💸 Token Buybacks Are Heating Up — Here’s How to Profit From Them

-

When companies buy back their own stock, Wall Street cheers. Now crypto protocols are doing the same — and the results are starting to show up in token prices.

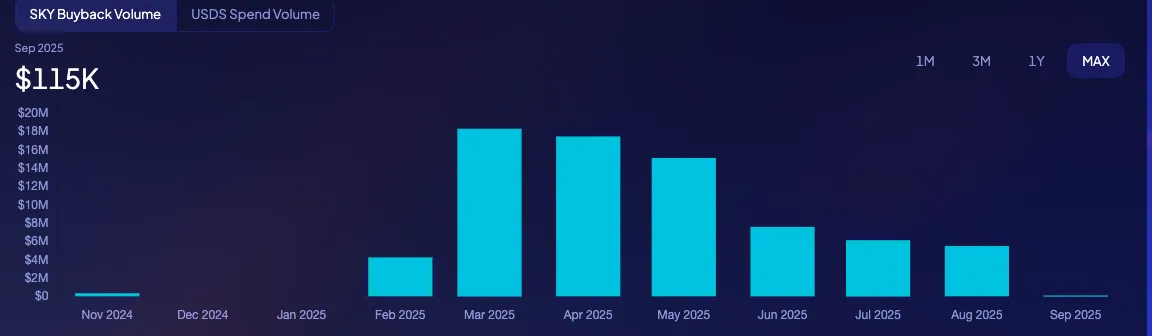

Sky’s $75M Play

Sky’s $75M PlayProtocol: Sky (rebranded from Maker in Aug 2024).

Mechanism: Spent 75M USDS in six months buying back SKY tokens.

Result: SKY price up 8.1% since Feb — from $0.063 to $0.0685.

Peak: Hit $0.096 in July, close to ATH, before sliding with the market.

Why it matters: buybacks shrink circulating supply, making each token theoretically more valuable — especially if demand holds steady.

Who Else Is Buying Back?

Who Else Is Buying Back?World Liberty Financial (WLFI): Trump-linked protocol proposing to burn 100% of its fees via buybacks. WLFI is down since launch but early buyers (at $0.015) are still up 1,400%.

Pump.fun (PUMP): Meme token factory has already spent $66.5M on buybacks. PUMP is up 30% in a month and 70% from July lows.

How to Make Money From Buybacks

How to Make Money From BuybacksFollow the Cash Flow

A buyback backed by real protocol revenue (fees, stablecoins, yield) is stronger than one based on pure hype.

Sky & Pump.fun are funding burns from actual income.

Look for Early Signals

The best entries are before the buyback effect shows in price.

Sky rallied early; PUMP’s rebound began right after buyback news.

Mind the Scale

Small protocols spending millions on buybacks can move the chart faster than giants where the % impact is diluted.

Beware of Optics-Only Moves

WLFI’s “all-in burn” sounds bullish, but if revenue is tiny, the effect on supply is negligible. Always check the math.

️ The Takeaway

️ The TakeawayBuybacks aren’t magic, but they’re becoming a new norm in DeFi tokenomics.

If demand returns, tokens with ongoing buyback/burn programs could outperform peers without them.

In crypto, scarcity sells — but only if it’s backed by revenue and adoption.

Pro tip: Track buyback dashboards and treasury wallets. The earlier you spot consistent burns, the earlier you catch the upside.

Pro tip: Track buyback dashboards and treasury wallets. The earlier you spot consistent burns, the earlier you catch the upside. -

The difference-maker is REVENUE.

If a protocol funds buybacks with real fees (like Sky or Pump.fun), it’s sustainable. If it’s just treasury drain or hype, you’re basically watching exit liquidity. Numbers > narratives.

If a protocol funds buybacks with real fees (like Sky or Pump.fun), it’s sustainable. If it’s just treasury drain or hype, you’re basically watching exit liquidity. Numbers > narratives. -

I like how DeFi is mirroring TradFi tools (buybacks), but the scale impact is unique. A $75M burn for a small-cap token moves the chart way harder than a $10B stock buyback on Wall Street. Scarcity is exponential here.