How to Trade Bitcoin Around Fed Rate Cuts 🚀

-

Bitcoin is highly sensitive to US monetary policy — here’s how traders can make money from interest rate decisions:

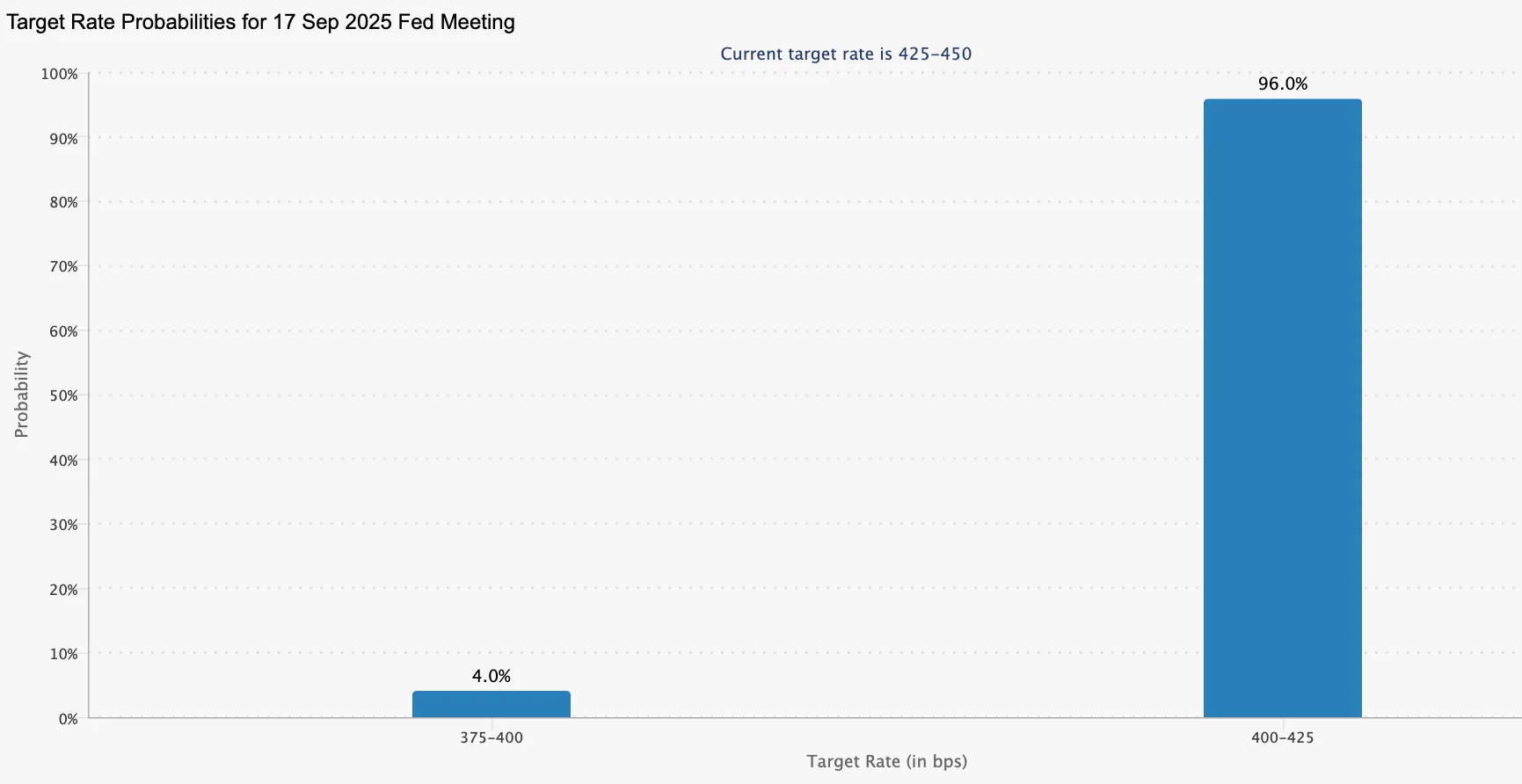

Monitor rate-cut odds

Current odds: 100% chance of Fed cutting rates today.

Historical patterns: BTC often rallies before and after expected rate cuts.

Lesson: Track CME FedWatch or Polymarket data to anticipate short-term swings.

Lesson: Track CME FedWatch or Polymarket data to anticipate short-term swings.Key resistance levels matter

BTC sits near $118,000, crucial for breakout.

Holding above this level could trigger new all-time highs, possibly $120K–$124K.

Lesson: Use technical analysis + macro events to set entry and exit points.

Lesson: Use technical analysis + macro events to set entry and exit points.Prepare for volatility

Fed Chair speeches can shift markets instantly.

BTC’s risk index shows areas for potential retracements: $116,800–$114,500 or $112,000 support.

Lesson: Use stop-loss orders and focus on risk-to-reward ratios for safe trading.

Lesson: Use stop-loss orders and focus on risk-to-reward ratios for safe trading.Play scenarios, not guesses

Traders can draft multiple scenarios:

Bullish: Breaks $118K → ATHs

Bearish: Rejection → retrace to $114–$112K

Neutral: Consolidation → wait for confirmation

Lesson: Treat BTC like macro-driven assets — plan trades based on outcomes, not hope.

Lesson: Treat BTC like macro-driven assets — plan trades based on outcomes, not hope. Bottom line:

Bottom line:

Interest rate moves create huge trading opportunities. By combining macro awareness, technical resistance levels, and disciplined risk management, you can turn Fed events into profitable Bitcoin trades.