How Macro Uncertainty Creates Bitcoin Trading Opportunities

-

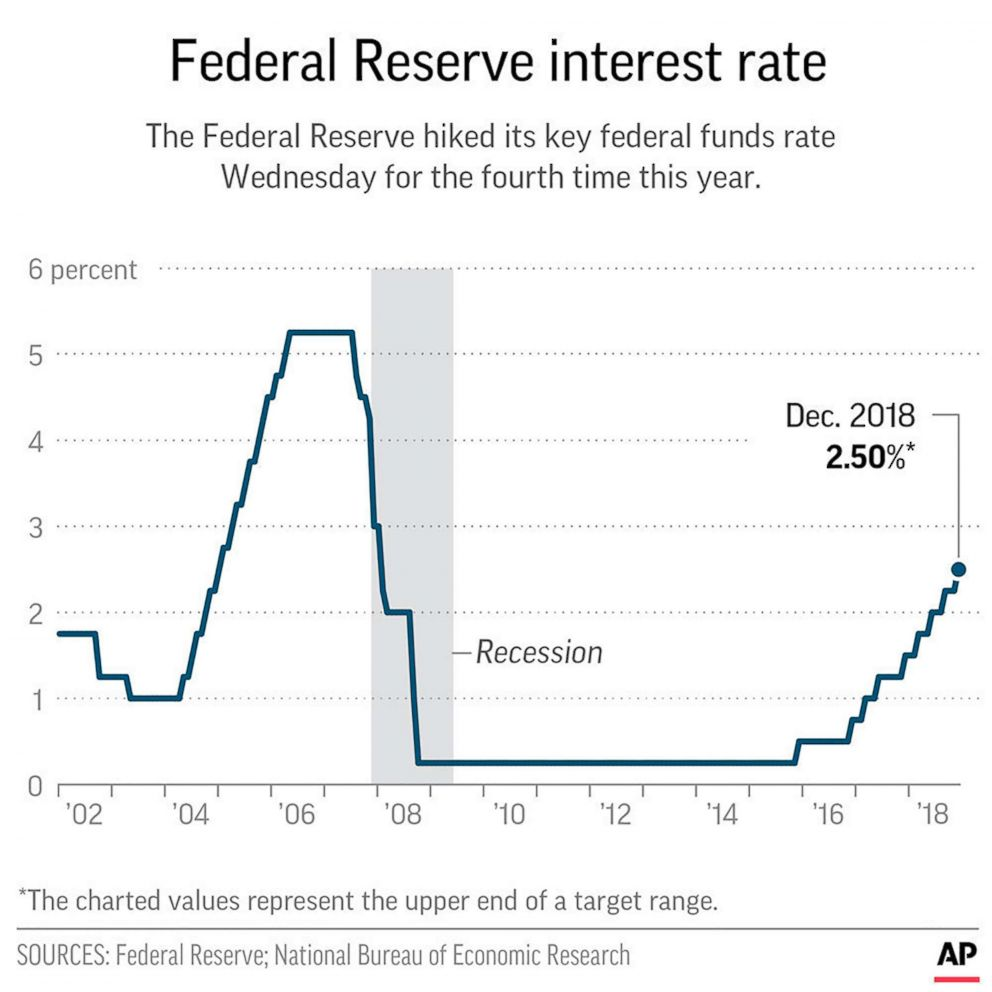

Macro uncertainty doesn’t always mean Bitcoin goes straight up—but it does create asymmetrical trading opportunities. Investigations involving the Federal Reserve and political pressure on interest rates add long-term appeal to scarce assets like Bitcoin, even if short-term price action remains muted. Traders can position for this by scaling into spot positions during periods of pessimism rather than buying during hype-driven rallies.

At the same time, a strong US dollar and steady Treasury yields suggest no immediate crisis trade. That means the smarter money-making approach is flexibility: combining short-term trades with small long-term accumulation. Until ETF flows turn positive and bullish leverage demand returns, the best profits will likely come from patience, precision, and selective exposure—not blind optimism.