Leverage and ETF Flows Signal Caution, Not Confidence

-

Even as Bitcoin hit its highest levels since mid-December, demand for leveraged bullish positions stayed flat. Futures data shows the BTC basis rate remains below neutral, suggesting traders are hesitant to pay a premium for upside exposure while macro risks—such as potential US import tariffs—linger.

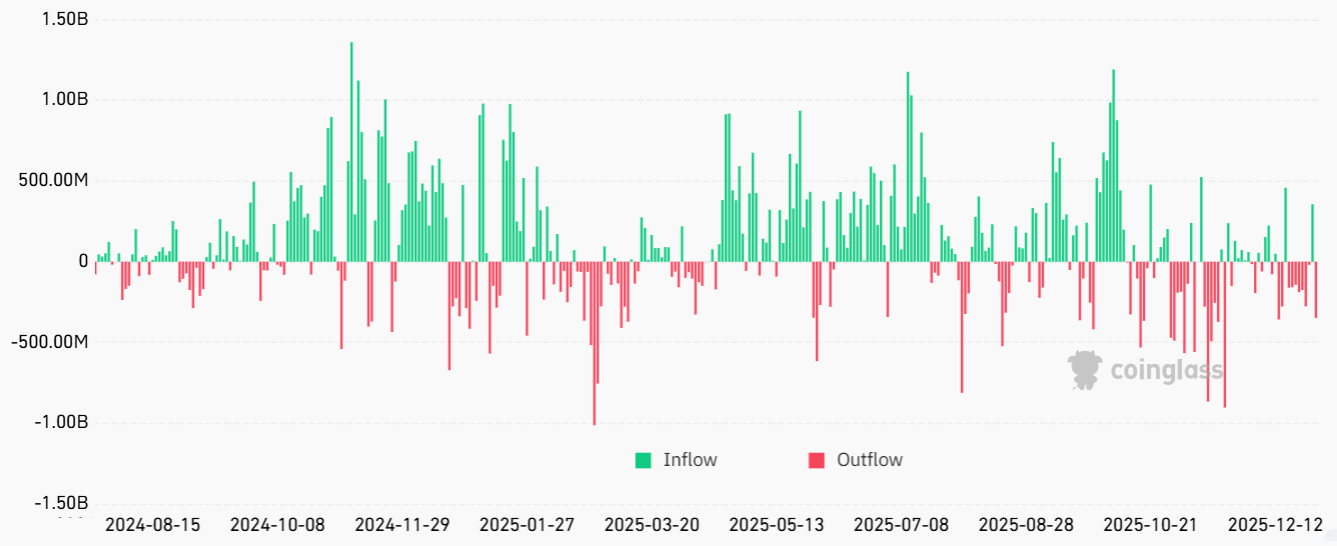

Spot Bitcoin ETFs tell a similar story. Since mid-December, US-listed products have seen more than $900 million in net outflows, while gold ETFs have recorded weeks of inflows. That divergence points to investor caution and a preference for defensive assets rather than a full-throttle bet on crypto’s near-term upside.