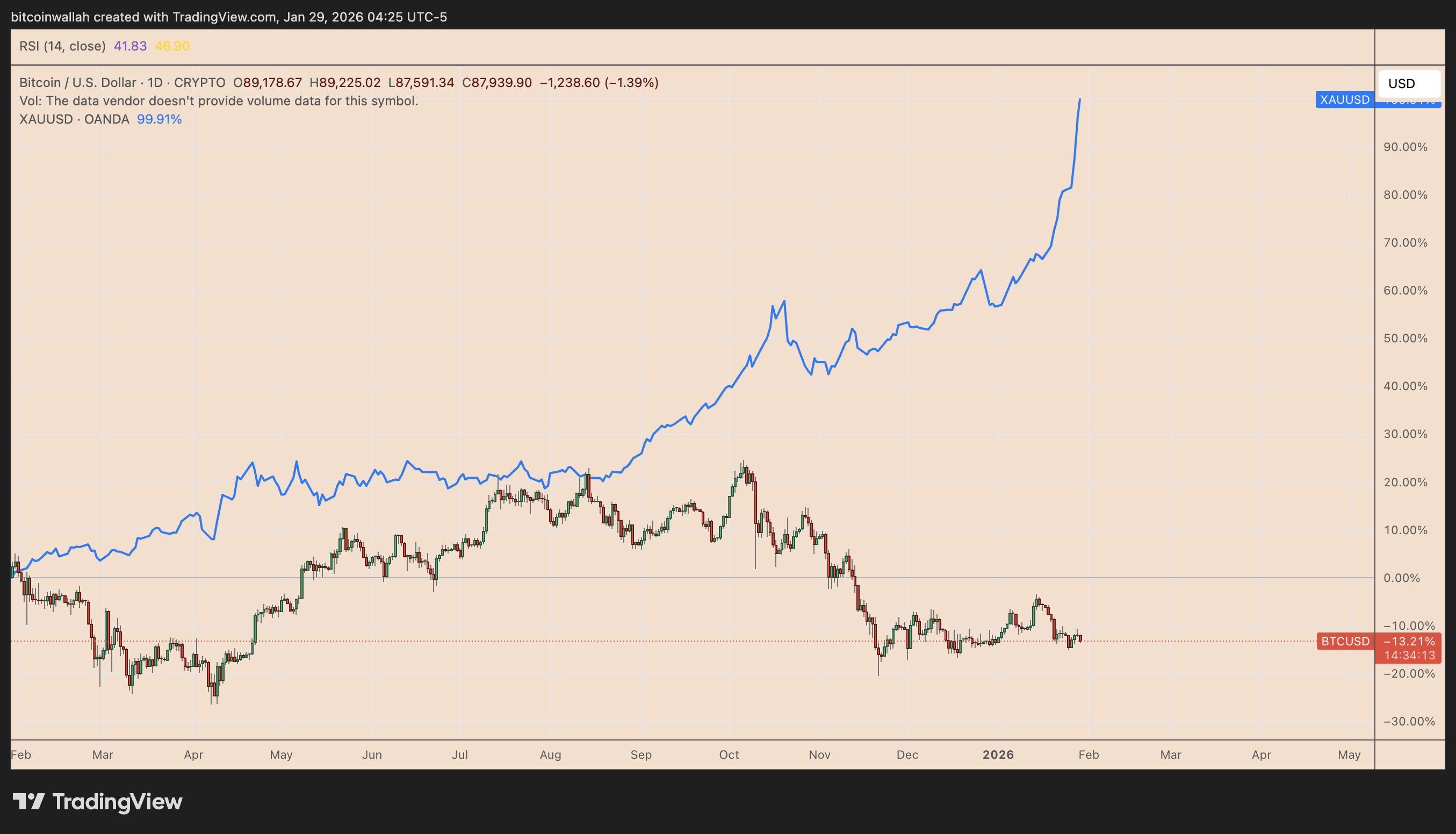

Bitcoin has lagged gold — but the supply story tells a different tale

-

Over the past year, Bitcoin has significantly underperformed gold. BTC is down about 13%, while gold has surged nearly 100%, reigniting debate over whether Bitcoin can still compete as a hard-asset hedge.One key difference lies in supply dynamics. Bitcoin’s issuance is fixed by code, capped at 21 million coins, with roughly 93% already mined. New supply enters the market on a predictable schedule that slows over time through halvings.

Gold operates differently. Rising prices incentivize more mining, increasing above-ground supply. While Bitcoin miners can scale operations, they cannot alter issuance. Supporters argue this structural scarcity could matter more over the long term — even if short-term price performance tells a different story.