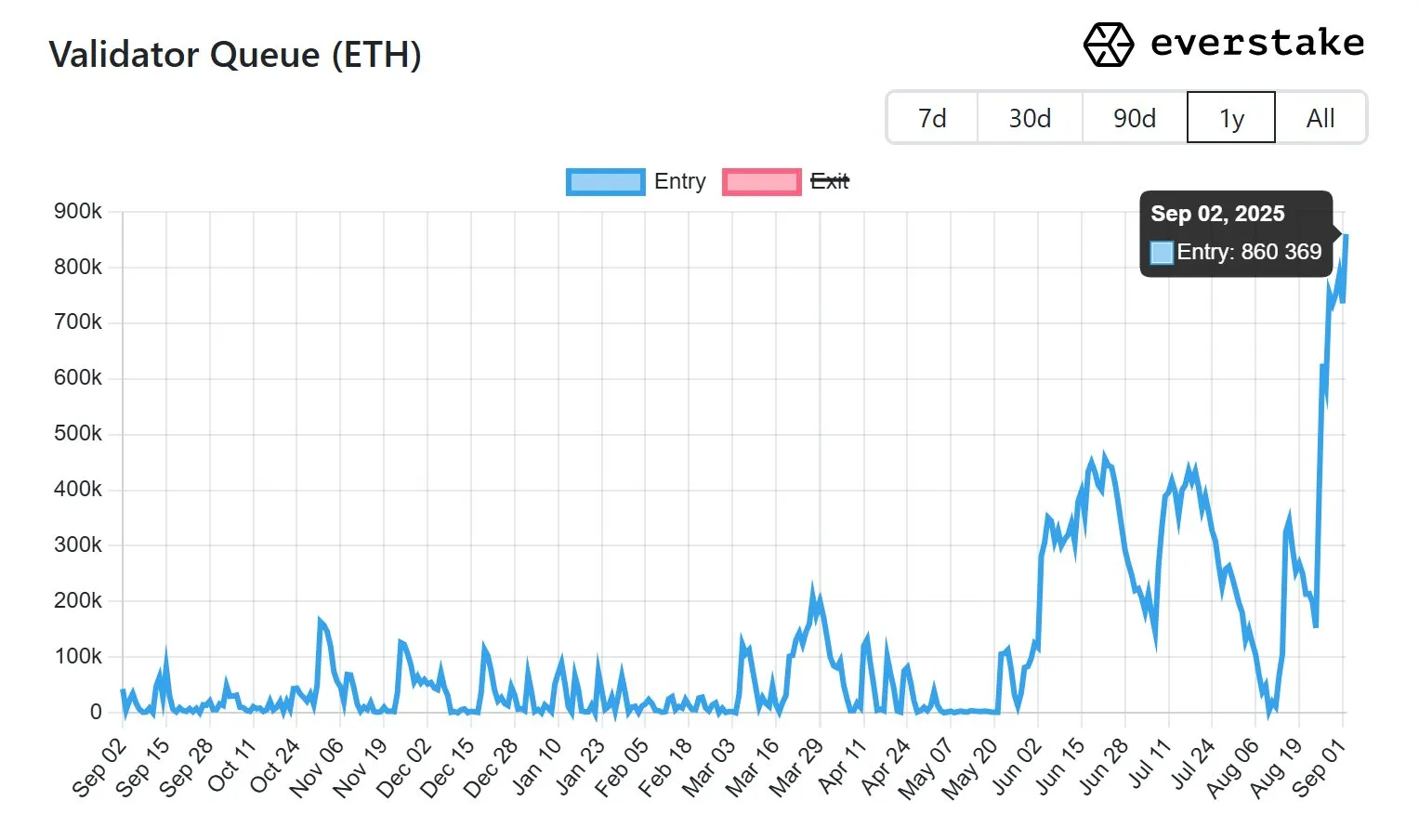

🚀 Stake Your ETH Queue Surges to $3.7B — Highest Since 2023

-

Ethereum staking demand is heating up again, with the entry queue hitting levels not seen in nearly two years.

On Tuesday, 860,369 ETH (~$3.7B) sat in line to be staked, according to onchain data — the largest figure since September 2023.

Why the spike?

Why the spike?Staking protocol Everstake points to three main drivers:

Rising confidence → more investors trust ETH’s long-term value and want to help secure the network.

Favorable market conditions → ETH’s recent price run and low gas fees make staking more attractive.

Institutional entry → corporate treasuries and funds are piling in, staking large amounts for yield.

Exit queue cools off

Exit queue cools offConcerns of a major ETH sell-off have eased. After hitting a record 1M ETH exit queue on Aug. 29, unstaking demand has dropped 20%, signaling fewer withdrawals.

Currently, 35.7M ETH (≈31% of supply, ~$162B) is locked in staking, according to Ultrasound.Money.

Institutional treasuries stacking ETH

Institutional treasuries stacking ETHCorporate players now hold 4.7M ETH (~$20.4B) across 70+ treasury funds (StrategicEtherReserve). Most of this ETH is already staked or earmarked for staking, further fueling the entry queue.

Price check

Price checkETH trades at $4,321, down 1.2% on the day and 12.4% below its ATH of $4,946 (Aug. 24), as retail profit-taking continues.

Takeaway: With staking demand surging while exits slow down, Ethereum is seeing a new wave of long-term conviction — led this time by deep-pocketed institutions.

Takeaway: With staking demand surging while exits slow down, Ethereum is seeing a new wave of long-term conviction — led this time by deep-pocketed institutions.