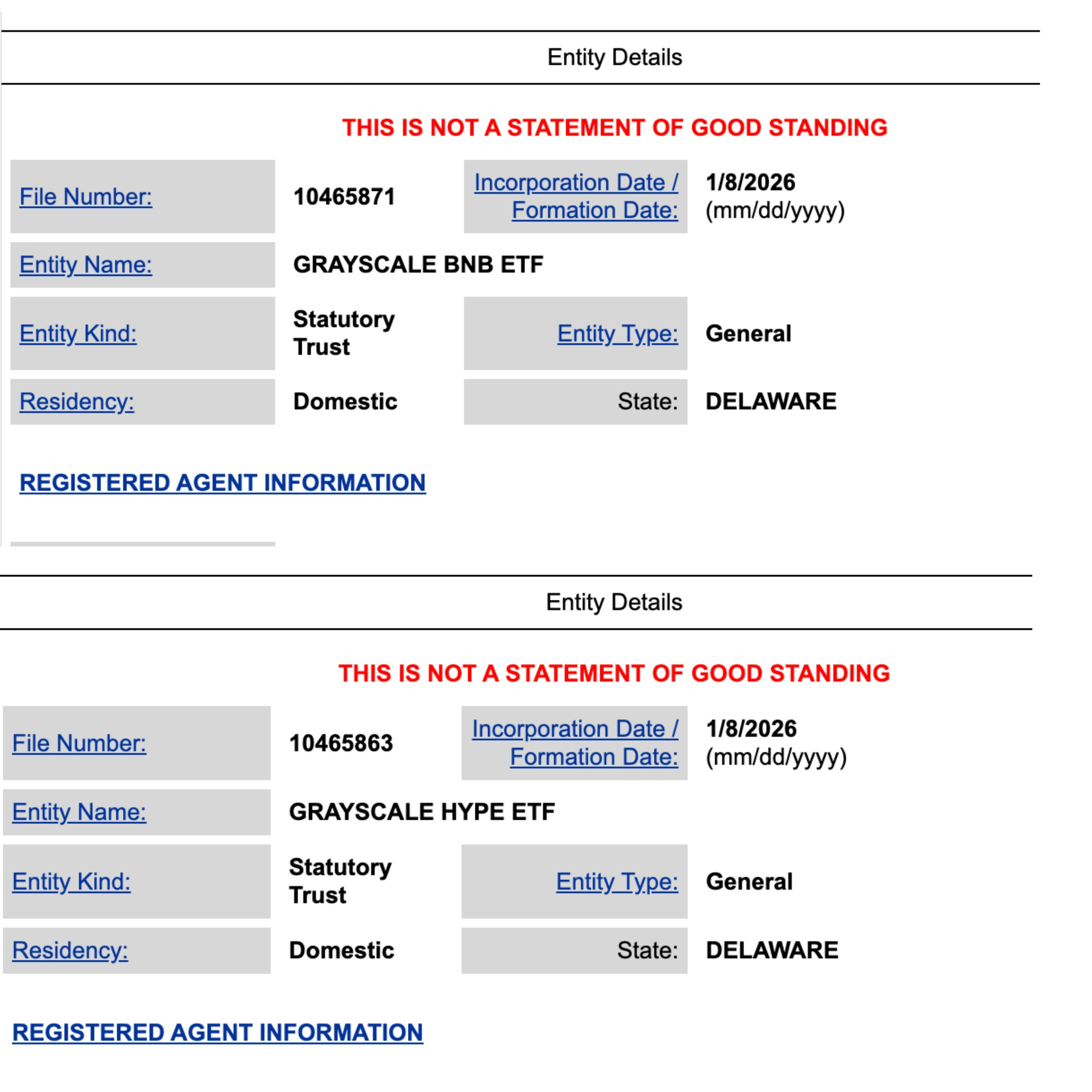

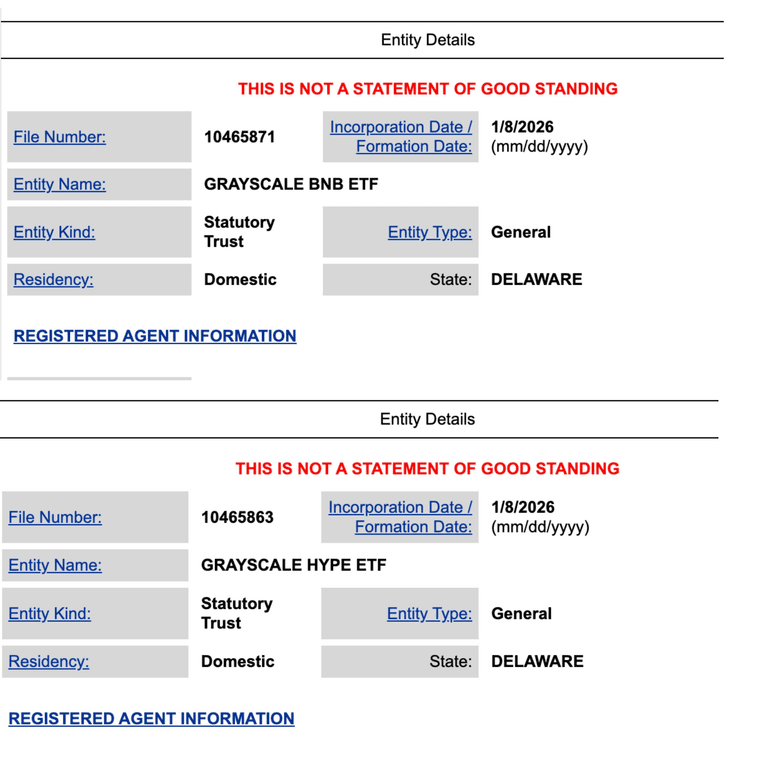

A Streamlined Path for New Crypto ETFs

-

The timing of Grayscale’s filings is notable. Recent regulatory changes mean crypto ETFs no longer require asset-specific rule change proposals, simplifying the listing process for qualifying products. This shift lowers friction for issuers looking to bring new digital assets into regulated investment vehicles.

Grayscale now joins VanEck, which has already filed for a spot BNB ETF and confirmed plans for a HYPE-linked product. Together, these moves suggest growing institutional confidence in expanding ETF exposure beyond Bitcoin and Ethereum.

-

etfs not needing asset-specific rule changes anymore is kinda a quiet game changer