Why Bitcoin Liquidation Maps Matter Right Now

Airdrop and Ways to earn money

2

Posts

2

Posters

12

Views

-

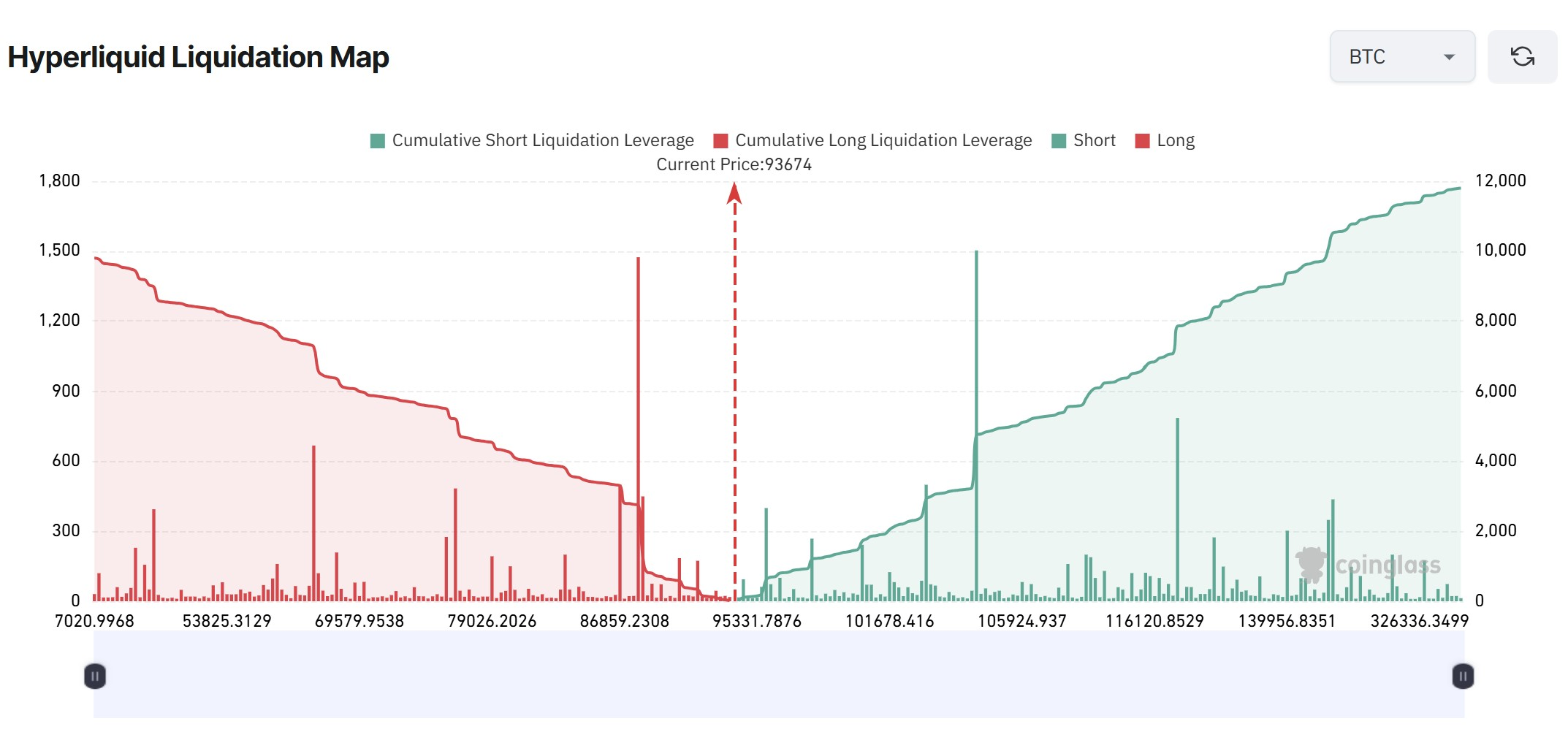

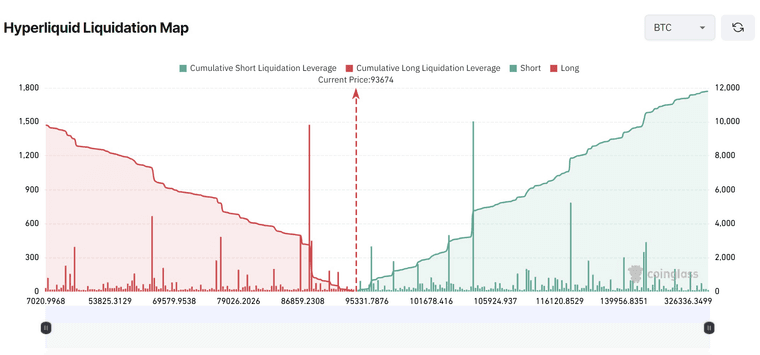

Liquidation levels are not just data points—they represent forced market orders when price hits certain thresholds. When large clusters are triggered, momentum can accelerate quickly in either direction.

Current data shows roughly $10.6 billion in long liquidations below $84,000, compared with far fewer shorts above $104,000. This skew highlights where volatility pressure is most concentrated.

-

that long stack below 84k is basically a giant “do not step here” sign