Leverage reset and quantum fears shape cautious Bitcoin outlook

-

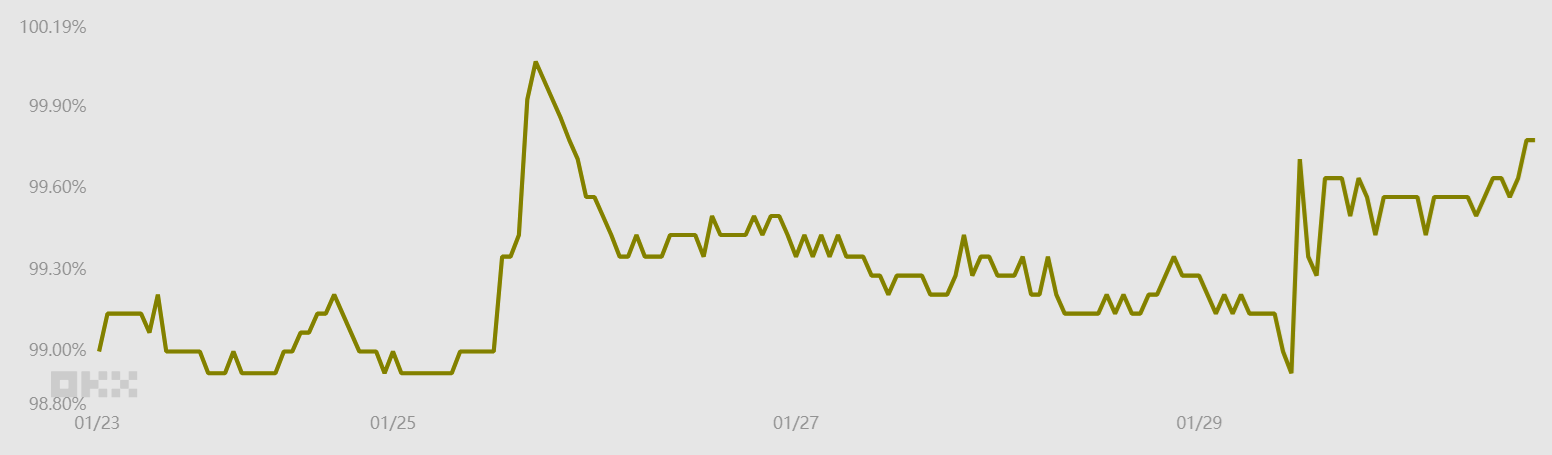

Bitcoin’s recent selloff liquidated approximately $860 million in leveraged long futures positions, suggesting many traders were caught offside. Despite this, overall BTC futures open interest has declined significantly compared to three months ago, indicating that excessive leverage has already been reduced.

Some analysts view this as a stabilizing factor, arguing that markets tend to be healthier after speculative leverage is flushed out. However, investor anxiety has also been fueled by longer-term concerns, including the potential impact of quantum computing on blockchain security.

While industry experts say such risks remain distant, derivatives data and stablecoin flows point to a cautious mood. Bitcoin’s ability to reclaim higher levels may depend on easing macro pressures and renewed confidence across global markets.