From Speculative Frenzy to Reset — Bitcoin’s Open Interest Reality Check

-

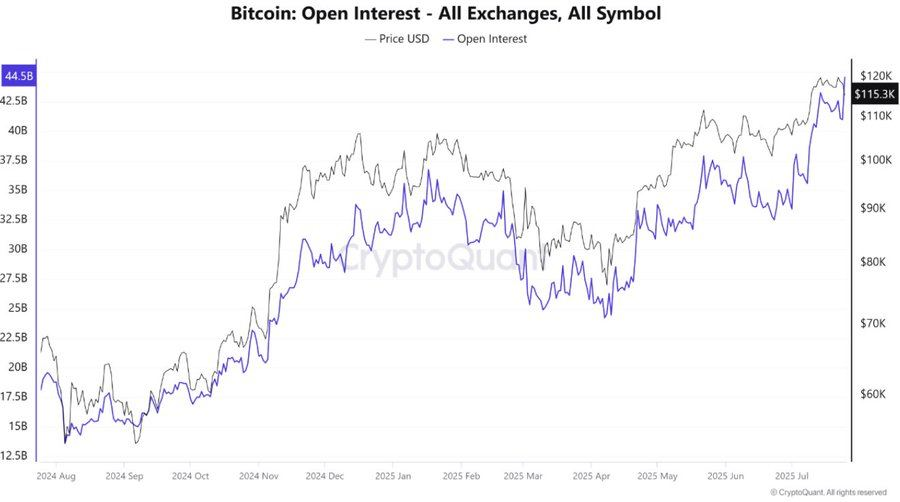

Bitcoin’s derivatives market looked very different just a few months ago. During 2025’s speculative surge, open interest exploded to over $15 billion, nearly triple the level seen at the 2021 bull market peak. That buildup left the market vulnerable, a weakness exposed during the sharp liquidation event in October.

Since then, the steady decline in open interest suggests leveraged traders are being forced out or choosing to exit. This matters because rallies that occur alongside falling leverage are often considered more durable. Instead of being fueled by risky positions, price strength increasingly reflects spot demand and reduced selling pressure from overextended traders.

-

october really shook ppl out, market feels calmer since