Trading Psychology 101: Master Your Mind Before the Market

-

When people first start trading, most of their attention goes to entries, indicators, and strategies. It feels like the secret to success must be hidden in the charts.

Over time, traders realize something uncomfortable: the biggest challenge isn’t the market—it’s themselves.

You can learn technical analysis, understand risk management, and even copy profitable strategies. Yet, if fear, greed, or impatience take over, the outcome will be inconsistent.

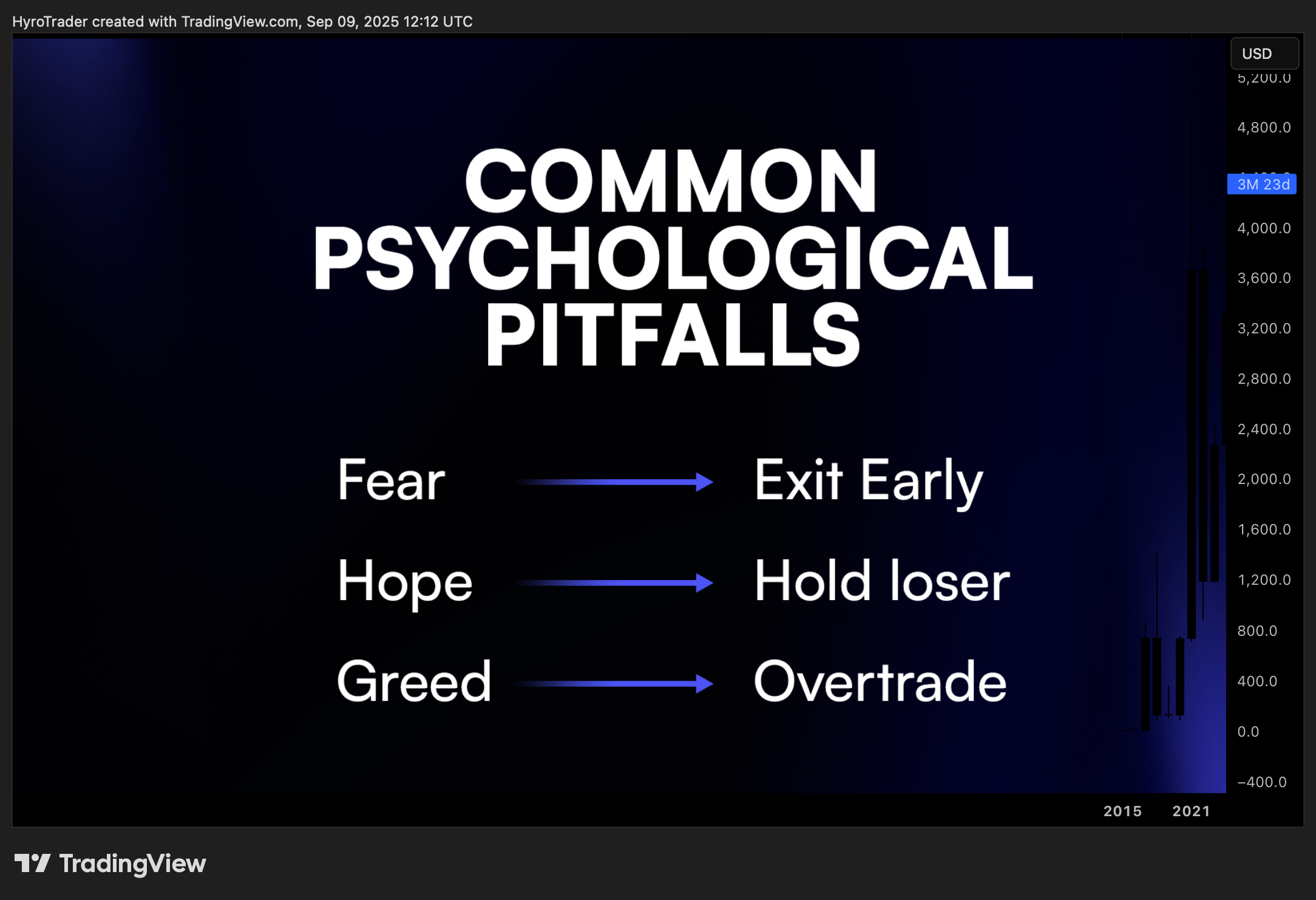

Research suggests that trading performance depends far more on mindset than on technical skill alone.Here are a few patterns almost every trader will recognize:

Entering too quickly because of FOMO.Closing winners too early out of fear they will reverse.

Holding on to losers, hoping they will turn around.

Ignoring rules after a streak of good trades because of overconfidence.Each one might feel harmless in the moment, but over time they erode consistency.

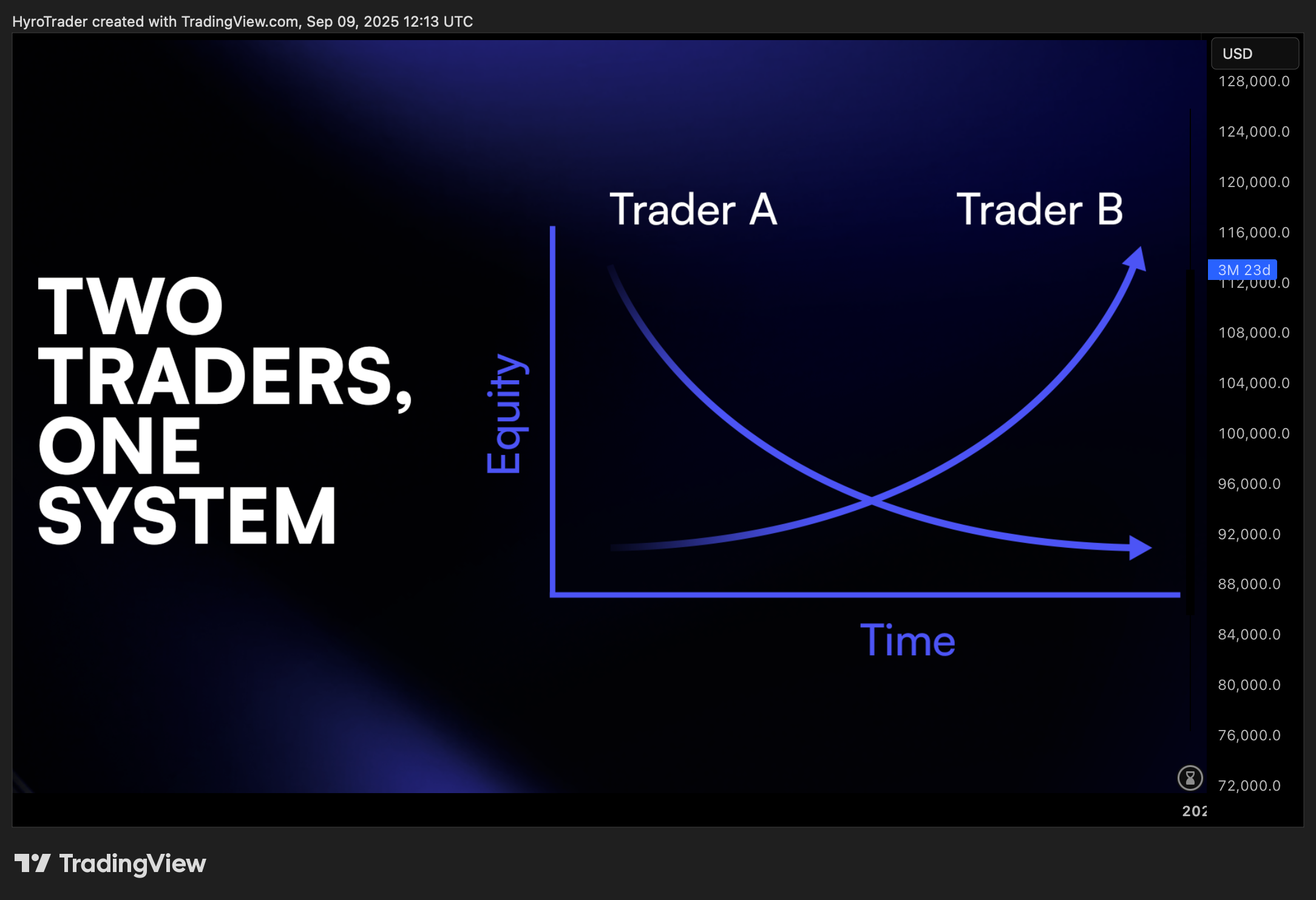

Imagine two traders using the exact same strategy with a 60% win rate.

Trader A lets emotions dictate actions. They cut winners short, stretch losers, and end up losing money.Trader B follows rules calmly. Losses are accepted, winners are allowed to run. Over the same number of trades, this trader ends profitable.

The system is identical, but psychology makes all the difference.

-

The Real Lesson

Markets are unpredictable. Strategies are never perfect. What you can control is how you respond.

Strong psychology allows you to execute consistently and let probabilities play out. Without it, even the best system will eventually fail. -

Benefits of a Solid Mindset

Building psychological strength in trading gives you:

Patience to wait for quality setups. -

Discipline to stick with your plan.

-

Resilience to handle losing streaks.

-

Consistency across weeks and months.

-

Mental clarity to make rational decisions under stress.

-