How Short-Term Crypto Rallies Can Create Trading Opportunities

-

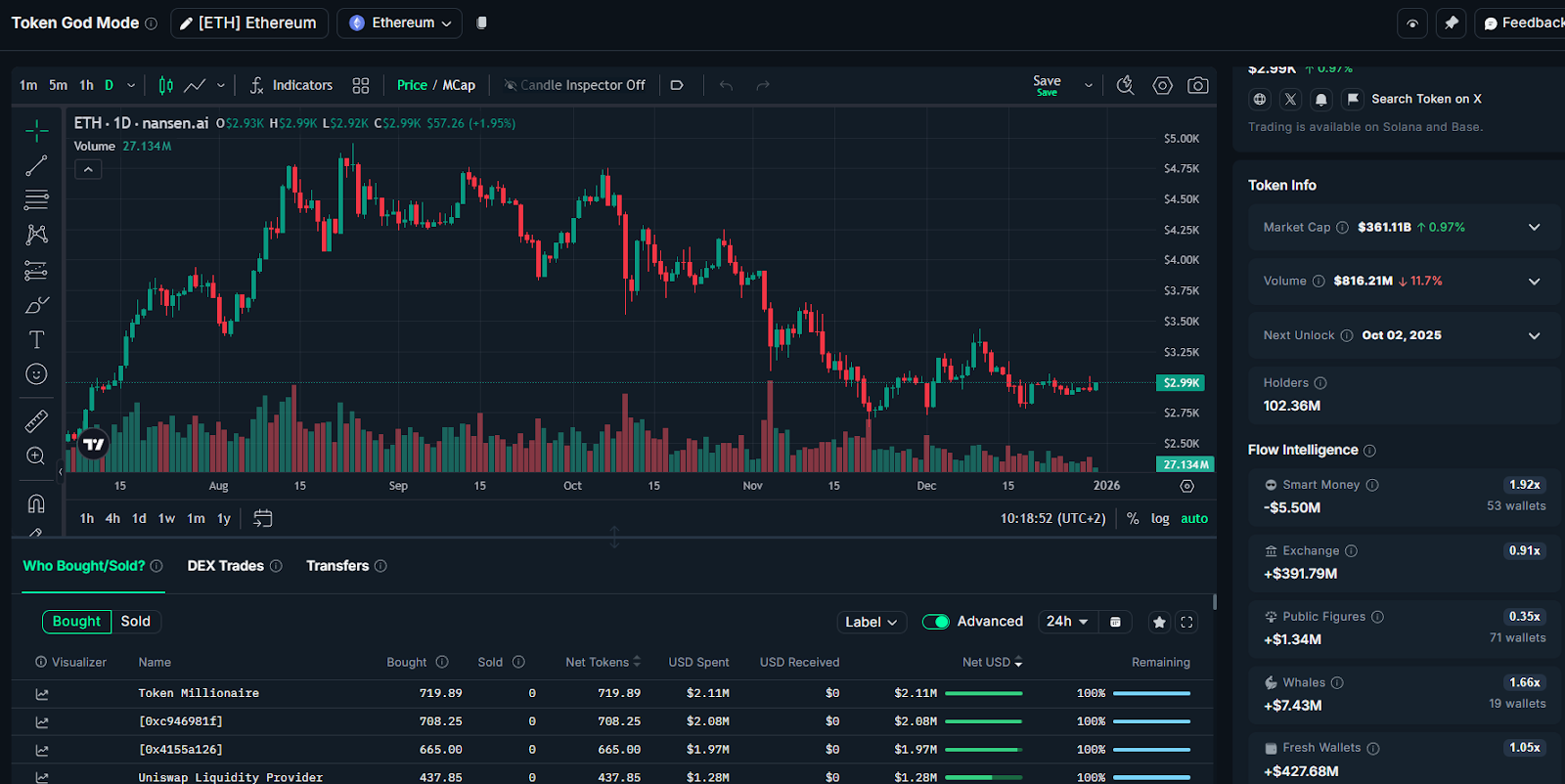

ETH/USD, one-day chart, Token God Mode. Source: nansen.aiLarge leveraged positions often indicate expectations of near-term price moves. In this case, a whale opened massive long positions on ETH, BTC, and SOL, even while sitting on tens of millions in unrealized losses. That suggests confidence in a bounce despite recent volatility.

Traders aiming to make money in similar setups often look for confirmation on price charts—such as support holding or volume expansion—before entering smaller, lower-risk trades. The goal isn’t matching the whale’s size, but aligning with potential momentum while defining clear exit levels.