Itaú Unibanco Recommends Bitcoin Allocation

Hero Portfolio

3

Posts

3

Posters

12

Views

-

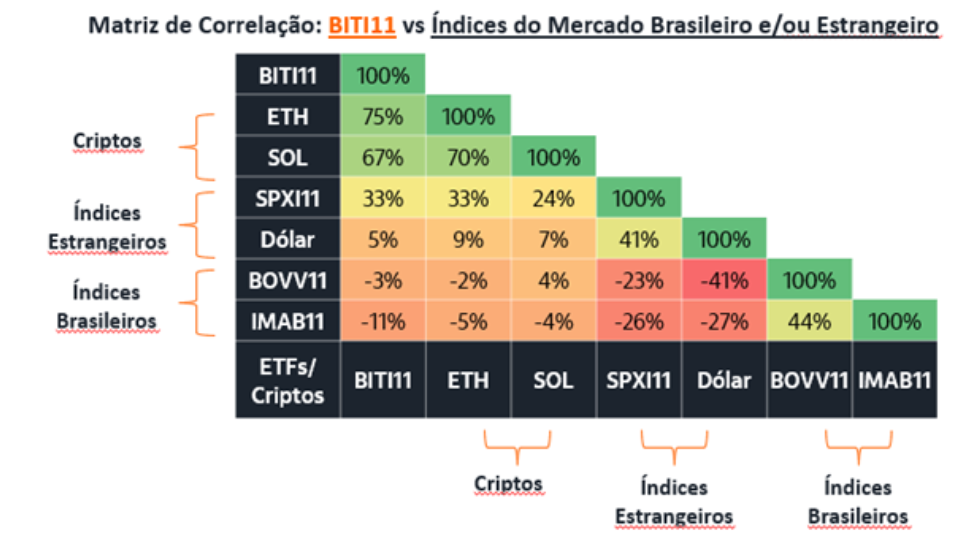

Itaú Unibanco, Latin America’s largest private bank, is advising clients to allocate 1–3% of their portfolios to Bitcoin in 2026. The bank frames BTC not as a speculative bet, but as a hedge against Brazilian real depreciation and a way to diversify portfolios beyond traditional assets. Itaú emphasizes moderation, long-term strategy, and cautions against trying to time the market.

-

A major bank recommending Bitcoin shows how far adoption has come.

-

Institutional validation like this changes how investors view BTC risk.