USDC vs Other Stablecoins: Strengths and Trade-Offs

-

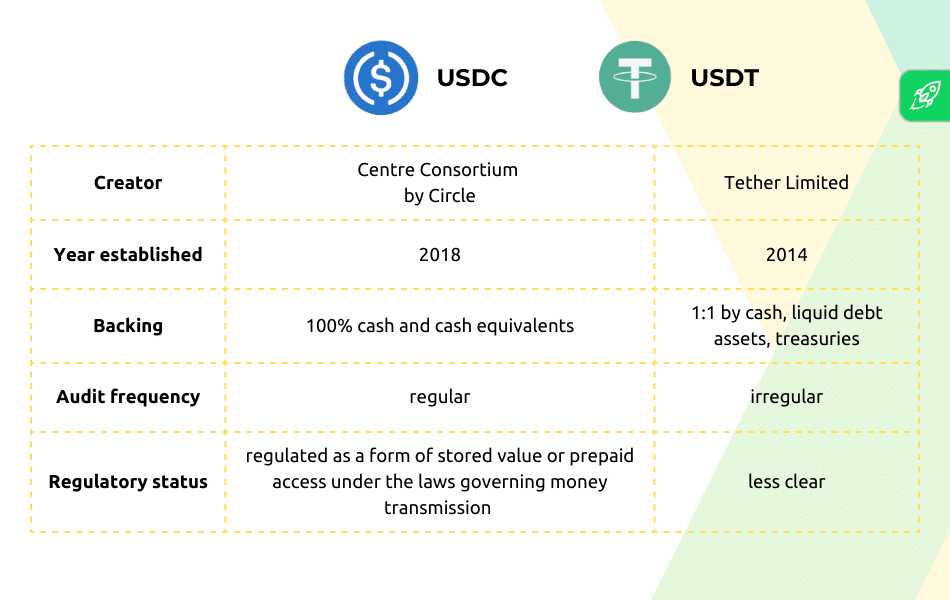

Compared with rivals like Tether, USDC is often viewed as the “safer” option due to clearer reserve disclosures and closer ties to traditional finance. That reputation has helped it gain adoption among banks, payment firms, and asset managers exploring blockchain-based settlement.

The trade-off is growth speed. USDC tends to expand more cautiously, sometimes losing market share during speculative bull runs. Still, as crypto matures and regulation tightens, many analysts believe USDC’s conservative approach positions it well for long-term relevance — especially in a future where stablecoins underpin global digital payments rather than just trading.