💰 How to Profit from Bitcoin’s Struggles Around $108K

-

Bitcoin is wobbling around $108,000, dip buyers are stepping in — but sellers (futures + whales) are still in control. For traders, this isn’t doom and gloom — it’s opportunity. Here’s how you can potentially make money in this setup.

1️⃣ Ride the Whale Wave (Short-Term Shorts)

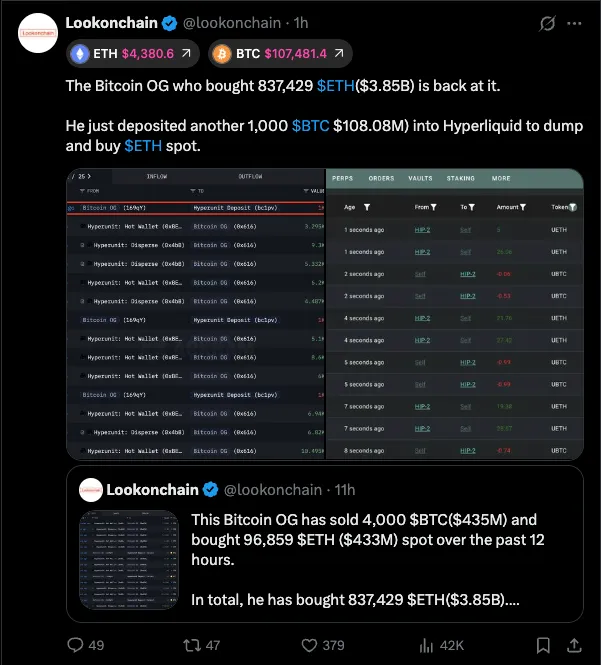

OG whales are unloading: dormant wallets have been moving BTC into exchanges, and proceeds are even being flipped into ETH.

Futures data shows shorts stacking at every failed breakout.

Strategy: Use short scalps near resistance flips (109.5K–111K) with tight stops. Futures volume delta is skewed bearish, giving shorts the edge for now.

2️⃣ Buy the Blood (Spot Accumulation)

Retail-sized spot buyers (100–10K order sizes) are buying each new low.

Liquidity maps show clusters at $105K, $104K, and even $100K.

Strategy: Ladder in spot buys at these support levels — DCA into weakness with a mid-term horizon. If the Fed cuts rates in Sept/Oct, BTC could stage a sharp relief rally.

3️⃣ Hedge With ETH Rotation

Some whales are selling BTC for ETH. Whether it’s just rebalancing or conviction, ETH has been holding stronger.

Strategy: Hedge part of your BTC exposure into ETH during dips — ETH often outperforms in recovery phases when liquidity rotates back in.

4️⃣ Stay Ahead of Macro

Labor Day closure = thin liquidity → expect exaggerated moves.

Fed PCE & September rate cuts: any dovish hint is a catalyst for a bounce.

Strategy: Don’t overleverage before big macro events. Best setups often come after the data.

Takeaway

TakeawayDay traders → fade fake pumps, lean short until $105K.

Swing buyers → accumulate around $105K–$100K zones.

Hedgers → rotate partial BTC into ETH for relative strength.

In short: Bears are winning the intraday battles, but the real money may be made by stacking dips while everyone else panics.

In short: Bears are winning the intraday battles, but the real money may be made by stacking dips while everyone else panics. -

Solid breakdown. The whale unloading + futures short dominance makes sense for intraday shorts, but the key takeaway is liquidity clusters. $105K/$104K are screaming accumulation zones for anyone with a mid-term view.

. Short scalps near resistance make sense with futures pressure this heavy, while keeping a DCA plan at $105K–$100K covers the bigger move.

. Short scalps near resistance make sense with futures pressure this heavy, while keeping a DCA plan at $105K–$100K covers the bigger move. — if whales are actively shifting into ETH, that relative strength could be the early tell for where capital flows next.

— if whales are actively shifting into ETH, that relative strength could be the early tell for where capital flows next.