Stop Blaming Market Manipulation: It’s Just Your Wrong Interpretation

-

The Excuse Factory

Recently, Bitcoin dropped from 118k to 108k.

Suddenly, TikTokers, YouTubers, and X posters spiraled into paranoia, copy-pasting the same narrative: the “big masterminds,” reptilians, or aliens manipulated the market to liquidate 1.7 billion in buy orders.Let’s pause for a second. A 10% pullback in Bitcoin is now considered “market crash”? If we look deeper, Ethereum fell about 20% from its top — but this same ETH had already grown 300% since April.

Was that also “manipulation”? Or does manipulation only happen when you lose money?How do you think markets work in general? Do they move only upward, just to make you richer?

The truth is simpler: there is no manipulation conspiracy here. There are no “false signals.” What exists are wrong interpretations.

The Market Is Neutral

The market doesn’t care about your position. It doesn’t send “false” signals; it simply moves.

Price action reflects the sum of supply and demand in each moment. When traders label a signal as “false,” what they really mean is:-

They misread the context.

-

They didn’t account for a higher timeframe.

Their stop placement wasn’t aligned with market structure or too close.

The market doesn’t lie. It only reveals how much or how little you understand it.

Examples of Misinterpretation

-

The “false breakout” myth – What you see as a false breakout on the 1H chart may be a perfect retest on the daily timeframe. The market wasn’t wrong—you were looking at it from the wrong lens.

-

Stop hunting paranoia – Many traders cry “manipulation” when price takes out a cluster of stops. But think: stops are liquidity, and liquidity is where big players need to fill orders. That’s not manipulation—it’s how markets function.

-

News volatility – Many traders call sudden spikes around economic releases “market tricks.” In reality, it’s about liquidity gaps. There aren’t buy and sell orders evenly distributed at every price level. When major news hits, price “rearranges” itself to include the new information and moves sharply until it finds liquidity — usually around strong support or resistance zones.

The Psychology Behind Blame

Blaming manipulation is easier than admitting error. It protects the ego. If the loss was due to some shadowy force, you don’t have to change. But this mindset locks traders into a cycle of frustration. Progress begins when you stop blaming the market and start analyzing your own decision-making.

Case Study: Ethereum’s Current Setup

As the saying goes, a picture says more than a thousand words.

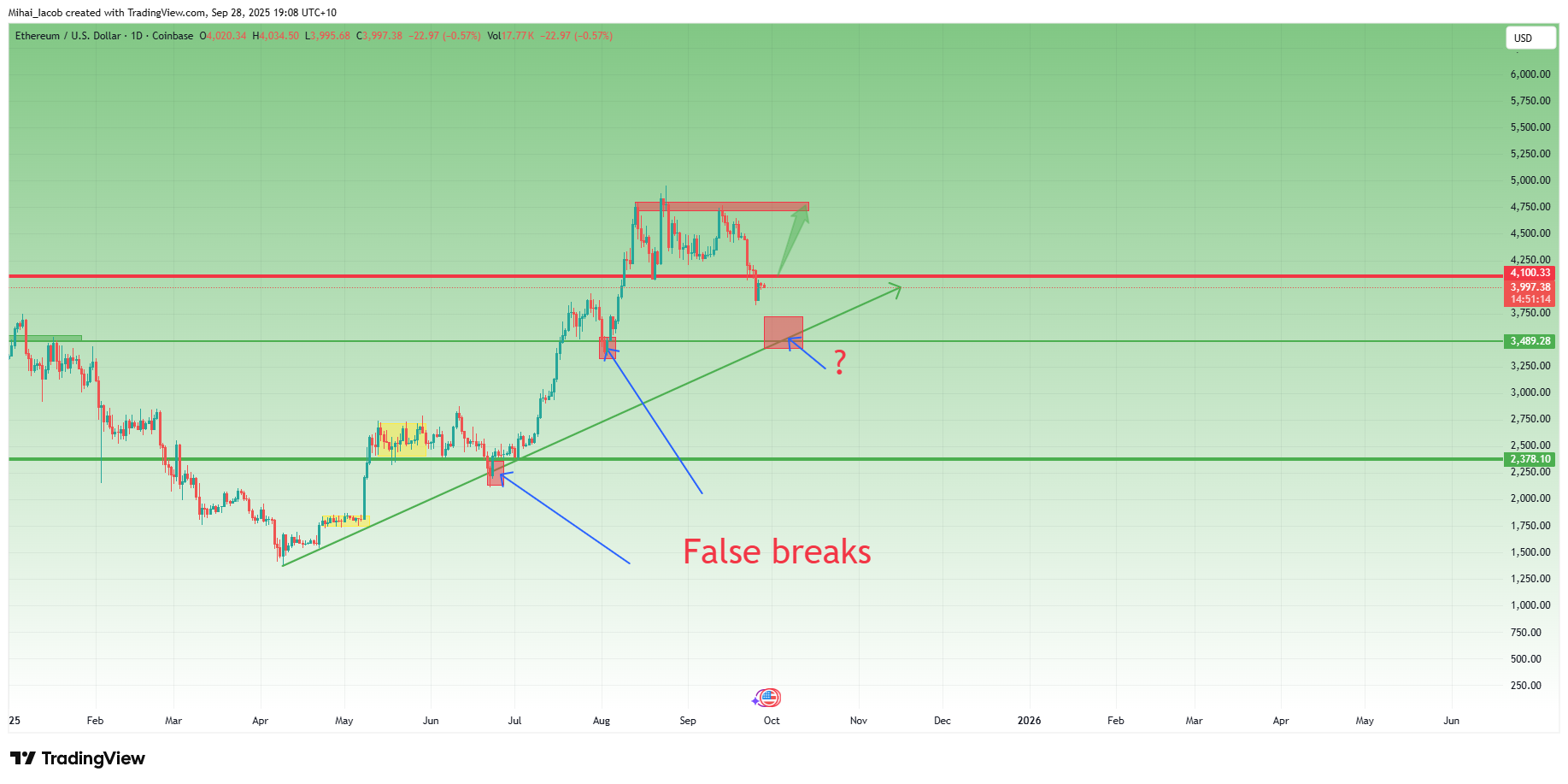

Since April, Ethereum has rallied over 300% in just six months. On this path upward, the chart shows two apparent “false breaks” of support.The question now is: will the current move be the third “false break,” or the first real break? As I wrote in yesterday’s analysis, confirmation is key.

But even if ETH drops further, say to 3600, nothing truly changes in the broader picture. Such a move would only be a healthy correction of the trend that started in April — perfectly aligning the price with the 38% Fibonacci retracement and the rising trendline support.

Conclusion: The Trader’s Responsibility

There are no false signals. There is no hidden enemy in the market. There is only your interpretation.

The moment you accept this, your growth accelerates. Losses turn from “proof of manipulation” into valuable feedback. And instead of fighting an imaginary villain, you start refining your edge.

The market doesn’t fool you. It teaches you. If you listen carefully, you’ll realize it’s never been against you—it’s only been holding up a mirror.

The market doesn’t fool you. It teaches you. If you listen carefully, you’ll realize it’s never been against you—it’s only been holding up a mirror.

-

-

wow this is very informative