How Covered Calls Are Steering Bitcoin’s Price Action

-

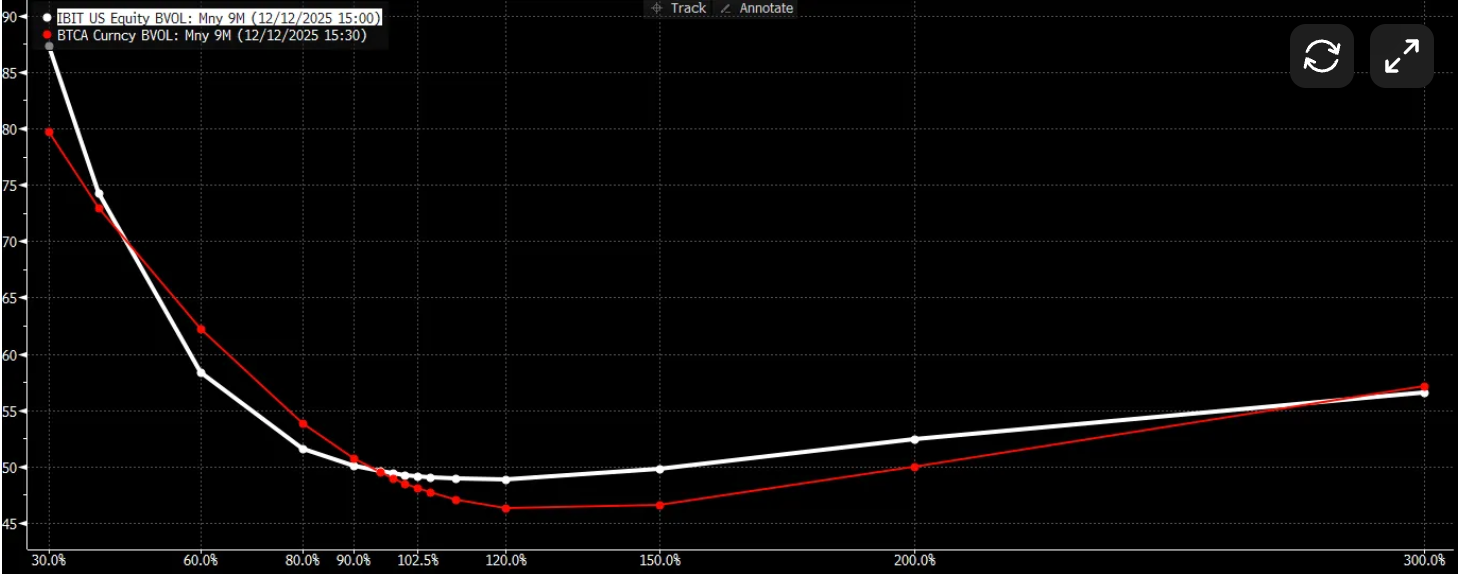

The volatility skews of BlackRock’s IBIT ETF versus native Bitcoin options, like those found on crypto derivatives exchange Deribit. Source: Jeff ParkCovered calls may sound harmless, but at scale they matter. Jeff Park explains that when OG Bitcoin holders sell calls against coins they’ve held for years, they become “net sellers of delta,” tilting market momentum downward.

Market makers on the other side of these trades hedge by offloading spot BTC, which dampens price rallies. The result: choppy price action despite growing institutional interest through spot Bitcoin ETFs.

-

Covered calls are adding selling pressure near resistance zones.

-

Understanding options strategies helps explain current BTC range behavior.