Hash rate drops may set the stage for a Bitcoin rebound

-

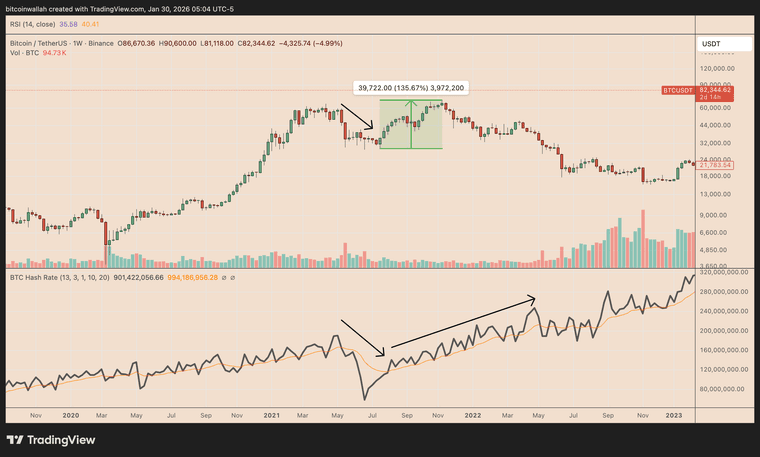

While recent declines in Bitcoin’s hash rate have raised concerns, history suggests they can sometimes precede strong price recoveries.

When miners shut down, the network gradually adjusts by lowering mining difficulty, making it cheaper and easier for remaining miners to earn Bitcoin. This process has helped stabilize the network during past stress periods.

After China’s mining ban in 2021, Bitcoin’s hash rate fell roughly 50%, and BTC dropped from about $64,000 to $29,000. Within five months, the price rebounded to nearly $69,000.

According to Capriole Investments, Bitcoin’s energy value, a metric estimating fair price based on network energy usage, currently sits near $121,000. Historically, BTC has tended to climb back toward this level after prolonged drawdowns.

If Bitcoin finds a bottom near miners’ cost levels, any recovery could trigger a longer-term move back toward its energy-based fair value.

-

lol hash rate drops always freak people out but history shows it can actually signal a rebound, wild how resilient btc is