Bitcoin: Leaning Towards Bullish

-

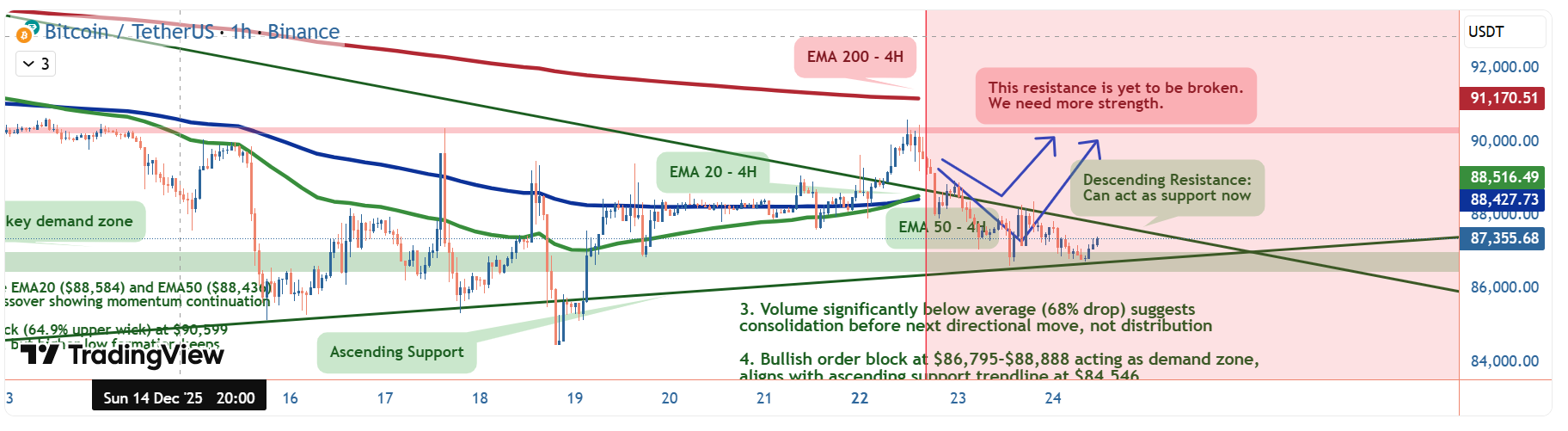

We're sitting at equilibrium ($89,619) with a clean higher low formation intact above both EMAs. The structure favors continuation, but the 64.9% rejection wick at $90,599 created a supply zone we need to respect. Volume is 68% below average—this is consolidation, not distribution.

-

THE TECHNICAL REALITY

• Higher low formation holding above EMA20 ($88,584) and EMA50 ($88,436)

• Bearish order block at $89,429-$90,617 acting as supply after aggressive rejection

• Bullish order block at $86,795-$88,888 aligned with ascending trendline (4 touches, 127 bars validated)

• Structure remains unbroken despite the upper wick—support at $89,200 held -

THE INDICATORS

️

️

Bullish Signals:

• MACD crossover confirmed (476 vs 308) showing momentum build

• MFI at 75.5 indicates strong money flow

• ADX at 30.2 shows moderate directional convictionBearish Signals:

• RSI at 67.7 approaching overbought territory

• Volume 68% below average suggests caution on immediate breakoutThe Conflict:

Low volume typically signals accumulation at these levels, not distribution. The question is whether we get one more shakeout to the demand zone before the next leg.- THE TRADE SETUP

🟢 Scenario A: Pullback Entry (Higher Probability)

• Trigger: Pullback to $89,200 or sweep to $86,795-$88,888 bullish OB

• Entry: $86,795-$88,888 demand zone (confluence with ascending trendline at $84,546)

• Target 1: $90,363 (immediate resistance)

• Target 2: $91,066 (premium zone entry)

• Target 3: $94,555 (weak high sweep)

• Stop: Below $86,700🟢 Scenario B: Breakout Acceleration

• Trigger: Clean 4H close above $91,066 with volume confirmation

• Entry: Flip of $91,066 to support (CHoCH bullish)

• Target: $94,555

• Invalidation: 4H close below $86,795 (breaks bullish OB and trendline)MY VERDICT

This is a 7/10 setup that favors patience. The structure is intact, indicators are aligned, but volume concerns and the overhead supply zone keep it from being perfect. If you're positioned, stop below $86,700. If you're waiting, the pullback to demand is your entry. -