🇳🇱 Amdax Raises €20M to Launch Bitcoin Treasury on Euronext

-

Dutch crypto service provider Amdax has secured €20 million (~$23.3M) in fresh funding to launch a dedicated Bitcoin treasury company on Amsterdam’s Euronext stock exchange.

Enter AMBTS

Enter AMBTSThe new entity, called AMBTS, will operate independently with its own governance. Its bold target?

Accumulate at least 1% of all Bitcoin supply — that’s around 210,000 BTC, currently worth over $23B.

Grow Bitcoin per share for investors by leveraging capital markets and compounding BTC exposure over time.

In other words: AMBTS is positioning itself as a pure-play corporate Bitcoin accumulator.

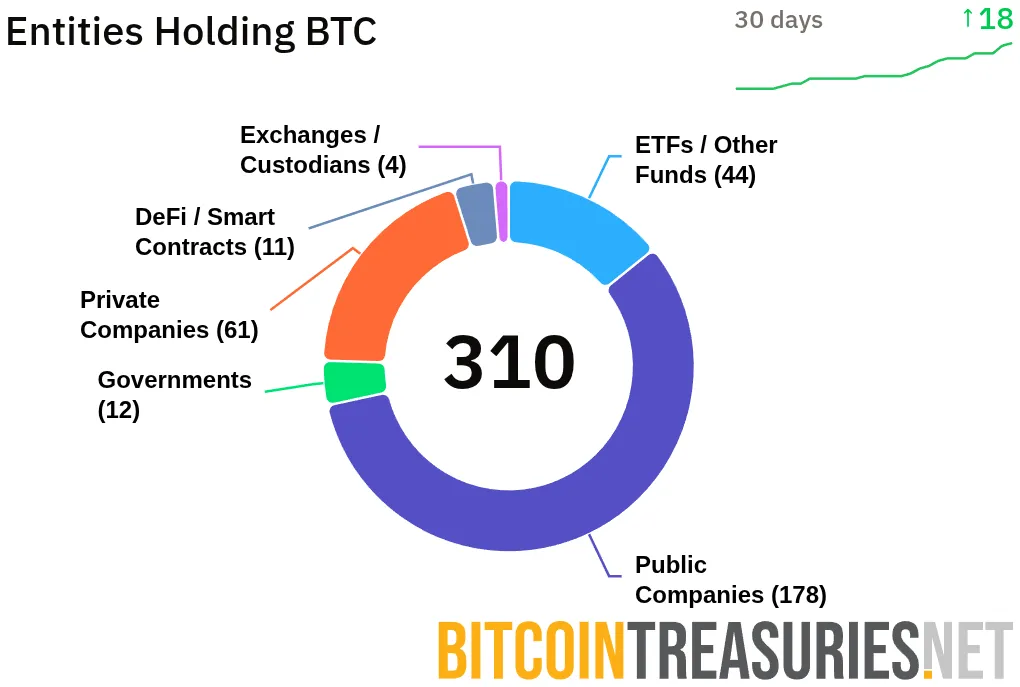

Corporate Bitcoin Treasuries Are Booming

Corporate Bitcoin Treasuries Are BoomingThis isn’t happening in a vacuum. Ever since MicroStrategy (now “Strategy”) pioneered the corporate Bitcoin treasury model, companies across industries have been adding BTC to their balance sheets.

Some notable names beyond the usual suspects:

Tesla (EVs)

KULR Technology (thermal + battery safety)

Aker (Norwegian industrial investment)

Méliuz (Brazilian fintech)

MercadoLibre (LatAm e-commerce giant)

Samara (Malta investment manager)

Jasmine (Thai telecom)

Alliance Resource Partners (US coal producer)

Rumble (Canadian video platform)

Meanwhile, firms dedicated to Bitcoin accumulation keep scooping up supply, steadily reducing liquid BTC in circulation.

Global Bitcoin Accumulation Continues

Global Bitcoin Accumulation ContinuesThe Amdax move comes on the heels of other major treasury plays this month:

Metaplanet (Japan): Approved an ~$880M raise, with ~$835M earmarked for Bitcoin.

Sequans (France): Filed for a $200M equity raise to fuel BTC strategy.

Strategy (fka MicroStrategy): Michael Saylor teased yet another August Bitcoin buy — the firm already holds 632,457 BTC (~$69.5B), over 3% of all future supply.

Takeaway

TakeawayAmdax’s AMBTS isn’t just another treasury experiment — it’s aiming for a systemic position in Bitcoin’s supply dynamics. If successful, it could join Strategy in shaping how institutional capital interacts with BTC scarcity.

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands? -

Dutch crypto service provider Amdax has secured €20 million (~$23.3M) in fresh funding to launch a dedicated Bitcoin treasury company on Amsterdam’s Euronext stock exchange.

Enter AMBTS

Enter AMBTSThe new entity, called AMBTS, will operate independently with its own governance. Its bold target?

Accumulate at least 1% of all Bitcoin supply — that’s around 210,000 BTC, currently worth over $23B.

Grow Bitcoin per share for investors by leveraging capital markets and compounding BTC exposure over time.

In other words: AMBTS is positioning itself as a pure-play corporate Bitcoin accumulator.

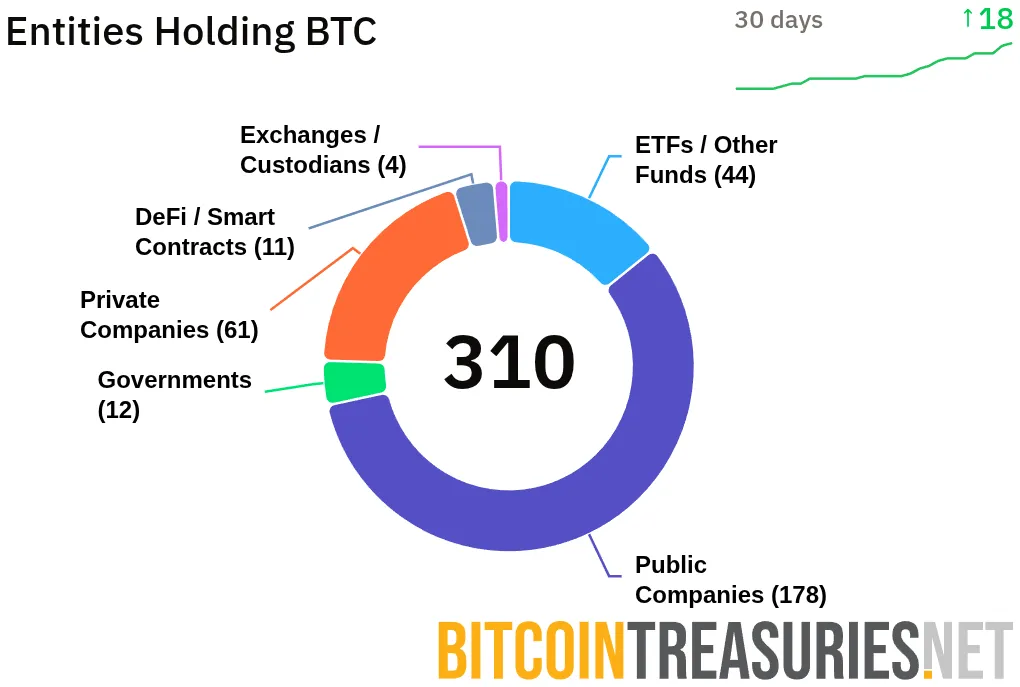

Corporate Bitcoin Treasuries Are Booming

Corporate Bitcoin Treasuries Are BoomingThis isn’t happening in a vacuum. Ever since MicroStrategy (now “Strategy”) pioneered the corporate Bitcoin treasury model, companies across industries have been adding BTC to their balance sheets.

Some notable names beyond the usual suspects:

Tesla (EVs)

KULR Technology (thermal + battery safety)

Aker (Norwegian industrial investment)

Méliuz (Brazilian fintech)

MercadoLibre (LatAm e-commerce giant)

Samara (Malta investment manager)

Jasmine (Thai telecom)

Alliance Resource Partners (US coal producer)

Rumble (Canadian video platform)

Meanwhile, firms dedicated to Bitcoin accumulation keep scooping up supply, steadily reducing liquid BTC in circulation.

Global Bitcoin Accumulation Continues

Global Bitcoin Accumulation ContinuesThe Amdax move comes on the heels of other major treasury plays this month:

Metaplanet (Japan): Approved an ~$880M raise, with ~$835M earmarked for Bitcoin.

Sequans (France): Filed for a $200M equity raise to fuel BTC strategy.

Strategy (fka MicroStrategy): Michael Saylor teased yet another August Bitcoin buy — the firm already holds 632,457 BTC (~$69.5B), over 3% of all future supply.

Takeaway

TakeawayAmdax’s AMBTS isn’t just another treasury experiment — it’s aiming for a systemic position in Bitcoin’s supply dynamics. If successful, it could join Strategy in shaping how institutional capital interacts with BTC scarcity.

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?@lingriiddd

Wow, AMBTS is taking corporate Bitcoin accumulation to the next level! €20M is just the start, and aiming for 1% of all BTC is huge. If executed well, this could really impact BTC scarcity and be a strong bullish signal for the market. Excited to see how institutional strategies evolve here!

-

Dutch crypto service provider Amdax has secured €20 million (~$23.3M) in fresh funding to launch a dedicated Bitcoin treasury company on Amsterdam’s Euronext stock exchange.

Enter AMBTS

Enter AMBTSThe new entity, called AMBTS, will operate independently with its own governance. Its bold target?

Accumulate at least 1% of all Bitcoin supply — that’s around 210,000 BTC, currently worth over $23B.

Grow Bitcoin per share for investors by leveraging capital markets and compounding BTC exposure over time.

In other words: AMBTS is positioning itself as a pure-play corporate Bitcoin accumulator.

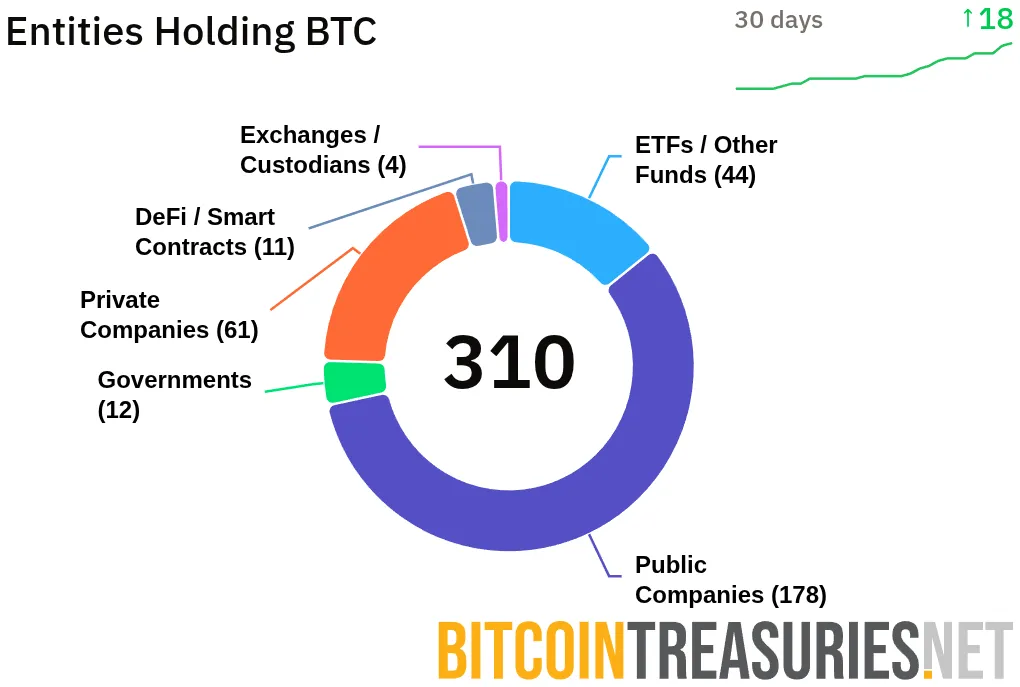

Corporate Bitcoin Treasuries Are Booming

Corporate Bitcoin Treasuries Are BoomingThis isn’t happening in a vacuum. Ever since MicroStrategy (now “Strategy”) pioneered the corporate Bitcoin treasury model, companies across industries have been adding BTC to their balance sheets.

Some notable names beyond the usual suspects:

Tesla (EVs)

KULR Technology (thermal + battery safety)

Aker (Norwegian industrial investment)

Méliuz (Brazilian fintech)

MercadoLibre (LatAm e-commerce giant)

Samara (Malta investment manager)

Jasmine (Thai telecom)

Alliance Resource Partners (US coal producer)

Rumble (Canadian video platform)

Meanwhile, firms dedicated to Bitcoin accumulation keep scooping up supply, steadily reducing liquid BTC in circulation.

Global Bitcoin Accumulation Continues

Global Bitcoin Accumulation ContinuesThe Amdax move comes on the heels of other major treasury plays this month:

Metaplanet (Japan): Approved an ~$880M raise, with ~$835M earmarked for Bitcoin.

Sequans (France): Filed for a $200M equity raise to fuel BTC strategy.

Strategy (fka MicroStrategy): Michael Saylor teased yet another August Bitcoin buy — the firm already holds 632,457 BTC (~$69.5B), over 3% of all future supply.

Takeaway

TakeawayAmdax’s AMBTS isn’t just another treasury experiment — it’s aiming for a systemic position in Bitcoin’s supply dynamics. If successful, it could join Strategy in shaping how institutional capital interacts with BTC scarcity.

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?@lingriiddd

Love seeing innovation in the corporate Bitcoin space! AMBTS operating independently with its own governance shows serious ambition. Companies like this are slowly shaping BTC supply dynamics, and it’s fascinating to watch the ecosystem mature. Could be a game-changer for long-term holders -

@lingriiddd

This move by Amdax feels like the next evolution of the Bitcoin treasury model. If they seriously aim for 1% of the total supply, that’s not just another corporate buy — that’s systemic accumulation. Similar to MicroStrategy’s impact, these kinds of strategies lock up large amounts of BTC and make it harder for retail and institutions to buy in later. It’s both a bullish signal for scarcity and a wake-up call: the window for stacking meaningful BTC before corporations dominate the float is closing fast. -

I think the AMBTS plan highlights both the strength and risk of the Bitcoin adoption curve. On one hand, dedicated treasuries provide constant buy pressure and legitimize BTC as a reserve asset across capital markets. On the other hand, centralization risk is real — if a few corporations end up holding a massive chunk of the supply, it could create power imbalances in what was meant to be a decentralized system. The next few years will show if this trend strengthens Bitcoin’s resilience or concentrates too much influence in too few hands.