Big Sellers Are Pulling Back

-

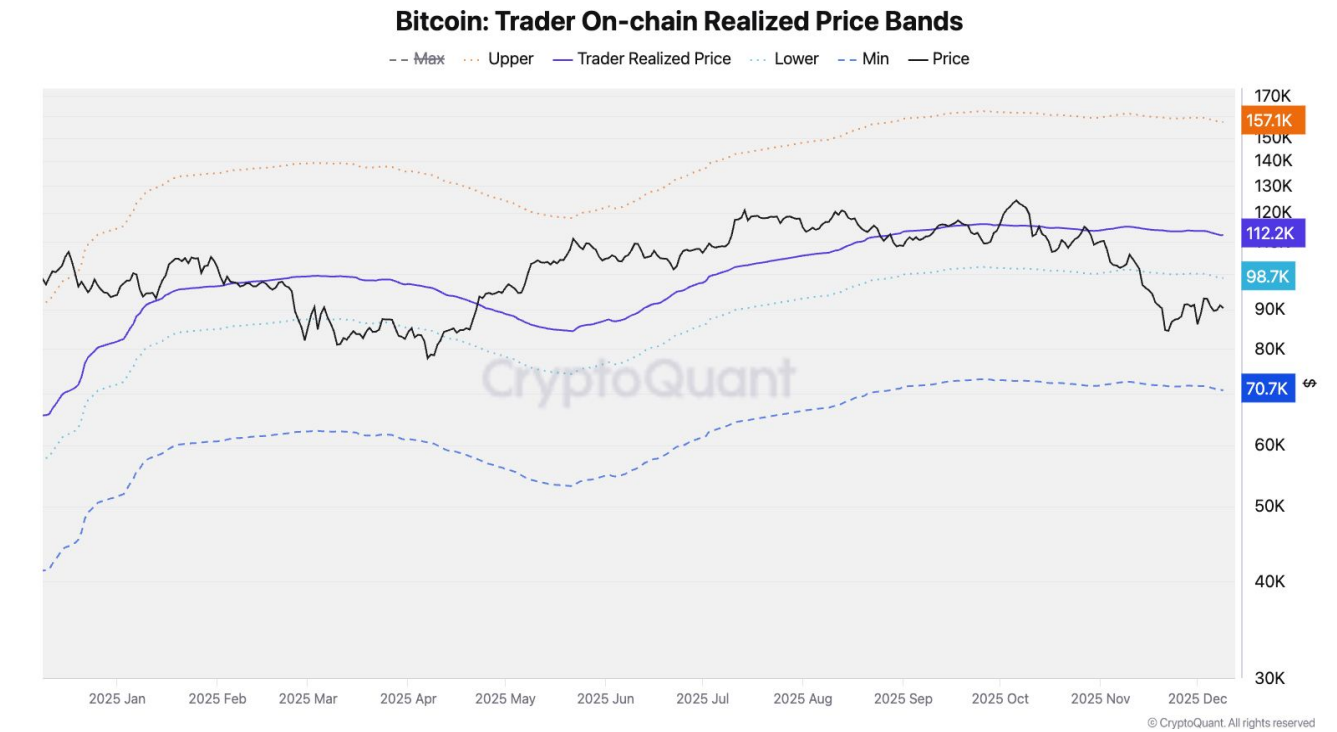

Bitcoin trader onchain realized price bands (screenshot). Source: CryptoQuantCryptoQuant’s latest report shows selling pressure easing across exchanges.

Large players’ deposits have fallen sharply — dropping from 47% to 21% of total inflows — while the average deposit size is down 36%.

This suggests whales and high-volume traders have stopped aggressively sending coins to exchanges, increasing the odds of a short-term Bitcoin rebound. -

When major sellers step back, it often indicates the end of short-term downside pressure.

-

Reduced selling activity is a healthy sign. It allows the market to stabilize and prepare for the next move.

-

This verdict shows regulators are becoming far stricter with high-impact crypto crimes.