What does it mean that Bitcoin ETFs are now dominated by long-term holders?

-

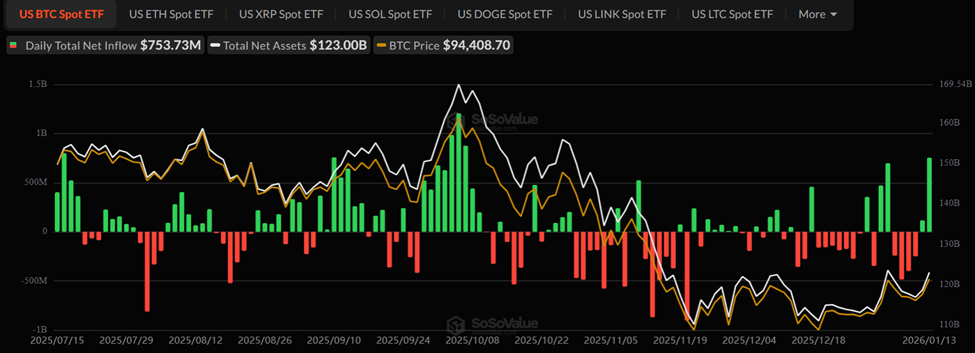

US spot Bitcoin ETFs have quietly crossed $120 billion in net assets, and analysts say the most important shift isn’t the size — it’s who is holding them. According to data from SoSoValue, recent inflows suggest that many ETF buyers are institutional and older investors who tend to allocate capital with multi-year time horizons rather than short-term trading strategies.

Bloomberg ETF analyst Eric Balchunas describes these investors as “not tourists,” meaning they are treating Bitcoin more like gold than a speculative tech asset. This “sticky capital” reduces the likelihood of rapid sell-offs and slowly alters Bitcoin’s supply dynamics over time.

-

Strong buyers are strong holders.

-

sticky capital is boring but thats how markets actually change