💰 How to Profit from the $2.48B ETF Inflow Wave

-

Crypto investment products just saw $2.48 billion in inflows last week — a sharp turnaround from $1.4B in outflows the week before. The big winners? Ether ETFs.

If you’re looking for ways to ride this institutional wave, here’s how:

1. Follow the Smart Money → Ether ETFs Dominate

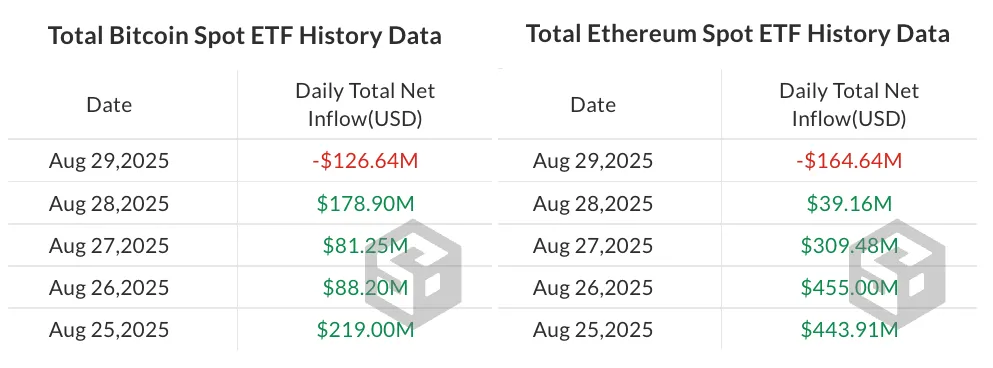

1. Follow the Smart Money → Ether ETFs DominateSpot Ether ETFs attracted $1.4B in inflows last week.

Compare that to Bitcoin funds at $748M, and you’ll see where institutions are allocating.

Nearly 91% of August’s total inflows went into Ether products.

Strategy: Keep a close eye on ETH accumulation zones ($4,200–$4,300). Institutions are buying dips — you can too.

Strategy: Keep a close eye on ETH accumulation zones ($4,200–$4,300). Institutions are buying dips — you can too. 2. Watch Rotation Into Altcoins

2. Watch Rotation Into AltcoinsSolana (+$177M) and XRP (+$134M) inflows show ETF speculation spreading beyond ETH & BTC.

Early positioning before official ETF approval could deliver outsized gains.

Strategy: Accumulate quality alts that are ETF “next-in-line” candidates. Solana and XRP are already showing signs of institutional nibbling.

Strategy: Accumulate quality alts that are ETF “next-in-line” candidates. Solana and XRP are already showing signs of institutional nibbling. 3. Arbitrage ETF Flows vs. Spot Prices

3. Arbitrage ETF Flows vs. Spot PricesEven with billions flowing in, ETH and BTC dipped last week. Why? Heavy retail profit-taking.

BTC slipped under $108K.

ETH dropped under $4,300.

Strategy: Short-term traders can exploit this mismatch. When ETF inflows continue but spot prices lag, it often signals a coming catch-up rally.

Strategy: Short-term traders can exploit this mismatch. When ETF inflows continue but spot prices lag, it often signals a coming catch-up rally. 4. Think Long-Term: AUM is Still Growing

4. Think Long-Term: AUM is Still Growing$35.5B YTD inflows → that’s 58% higher than last year.

Fund assets under management surged 165% YoY.

Strategy: Long-term investors can treat these inflows as confirmation bias — institutions are here, and they’re building exposure for the next cycle.

Strategy: Long-term investors can treat these inflows as confirmation bias — institutions are here, and they’re building exposure for the next cycle. Bottom Line

Bottom LineInstitutions are betting big on ETH, nibbling Solana & XRP, and still allocating to BTC despite outflows. For retail investors, the play is clear:

ETH = Core hold (backed by ETF demand).

SOL/XRP = High-upside ETF speculation bets.

BTC = Buy dips if whales keep selling.

When Wall Street pours billions into ETFs, don’t overcomplicate it — ride the same wave.