Fed Cuts Rates, but Bitcoin’s Reaction Isn’t So Simple

-

The U.S. Federal Reserve approved another 25 bps rate cut—its third this year—meeting expectations but sparking mixed market sentiment. Despite Bitcoin briefly rallying above $94,000 ahead of the announcement, the media’s “hawkish” framing highlights deep divisions inside the Fed over inflation and the 2026 economic outlook.

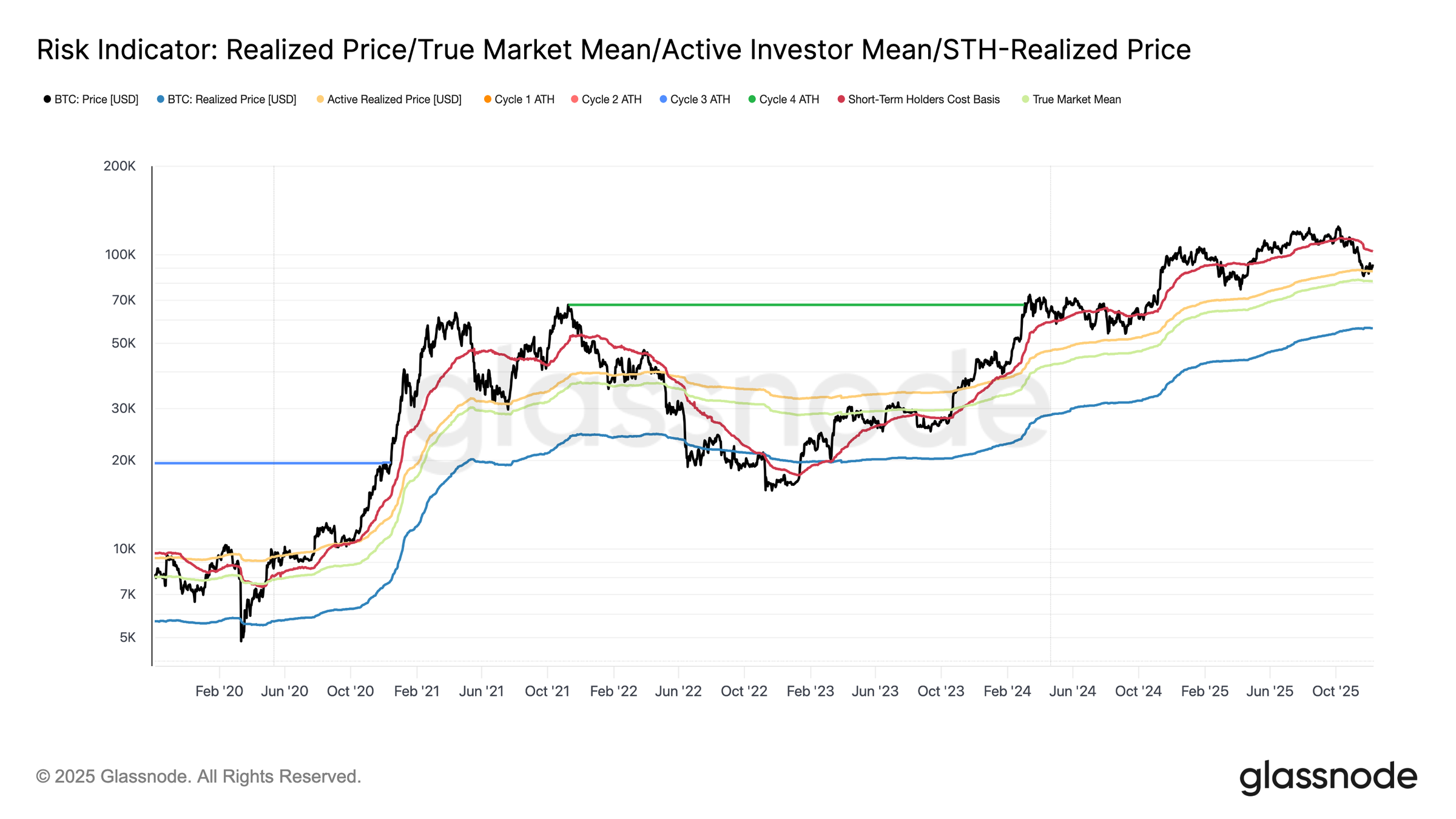

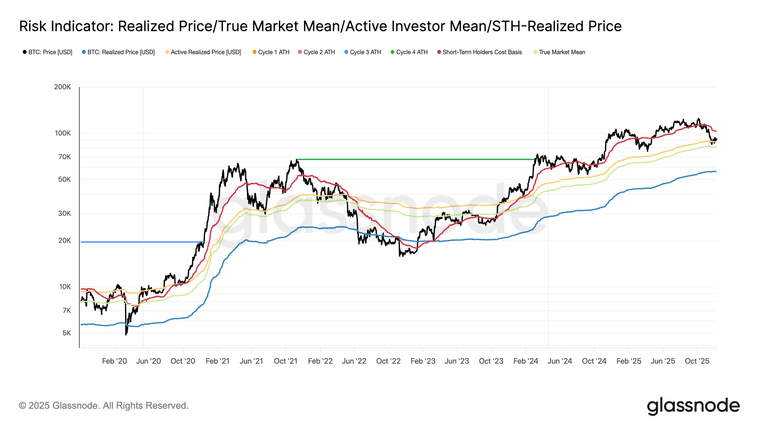

Glassnode data shows BTC stuck in a fragile range below $100K, squeezed between a short-term cost basis of $102,700 and a True Market Mean of $81,300. Meanwhile, weakening on-chain activity, shrinking futures demand and persistent selling pressure hint that Bitcoin may struggle to break out without a new catalyst. -

Rate cuts normally boost risk assets, but BTC’s muted reaction shows macro uncertainty is still in play.

-

Bitcoin isn’t reacting instantly because liquidity takes time to flow. The real impact may appear in the coming weeks.

-

This verdict shows regulators are becoming far stricter with high-impact crypto crimes.