Analysts Warn Bitcoin May Lead a Risk-Asset Reversion

-

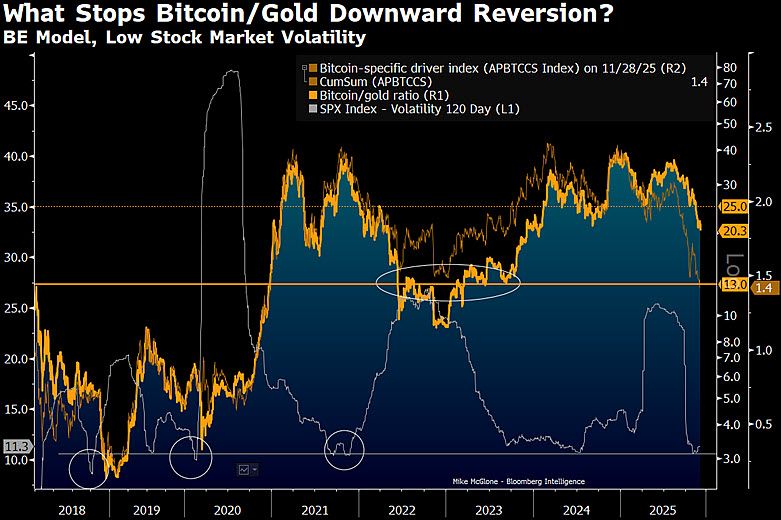

Not all signals are bullish. Bloomberg strategist Mike McGlone warned that Bitcoin’s recent weakness could be an early indicator of a broader risk-asset “reversion.”

McGlone cites the Bitcoin–gold valuation ratio, currently around 20x, far above the Bloomberg model’s fair value of ~13x.

Under that scenario, BTC could revisit levels near $50,000, especially as S&P 500 volatility sits at its lowest year-end levels since 2017, suggesting elevated complacency across markets. -

Analysts caution that Bitcoin could trigger a broader risk-asset pullback if momentum fades.