Bitcoin Hits Deepest Undervaluation Since 2022 Bear Market

-

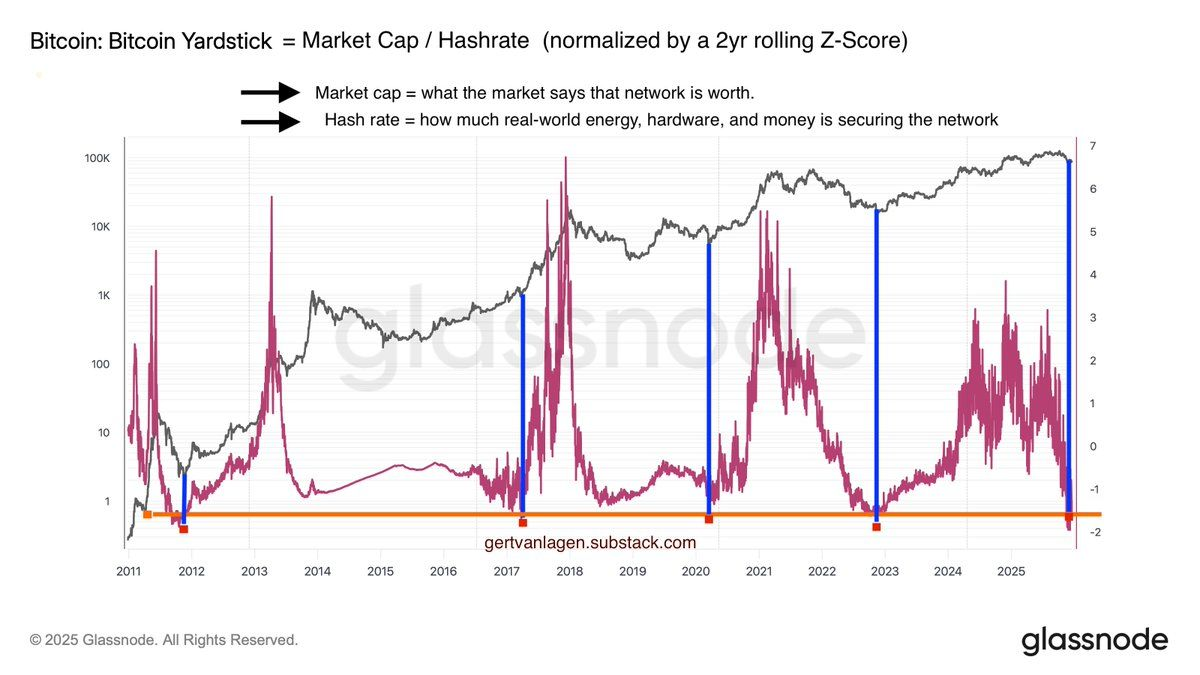

BTC Yardstick indicator at major market bottoms, attributed to Gert van LagenBitcoin may be nearing a major inflection point as the BTC Yardstick — a valuation model comparing price to network security costs — drops to –1.6 standard deviations below its long-term average. This marks Bitcoin’s deepest undervaluation in years, matching levels last seen at the 2022 bear market bottom.

Historically, similar readings have coincided with major cycle lows in 2011, 2017, 2020, and 2022, often followed by strong accumulation and long-term uptrends. Analysts say the metric suggests Bitcoin is trading far below the cost and economic effort required to secure the network — a rare setup that has preceded past market reversals.