SILVER, MONSTER RISE AHEAD targeting 3 digit pricing!!! SEED NOW

-

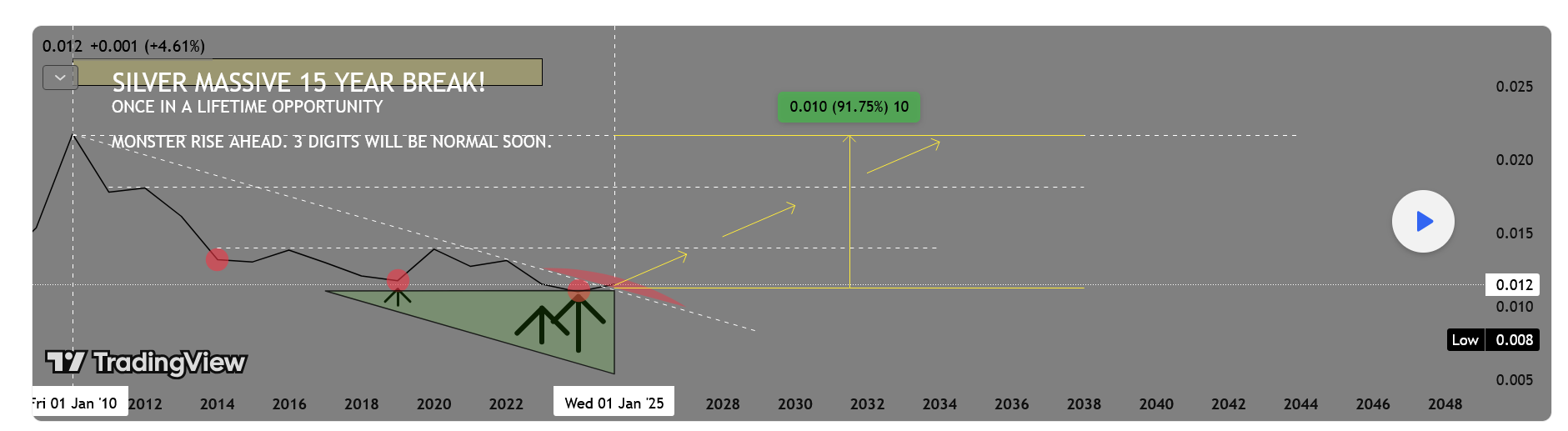

First things first. Chart is based on reverse metrics of GOLD/SIVER.

SILVER, is usually the supporting actor of the main star GOLD for months. During GOLD's relentless series of rise from 1900 -- silver has been pretty much on the low key state in terms of volume exposure and media mileage but that is about to change soon.

Recent long term data metrics is hinting of a massive reversal to the upside after that elusive 14-year downtrend break. This event does not come often, so THIS IS VERY SPECIAL -- a once in a lifetime opportunity.

Based on our diagram, we are seeing some expanding upside pressure this past few weeks rendering a strong break of this long standing resistance trend that lasted years -- which started from 0.033 on April 2011 to finally tapping an extreme lows at 0.09 on January 2025. This HUGE SHIFT is giving some clues already of whats about to transpire in the next few months -- to break barriers.

Now things are shifting BIG TIME for SILVER as recent price surge this past few weeks has depicted a very significant net long positioning on a grand time scale (long term).

Since the start of 2025, SILVER has already risen almost 40% from its lows. An impressive feat.

This yearly percentile growth is hinting of a bigger picture as we move forward -- to rise further, and explore new high HIGHS in the next few seasons.

This recent massive break -- 14 years in the making should warrant significant positioning already both in retail and institutions.

I'm expecting SILVER to supercede gold in terms of percentile growth metrics % because of the wide price difference ratio.

SILVER will continue to grab good attention from hereon as increasing demand of this metal will just inflate its prices -- moreso, with apparent depleting supplies.

To add to this, US has proposed adding silver to its Critical Minerals List, reflecting its vital industrial, technological, and national security importance, especially for renewable energy, electronics, and medical applications. The draft 2025 list by the USGS and Department of the Interior includes silver for the first time, aiming to boost domestic supply security and reduce reliance on imports by providing incentives for mining and recycling.

With all these factored in, SILVER should be a no-brainer part of your portfolio starting today.

Rewards will be far greater than you will ever imagine.Current price: 39.0

Target 100.

Long term Target 200-400.TAYOR. Trade safely.

-

That 14-year downtrend break is no joke — this is the kind of setup you only see once or twice in a generation. Silver is setting up to massively outperform gold in % terms, especially with the supply squeeze + industrial demand narrative.

-

The U.S. moving to add silver to the Critical Minerals List is a game-changer. That policy tailwind alone could supercharge investment flows into silver, beyond just the technicals. Institutions will not ignore this setup for long.

-

40% gains YTD and still early — Silver is finally waking up after a decade in the shadows. The gold/silver ratio has been flashing bullish divergence for months, and this breakout could mark the start of silver’s supercycle.

️

️