Understanding Elliott Wave Theory with BTC/USD Part 1

-

Introduction to Elliott Wave Theory:

Elliott Wave Theory is a popular method of technical analysis that seeks to predict the future price movement of financial markets. Developed by Ralph Nelson Elliott in the 1930s, the theory is based on the idea that market movements follow a repetitive pattern, driven by investor psychology.

At the core of Elliott’s theory is the idea that markets move in a 5-wave pattern in the direction of the trend, followed by a 3-wave corrective pattern. These waves can be seen on all timeframes and help traders identify potential entry and exit points in the market.

Key Concepts of Elliott Wave Theory:

-

Impulse Waves (The Trend)

-

These are the waves that move in the direction of the overall trend. They are labeled 1, 2, 3, 4, 5 and represent the price movement in the main direction of the market.

- Wave 1: The initial move up (or down in a bearish market). I like to mark up the first wave how I do my Fibs, from the point where price showed a major impulse.

- Wave 2: A correction of Wave 1 (it doesn’t go lower than the starting point of Wave 1).

- Wave 3: The longest and most powerful wave in the trend.

- Wave 4: A smaller correction in the direction of the trend.

- Wave 5: The final push in the direction of the trend, which can be shorter and weaker than Wave 3.

-

Corrective Waves (The Pullbacks)

-

After the five-wave impulse, the market enters a corrective phase, moving against the trend. This corrective phase is generally a 3-wave pattern, labeled A, B,

- Wave A: The initial correction, typically smaller than Wave 3.

- Wave B: A temporary move against the correction (it often confuses traders who think the trend has resumed).

- Wave

The final move against the trend, usually the strongest and most aggressive.

The final move against the trend, usually the strongest and most aggressive.

How to Implement Elliott Wave on BTC/USD:

Let’s break down how you can apply the Elliott Wave Theory to BTC/USD using a simple example.

-

Identify the Trend

-

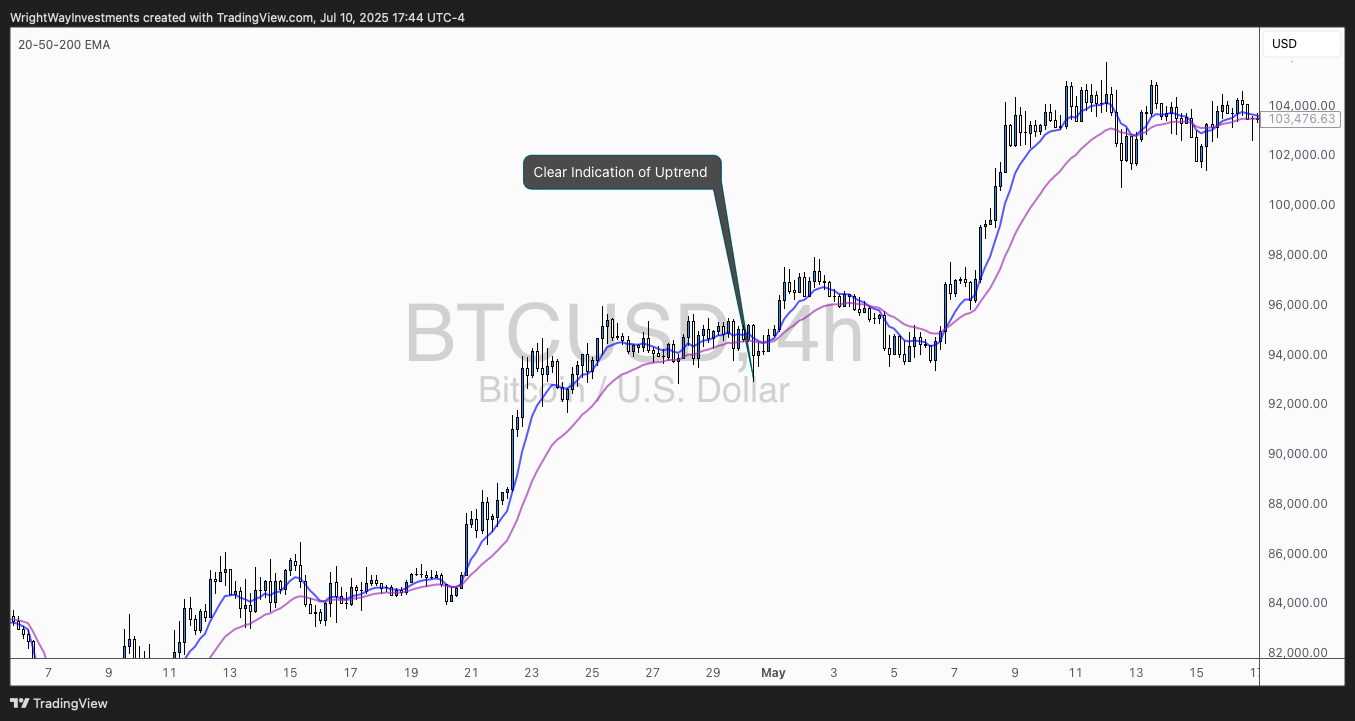

Start by identifying the current market trend for BTC/USD. Are we in an uptrend or downtrend? This will determine whether you’re looking for a 5-wave impulse up (bullish) or down (bearish).

5 102

Introduction to Elliott Wave Theory:Elliott Wave Theory is a popular method of technical analysis that seeks to predict the future price movement of financial markets. Developed by Ralph Nelson Elliott in the 1930s, the theory is based on the idea that market movements follow a repetitive pattern, driven by investor psychology.

At the core of Elliott’s theory is the idea that markets move in a 5-wave pattern in the direction of the trend, followed by a 3-wave corrective pattern. These waves can be seen on all timeframes and help traders identify potential entry and exit points in the market.

Key Concepts of Elliott Wave Theory:

-

Impulse Waves (The Trend)

-

These are the waves that move in the direction of the overall trend. They are labeled 1, 2, 3, 4, 5 and represent the price movement in the main direction of the market.

- Wave 1: The initial move up (or down in a bearish market). I like to mark up the first wave how I do my Fibs, from the point where price showed a major impulse.

- Wave 2: A correction of Wave 1 (it doesn’t go lower than the starting point of Wave 1).

- Wave 3: The longest and most powerful wave in the trend.

- Wave 4: A smaller correction in the direction of the trend.

- Wave 5: The final push in the direction of the trend, which can be shorter and weaker than Wave 3.

-

Corrective Waves (The Pullbacks)

-

After the five-wave impulse, the market enters a corrective phase, moving against the trend. This corrective phase is generally a 3-wave pattern, labeled A, B,

- Wave A: The initial correction, typically smaller than Wave 3.

- Wave B: A temporary move against the correction (it often confuses traders who think the trend has resumed).

- Wave

The final move against the trend, usually the strongest and most aggressive.

The final move against the trend, usually the strongest and most aggressive.

How to Implement Elliott Wave on BTC/USD:

Let’s break down how you can apply the Elliott Wave Theory to BTC/USD using a simple example.

-

Identify the Trend

-

Start by identifying the current market trend for BTC/USD. Are we in an uptrend or downtrend? This will determine whether you’re looking for a 5-wave impulse up (bullish) or down (bearish).

snapshot -

Locate the Waves

-

Look for the five-wave structure in the trend direction. Once you identify a potential impulse move, label the waves accordingly:

- Wave 1: A new uptrend starts.

5 102

Introduction to Elliott Wave Theory:Elliott Wave Theory is a popular method of technical analysis that seeks to predict the future price movement of financial markets. Developed by Ralph Nelson Elliott in the 1930s, the theory is based on the idea that market movements follow a repetitive pattern, driven by investor psychology.

At the core of Elliott’s theory is the idea that markets move in a 5-wave pattern in the direction of the trend, followed by a 3-wave corrective pattern. These waves can be seen on all timeframes and help traders identify potential entry and exit points in the market.

Key Concepts of Elliott Wave Theory:

-

Impulse Waves (The Trend)

-

These are the waves that move in the direction of the overall trend. They are labeled 1, 2, 3, 4, 5 and represent the price movement in the main direction of the market.

- Wave 1: The initial move up (or down in a bearish market). I like to mark up the first wave how I do my Fibs, from the point where price showed a major impulse.

- Wave 2: A correction of Wave 1 (it doesn’t go lower than the starting point of Wave 1).

- Wave 3: The longest and most powerful wave in the trend.

- Wave 4: A smaller correction in the direction of the trend.

- Wave 5: The final push in the direction of the trend, which can be shorter and weaker than Wave 3.

-

Corrective Waves (The Pullbacks)

-

After the five-wave impulse, the market enters a corrective phase, moving against the trend. This corrective phase is generally a 3-wave pattern, labeled A, B,

- Wave A: The initial correction, typically smaller than Wave 3.

- Wave B: A temporary move against the correction (it often confuses traders who think the trend has resumed).

- Wave

The final move against the trend, usually the strongest and most aggressive.

The final move against the trend, usually the strongest and most aggressive.

How to Implement Elliott Wave on BTC/USD:

Let’s break down how you can apply the Elliott Wave Theory to BTC/USD using a simple example.

-

Identify the Trend

-

Start by identifying the current market trend for BTC/USD. Are we in an uptrend or downtrend? This will determine whether you’re looking for a 5-wave impulse up (bullish) or down (bearish).

snapshot -

Locate the Waves

-

Look for the five-wave structure in the trend direction. Once you identify a potential impulse move, label the waves accordingly:

-

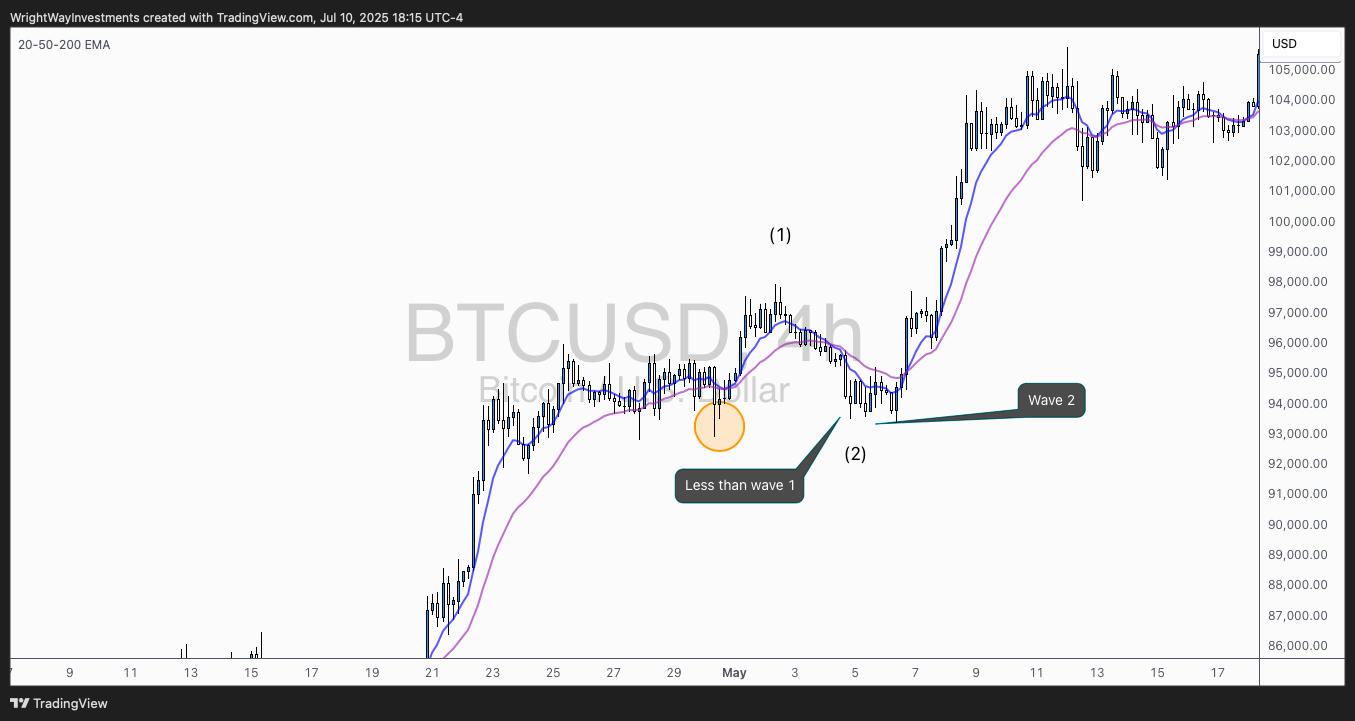

Wave 1: A new uptrend starts.

snapshot -

Wave 2: A small pullback (usually less than the size of Wave 1).

-

-

T TradingDog moved this topic from Trading on