september effect: why markets seem to catch a cold every fall

-

The September Effect

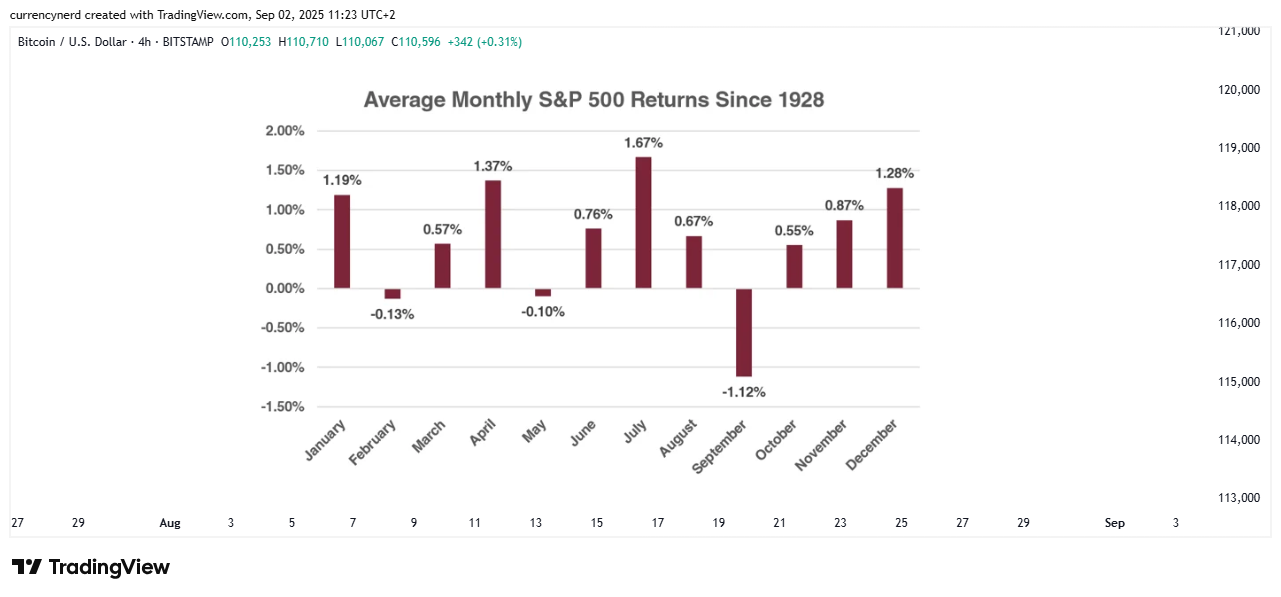

The September Effectchart example:

average monthly returns of the S&P500 since 1928

Every year, as summer ends and September rolls in, traders brace themselves. Why? Because the “September Effect” is notorious for turning even the steadiest markets into a rollercoaster. Understanding this seasonal quirk can make the difference between a smooth ride and a portfolio wipeout. What Is the September Effect?

What Is the September Effect?The September Effect is the observed tendency of financial markets to underperform during September. Historically, it’s one of the worst months for equities, currencies, and even commodities. Some reasons behind it:

Institutional Moves: Big players return from summer breaks, recalibrating portfolios. Expect sudden spikes in activity and volatility.

Quarter-End Adjustments: September marks the end of Q3, often triggering rebalancing or profit-taking.

Economic Releases: Important data (jobs, inflation, trade figures) often drop in September, leading to sharp market reactions.

How It Hits Global Markets

How It Hits Global MarketsThe effect isn’t just local—it ripples across the globe:

Equities: Indices like the S&P 500 and FTSE historically trend lower more often in September than other months.

Currencies: Pairs involving USD, EUR, and JPY can swing wildly as traders reposition ahead of data releases.

Commodities: Gold, oil, and other commodities may see sudden shifts based on sentiment, hedging, or macroeconomic expectations.

Navigating September Without Panic

Navigating September Without PanicYou don’t have to fear September—it just requires smarter strategies:

Tight Risk Management: Stop-losses, hedging, and diversification are your best friends.

Stay Updated: Economic reports, geopolitical events, and central bank actions can set the tone.

Chart Smarts: Technical patterns and indicators can guide better entries and exits amid the volatility.

snapshot

above chart shows the historical average of major indicies..

The Takeaway

The September Effect is real, but it’s not a doom prophecy. Recognizing it allows traders to plan, protect, and even profit from seasonal swings. The markets may shiver in September—but with the right strategy, your portfolio doesn’t have to.