💸 Crypto Investment Products Pull in $2.48B as Ether ETFs Dominate

-

After a bruising $1.4 billion outflow the prior week, crypto investment products snapped back with $2.48 billion in inflows last week, according to CoinShares.

But despite the cash inflow, both Bitcoin and Ether struggled to hold key levels, showing that institutional demand hasn’t yet translated into price stability.

Key Highlights

Key HighlightsTotal inflows: $2.48B (vs. $1.4B outflows the week before)

Ether leads: Spot Ether ETFs saw $1.4B inflows, continuing their dominance.

Bitcoin funds: Added $748M, but still logged $301M outflows month-to-date.

Other assets: Solana (+$177M) and XRP (+$134M) benefited from ETF optimism.

AUM check: Despite inflows, total crypto assets under management (AUM) slid 7% to $219B amid market price drops.

Prices Still Under Pressure

Prices Still Under PressureBitcoin (BTC): Dropped under $108K after touching $113K earlier in the week.

Ether (ETH): Fell below $4,300 after starting the week above $4,600.

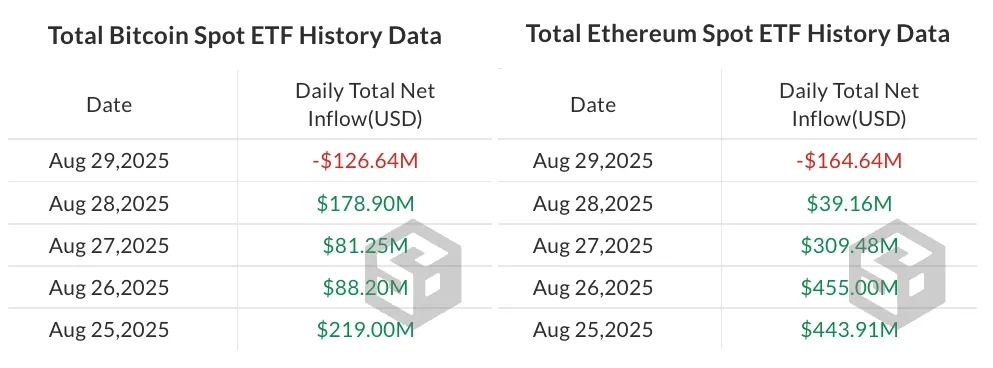

Both assets ended their ETF inflow streaks on Friday, according to SoSoValue.

Context: August Flows

Context: August FlowsAugust inflows: $4.37B vs. July’s record $12B.

Year-to-date (YTD): $35.5B inflows, up 58% YoY.

Ether’s dominance: Nearly $4B of August inflows, or 91% of the total.

Takeaway: Institutions keep pouring money into Ether, while Bitcoin faces mixed flows and heavy sell pressure. Meanwhile, Solana and XRP are emerging as ETF hopefuls riding the regulatory speculation wave.

Takeaway: Institutions keep pouring money into Ether, while Bitcoin faces mixed flows and heavy sell pressure. Meanwhile, Solana and XRP are emerging as ETF hopefuls riding the regulatory speculation wave.