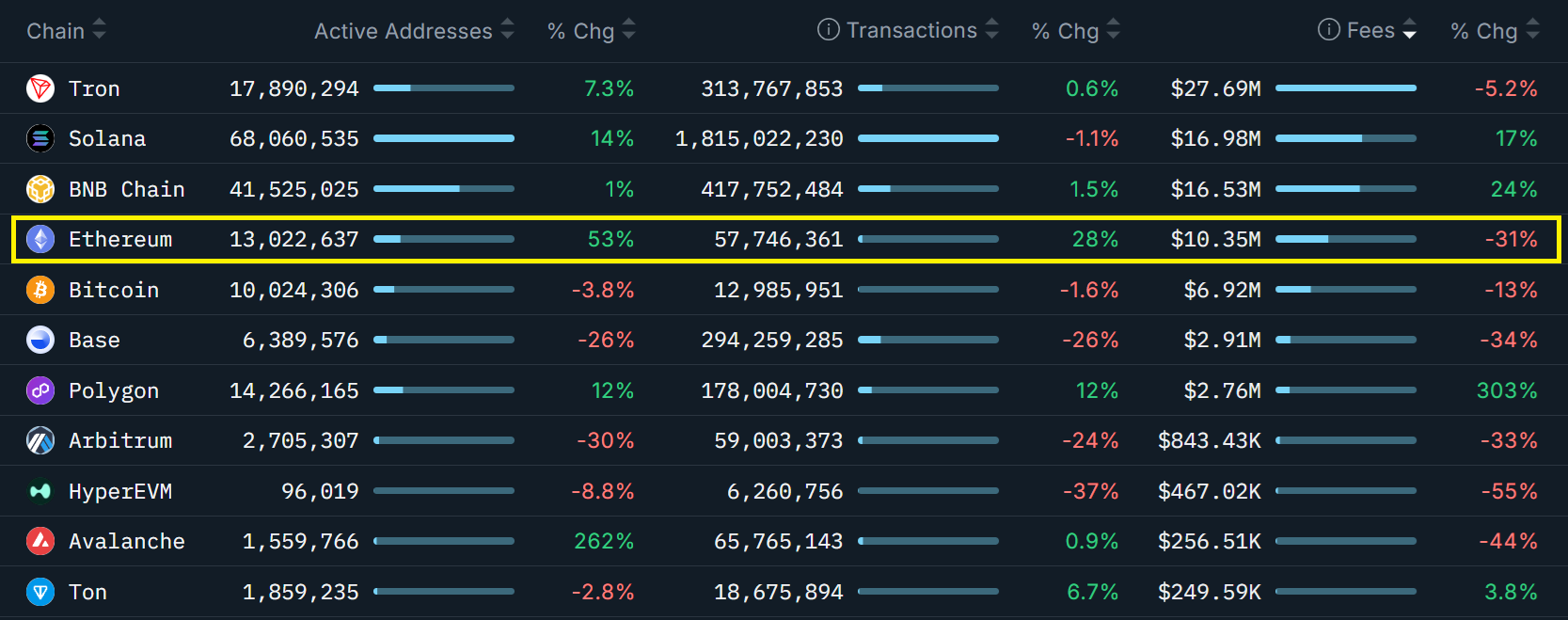

Even with spot ETF inflows and corporate ETH accumulation, institutional hesitation creates a unique setup for traders. When large buyers are underwater and confidence erodes, prices often remain externally driven—reacting more to macro assets like gold or the S&P 500 than to crypto fundamentals. This correlation allows traders to hedge ETH exposure using traditional markets or trade relative strength between crypto and equities.

In these conditions, money is often made not by predicting ETH’s next rally, but by positioning defensively: scaling into trades gradually, keeping dry powder, and exploiting short-term dislocations caused by liquidations. Until network demand and staking incentives recover, disciplined traders focus on survival and steady gains—knowing that capital preserved in uncertain phases is capital ready for the next real trend.

-

defensive trading is underrated, not every market is about sending it