🚀 Ethereum Fees Surge Past Tron & Solana as Institutions Keep Accumulating ETH

-

Ethereum is showing serious strength onchain even as its price cools off from record highs.

ETH is trading at $4,319, about 15% below the Aug. 24 all-time high, but network and institutional data suggest the next leg toward $5,000 could be forming.

Key Takeaways

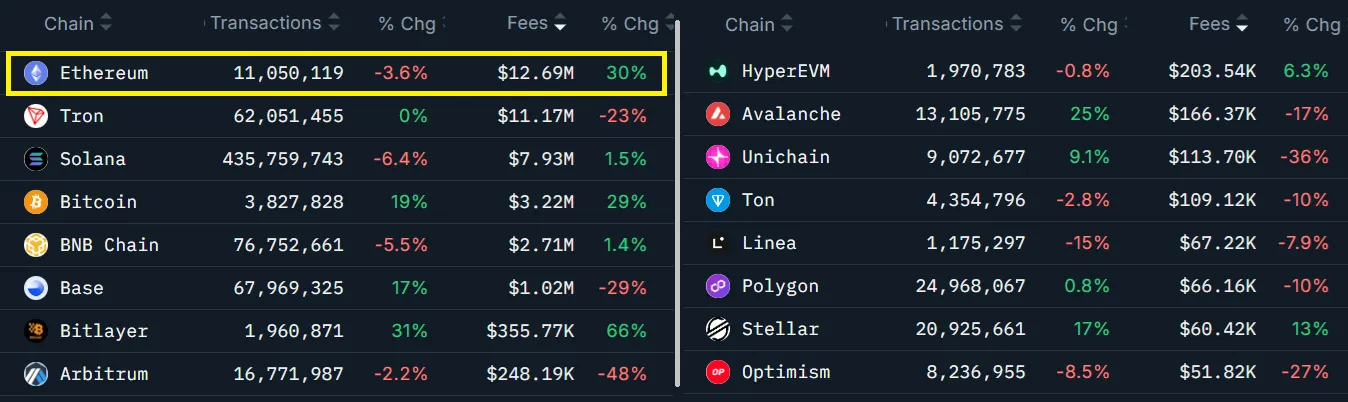

Key TakeawaysEthereum leads in fees → A 30% weekly surge pushed ETH’s 7-day fees to $16.3M, topping Tron and Solana combined.

DApp growth is booming → ETH apps generated $466M in fees in August, a 36% jump vs. July. Leaders: Lido ($91.7M), Uniswap ($91.2M), Aave ($82.9M).

Derivatives cautious → Futures premiums hover at a modest 5%, signaling neutrality. Options skew sits at 3%, showing traders see equal odds of upside or downside.

Institutions are stacking → Corporate treasuries added 2M ETH in the past 30 days, bringing total reserves to 4.71M ETH (~$20.2B).

Market Pressure vs.

Market Pressure vs.  Onchain Strength

Onchain StrengthMacro jitters, including Trump’s latest remarks on India-China ties, weighed on risk assets. Nasdaq dropped 1.3% while gold hit fresh all-time highs. ETH felt the heat, but unlike Solana (-10% DApp fees in August) and BNB Chain (-57%), Ethereum is surging in actual usage.

Meanwhile, derivatives traders are cautious but not bearish. Futures open interest climbed 26% in 30 days to $58.5B, showing traders remain engaged.

Why It Matters

Why It MattersCorporate ETH adoption isn’t just about balance sheets anymore. Companies like Bitmine Immersion Tech (BMNR) and SharpLink Gaming (SBET) are starting to actively deploy into Ethereum-based DApps. This is real-world capital flowing into decentralized applications — something Solana and Tron haven’t matched at the same scale.

Bottom Line: Despite short-term nerves in derivatives, Ethereum’s fundamentals — fees, apps, and institutional reserves — are stronger than ever. If adoption keeps building, the path back above $5K ETH looks increasingly likely.

Bottom Line: Despite short-term nerves in derivatives, Ethereum’s fundamentals — fees, apps, and institutional reserves — are stronger than ever. If adoption keeps building, the path back above $5K ETH looks increasingly likely.