AI and Arbitrage Are Redefining What It Takes to Win Prediction Markets

-

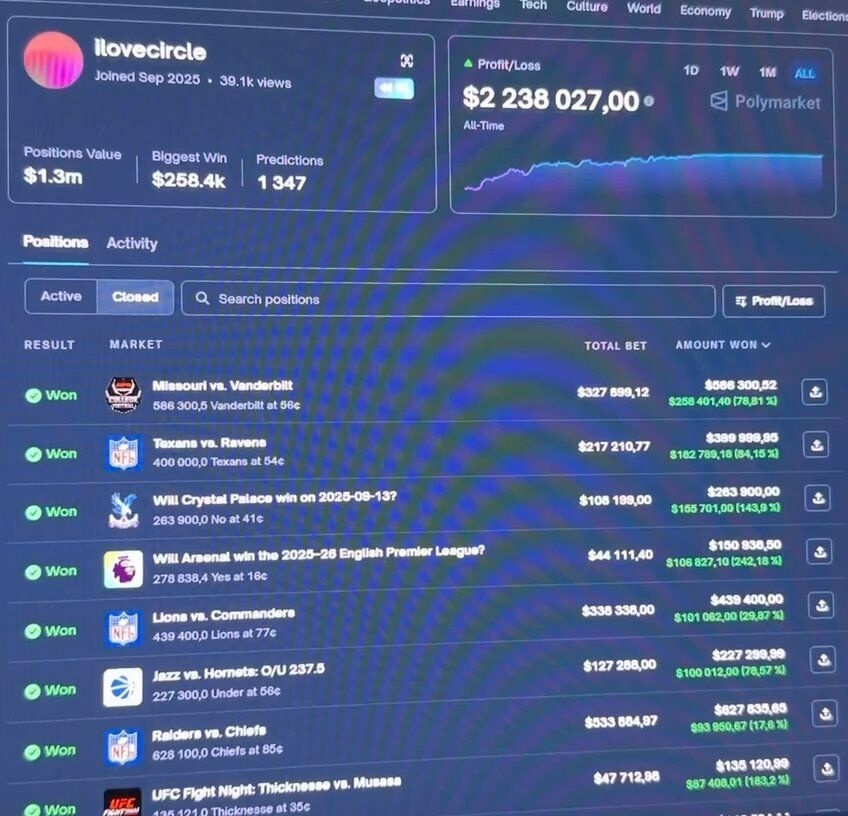

Beyond simple arbitrage, AI-driven strategies are pushing prediction markets into a new era. Some bots now rely on machine learning models trained on news flow, social data, and historical outcomes to identify undervalued contracts in real time, retraining constantly to stay ahead of the market.

The result is a widening performance gap: bots consistently outperform humans through disciplined position sizing, repetition, and near-emotionless execution. While this raises questions about fairness and long-term market dynamics, it also offers a lesson—success increasingly favors systematic, probability-based strategies over intuition, signaling a permanent shift in how prediction markets operate.

-

Edge comes from repetition, not brilliance.

-

Markets reward systems, not stories.