How to Make Money from the New Wave of Bitcoin & Ether ETF Inflows

-

Institutional money is pouring back into crypto ETFs, and smart traders can position to ride the momentum. Here’s a practical, profit-focused playbook.

1️⃣ Ride the Bitcoin ETF Momentum

What’s happening:

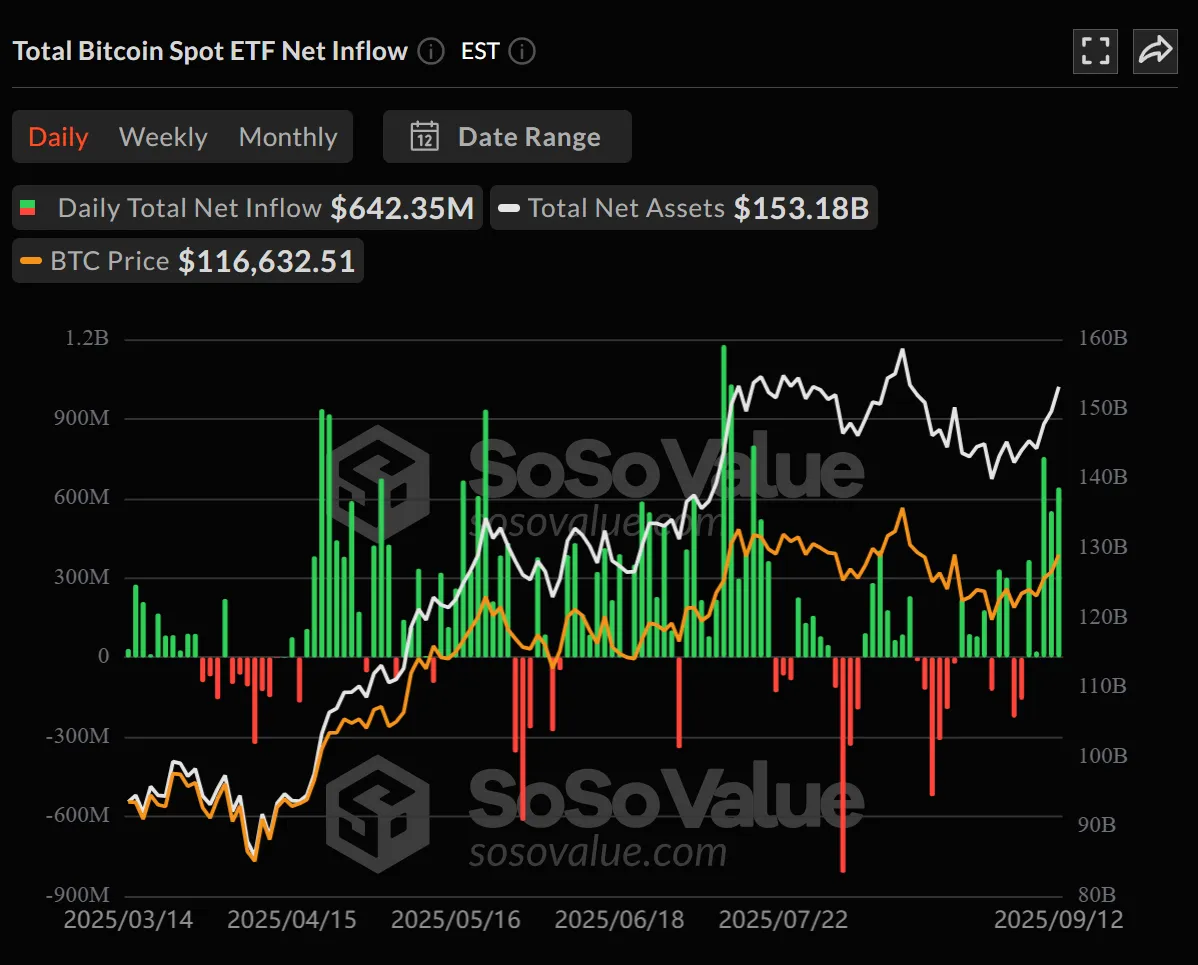

Spot Bitcoin ETFs added $2.34B in net inflows over 5 days, lifting total ETF holdings to $153.18B (~6.6% of BTC supply).Money angle:

Swing trade BTC spot or futures around key inflow announcements. Heavy buying by big funds can tighten spreads and create upside pressure.

Track inflow data daily on tools like SoSoValue or Coinglass. A rising 3–5 day streak often signals a short-term trend you can trade.

Example move: Buy BTC after consecutive multi-hundred-million inflow days and place stop-losses below recent support to catch the next leg up.

Example move: Buy BTC after consecutive multi-hundred-million inflow days and place stop-losses below recent support to catch the next leg up.2️⃣ Use Ether ETF Growth for Early Entry

What’s happening:

Spot Ether ETFs are on a 4-day inflow streak, adding $405M Friday alone and now holding $30.35B.Money angle:

Accumulate ETH ahead of staking or DeFi catalysts.

Pair trade ETH/BTC: When ETH inflows accelerate relative to BTC, traders often rotate into ETH for higher beta.

Pro tip: Monitor ETH ETF inflows vs. BTC; a strong ETH ratio can hint at a near-term ETH/BTC breakout.

Pro tip: Monitor ETH ETF inflows vs. BTC; a strong ETH ratio can hint at a near-term ETH/BTC breakout.3️⃣ Play the Tokenization Trend

What’s happening:

BlackRock is exploring on-chain tokenized ETFs, enabling 24/7 trading and DeFi integration.Money angle:

Research RWA (real-world asset) DeFi protocols like Centrifuge, Ondo, or Maple Finance that could integrate tokenized ETFs as collateral.

Hunt for governance tokens of DeFi projects likely to partner early.

Long-term bet: Accumulate quality RWA or DeFi infrastructure tokens before mainstream ETF tokenization launches.

Long-term bet: Accumulate quality RWA or DeFi infrastructure tokens before mainstream ETF tokenization launches.4️⃣ Trade the Liquidity Squeeze

Billions in ETF inflows tighten order books and reduce slippage, which can:

Fuel higher volatility around key resistance levels.

Create leverage opportunities on derivatives platforms (but manage risk carefully).

Execution tip: Use limit orders near breakout points and strict risk/reward ratios to avoid chasing parabolic spikes.

Execution tip: Use limit orders near breakout points and strict risk/reward ratios to avoid chasing parabolic spikes.5️⃣ Track Macro and Regulatory Signals

ETF flows respond to macro stability and policy clarity.

Watch for Fed rate decisions, inflation data, and crypto regulatory updates.

ETF inflows often accelerate after dovish Fed comments or pro-crypto legislation.

️ Bottom Line for Profit Seekers:

️ Bottom Line for Profit Seekers:Monitor ETF inflow dashboards daily.

Act on multi-day streaks with swing trades or options.

Position in ETH and DeFi infra for tokenization’s next wave.

Institutional accumulation is no longer theory — it’s live capital flow.

Trade smart, size positions with discipline, and you can turn this structural shift into real gains.