🐋 When Whales Sell Billions, Can Institutions Really Save the Market?

-

Over the past month, Bitcoin whales have dumped over $12B worth of BTC — the largest distribution in years. Naturally, everyone’s asking the same question:

If whales keep selling, can institutional inflows really balance the pressure?

If whales keep selling, can institutional inflows really balance the pressure?Here’s what’s really going on:

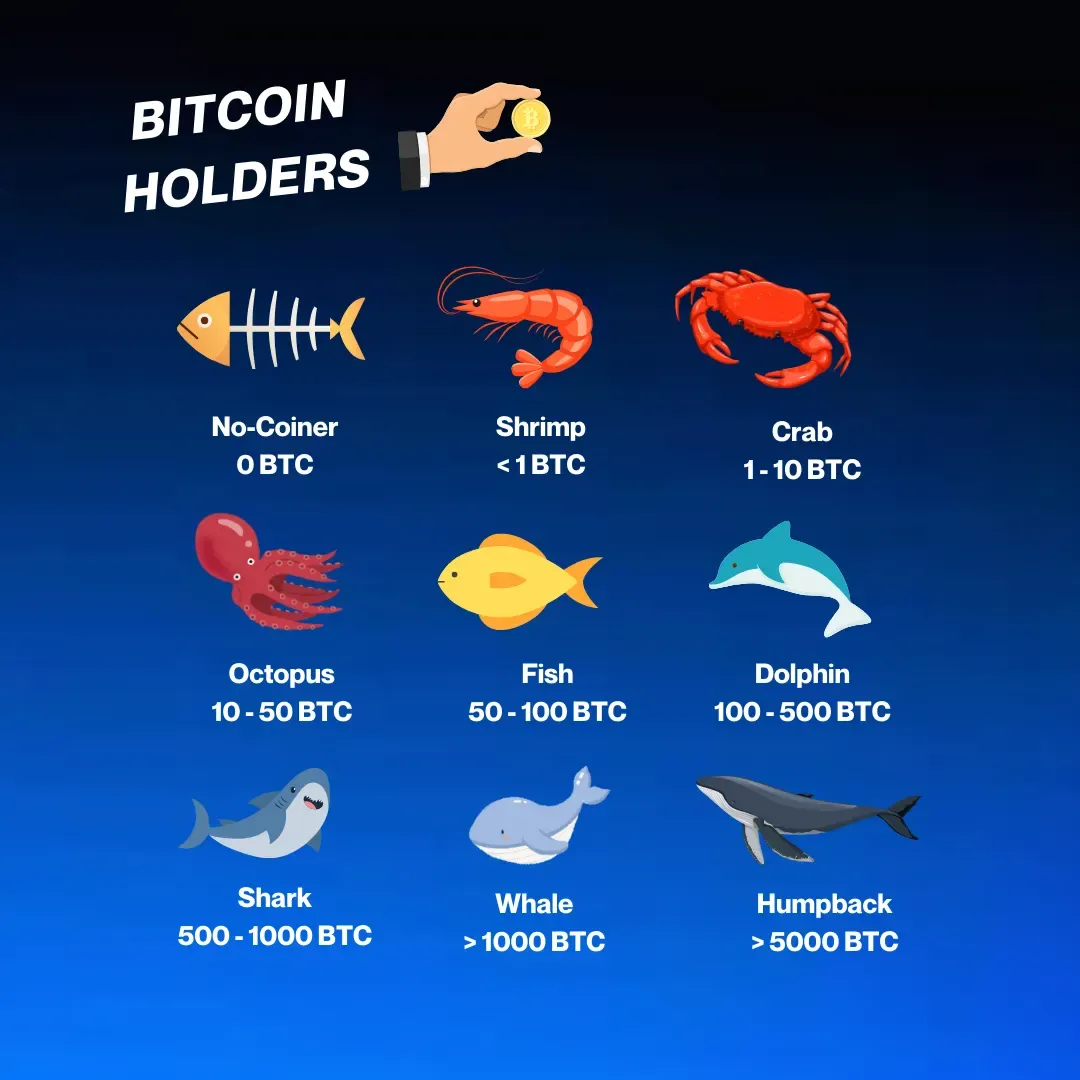

Whale sell-offs = short-term chaos. When 1,000–10,000 BTC wallets offload in bulk, liquidity pools get stressed, prices fall fast, and leveraged traders get liquidated. This creates a cascade effect that amplifies downside pressure.

Institutional buys = long-term ballast. ETFs, corporate treasuries, and funds don’t “ape in” during spikes. They accumulate steadily, often algorithmically. That’s why whale sell-offs look violent, but ETFs quietly vacuum BTC from the market over weeks.

The balancing act. If institutional inflows match or exceed outflows, we stabilize. If not, Bitcoin drifts lower. The real metric to watch isn’t just whale wallets — it’s ETF daily net flows vs. whale reserves.

Takeaway: Whale dumps are sharp and scary, but institutions aren’t playing the same game. Their slow, relentless accumulation builds structural demand that often outlasts whale fear. For traders, this means short-term pain can still align with long-term opportunity.

Takeaway: Whale dumps are sharp and scary, but institutions aren’t playing the same game. Their slow, relentless accumulation builds structural demand that often outlasts whale fear. For traders, this means short-term pain can still align with long-term opportunity.