Why Stablecoins Are Becoming the New Cash Layer

-

Stablecoins are emerging as one of the most important structural bets for crypto exchanges heading into 2026. With the global stablecoin market reaching roughly $310 billion in 2025, products like Tether’s USDT and Circle’s USDC are increasingly treated as yield-bearing cash alternatives rather than simple trading pairs.

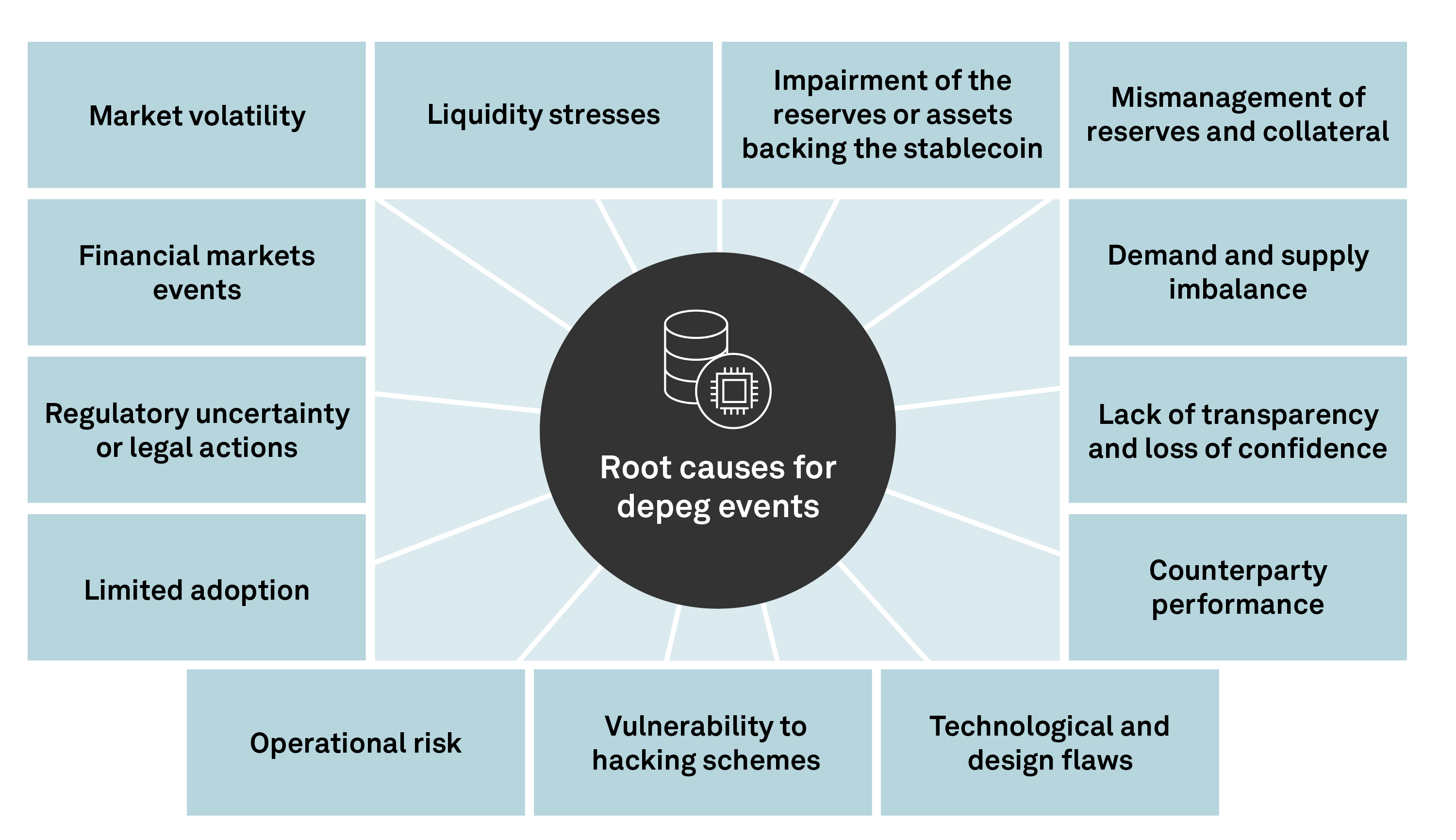

Rafique argues that stablecoins offer flexibility traditional banks often lack, especially in high-inflation regions. As interest rates rose, yields on stablecoin “earn” products stabilized around 4%–8%, attracting users seeking liquidity without lockups. Still, institutions like S&P Global and the European Central Bank warn that stablecoins carry risks, including de-pegging and potential impacts on financial stability.